- The Breakdown

- Posts

- 🟪 American-made AI

🟪 American-made AI

“I am the American dream.”

Friday charts: American-made AI

Jensen Huang is devoting a good portion of Nvidia’s cash flows to making sure the future of artificial intelligence happens in America, with American-designed GPUs, possibly made in an American fab.

As founder/CEO of the world’s most important company, he might be the only individual who can possibly make that happen.

Who else could credibly promise OpenAI $100 billion to build the data centers they need and the countless GPUs they'll need to run them?

Who else could make Intel a plausible competitor to TSMC again with just a $5 billion investment and a handshake deal to someday let Intel make Nvidia GPUs?

Many commentators are skeptical these will turn out to be good deals for Nvidia shareholders.

But there’s no doubt they’ll be good for America, whose lead in the global race to AGI is looking increasingly precarious.

If the US ultimately wins that race, it will likely be thanks to Jensen Huang’s Taiwanese parents’ decision to send him to live in America at the age of eight.

It’s an extraordinary story.

Jensen’s parents knew so little about the US they mistakenly sent him to a reform school for juvenile felons in Kentucky, thinking it was a boarding school for high-achieving academics.

He survived the many fights he got in there, and went on to co-found Nvidia on a shoestring budget, staving off bankruptcy multiple times.

He bet big on GPUs before they even had a name.

He bet even bigger on AI years before ChatGPT made that an obvious thing to do.

What's not particularly extraordinary is that Jensen’s story began outside of the US.

Satya Nadella, born in India, has restored Microsoft to its former greatness.

Sundar Pichai, born in India, is guiding Alphabet to a preeminent position in AI.

Sergey Brin, born in Russia, turned Google into a verb from a garage in Menlo Park.

Pierre Omidyar, born in France, created eBay from an apartment in Campbell, California.

Patrick and John Collison left Ireland to start Stripe in San Francisco.

And the guy who founded PayPal, Tesla, SpaceX, Neuralink, and The Boring Company in the US? He’s from South Africa.

There are countless less-prominent examples, too.

One study found that 55% of US unicorns (billion-dollar startups) have at least one immigrant founder, and nearly two-thirds were founded by immigrants or the children of immigrants.

(If you extend the lineage a step further, the statistics get even more incredible: 100% of the writers of this newsletter are the grandchildren of immigrants.)

This is the original American Dream.

But it’s also been a dream for America, because Silicon Valley isn’t just a tech hub. It’s also the wellspring of US wealth, job creation, stock-market primacy, dollar dominance, and global influence.

Without Silicon Valley, the US would likely resemble, say, Britain at best (culturally relevant, but economically irrelevant).

Or, terrifyingly, France at worst (economically stagnant, but with worse food).

Silicon Valley is a large part of what sets the US apart and immigrants are a large part of what sets Silicon Valley apart.

It’s not just about founders and CEOs, either.

One study found that companies that win just one additional high-skilled worker in the H1-B visa lottery were 23% more likely to have a successful IPO within five years.

23%! From one visa!

That seems like a strong indication that equivalent talent was not to be found at home.

If so, that could be a major obstacle to America’s ambitions in AI.

For national security reasons, the US of course wants to onshore semiconductor manufacturing, for example.

But Alex Tabarrok estimates there are only 164,000 people in America smart enough to work in those fabs.

That will not be enough.

TSMC alone employs 84,000 people — more than half the number of Americans smart enough to work there.

As vitally strategic as semiconductor manufacturing is, I don’t think we want half of America’s smartest people working on it — we’ll want some to be mathematicians, computer scientists, and newsletter writers, too.

So Americans will either have to get a lot smarter, fast. Or get a lot more smart people to come here.

“We want all the brightest minds to come to the US,” Jensen Huang said this week.

You only have to know his story to agree.

Let’s check the charts.

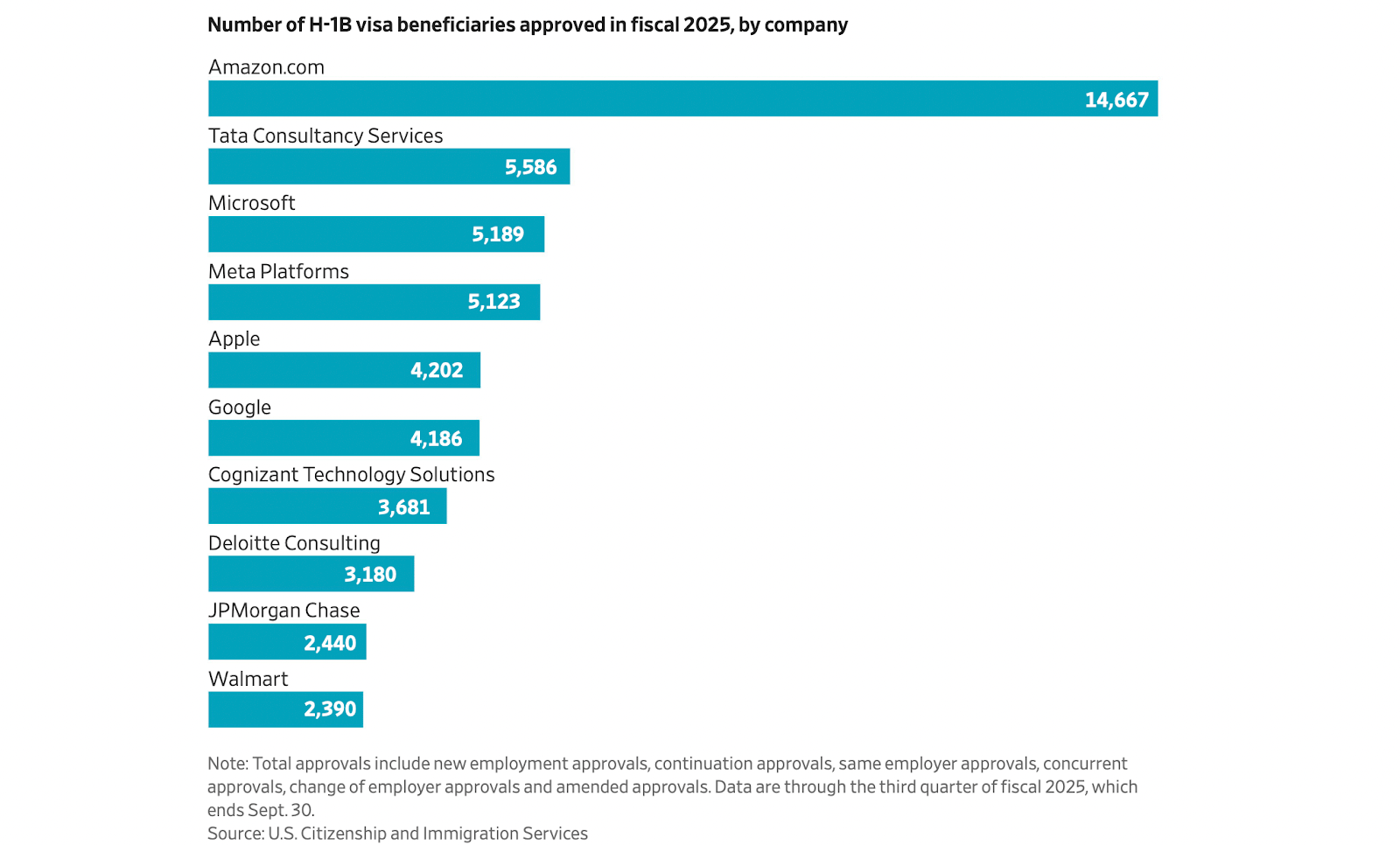

Winning the lottery:

The Wall Street Journal reports that 14,667 of the 120,603 H-1B visas granted by the US government in fiscal 2025 went to Amazon.

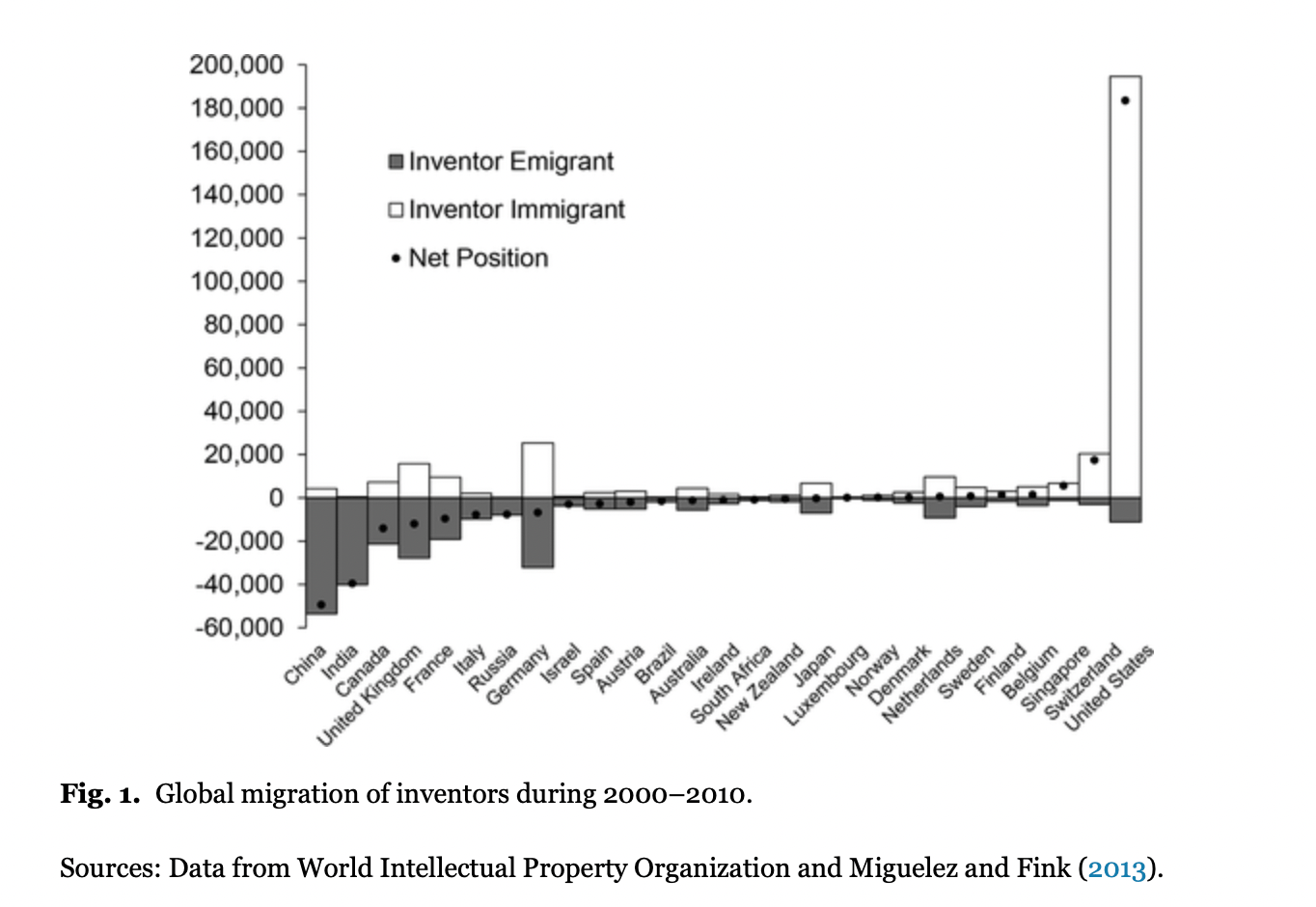

Inventors prefer the US:

Between 2000 and 2010, 57% of “migrating inventors” migrated to the United States.

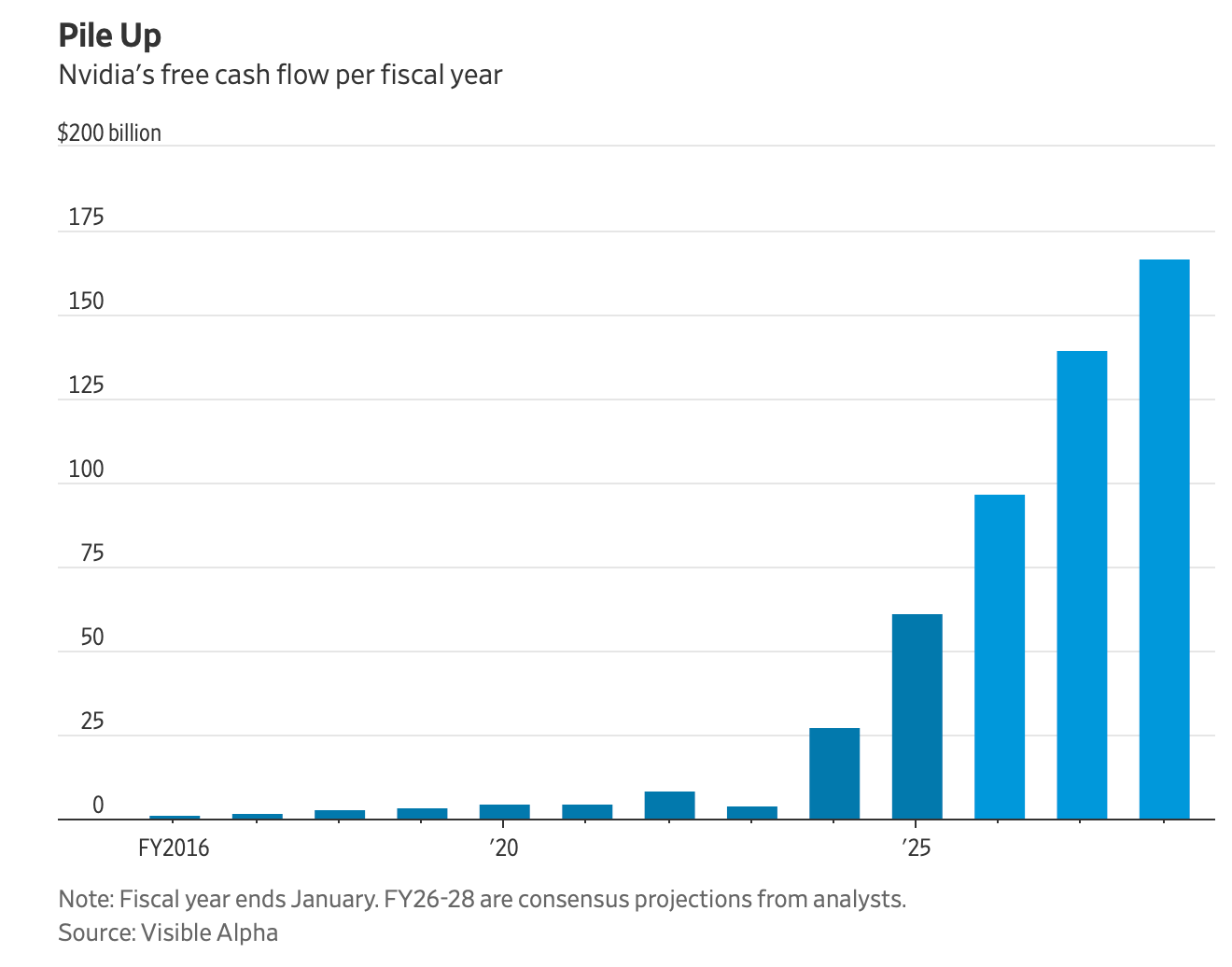

Jensen is good for the $100 billion:

By 2028, Nvidia is expected to be making nearly $175 billion of free cash flow a year.

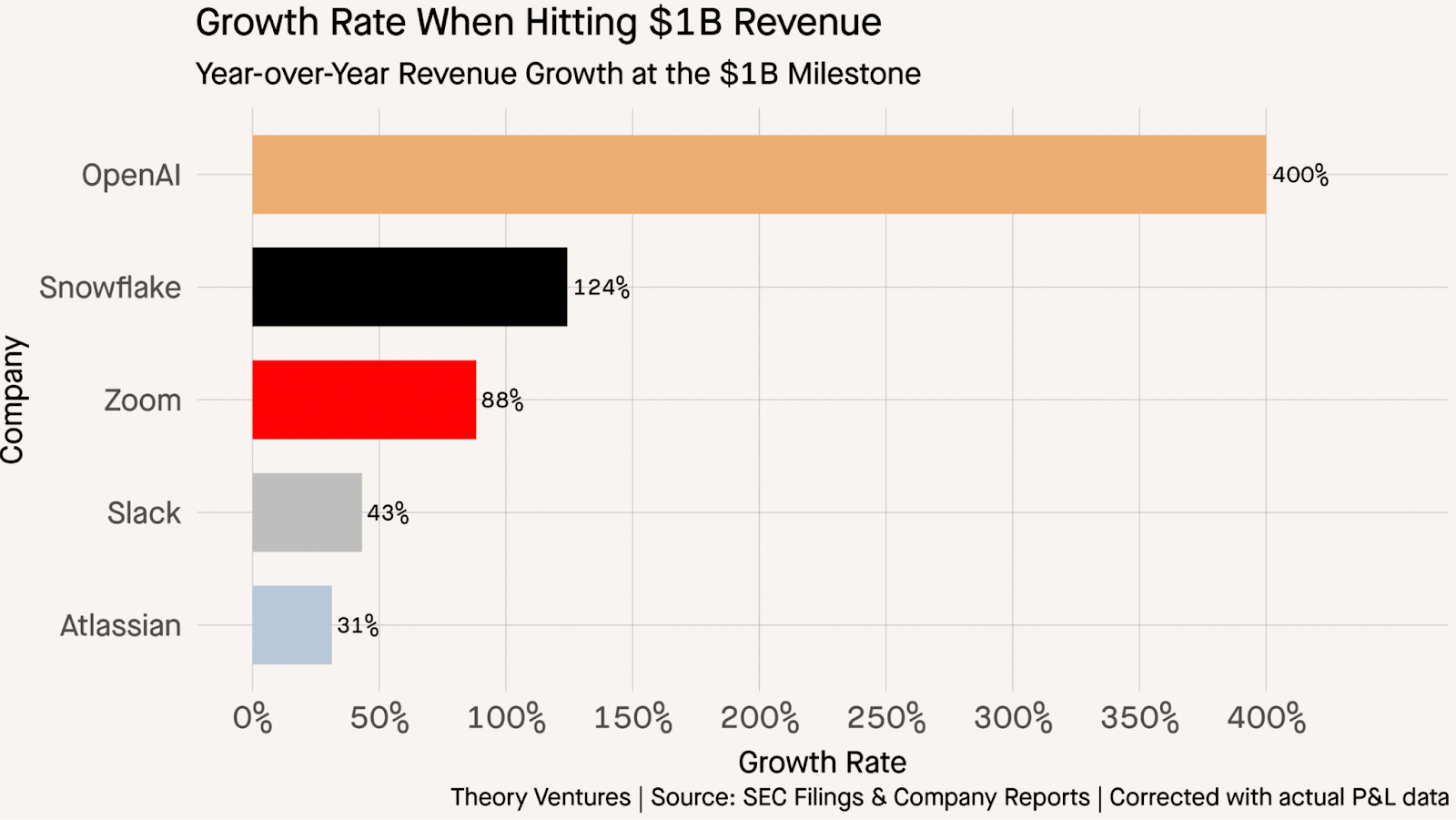

It’s different this time:

AI might well be a bubble, but not one we’ve ever seen before. Tomasz Tunguz notes that OpenAI has hit the $1 billion revenue mark while growing revenue an incredible 400%.

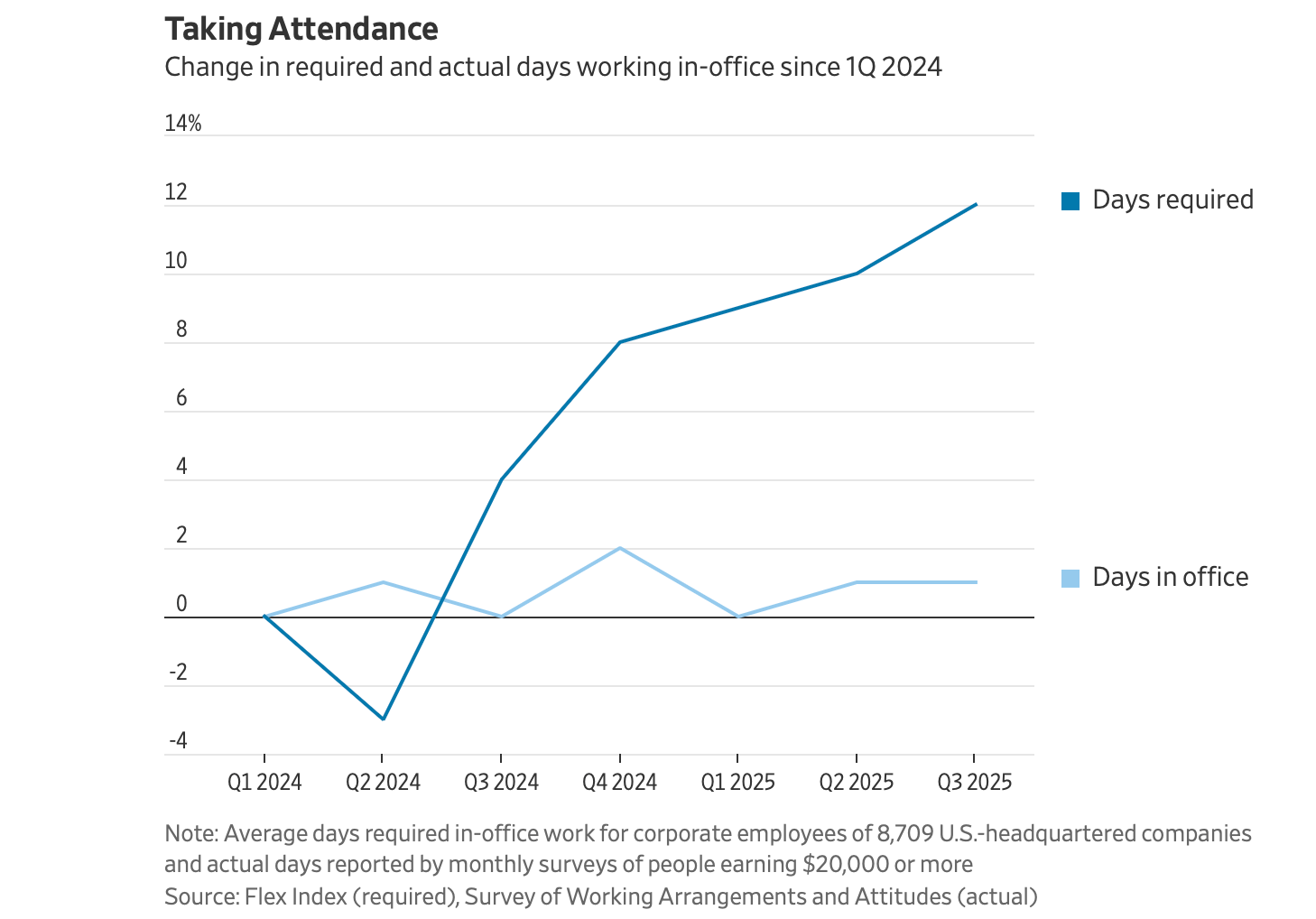

Just say no to RTO:

The Wall Street Journal reports that the days employers require employees to work from the office is up 12% over the last year or so — but the number of days employees actually work from the office has barely changed.

Wen recession?

Not this quarter. Kalshi odds imply the US economy is likely to grow 3.2% in Q3.

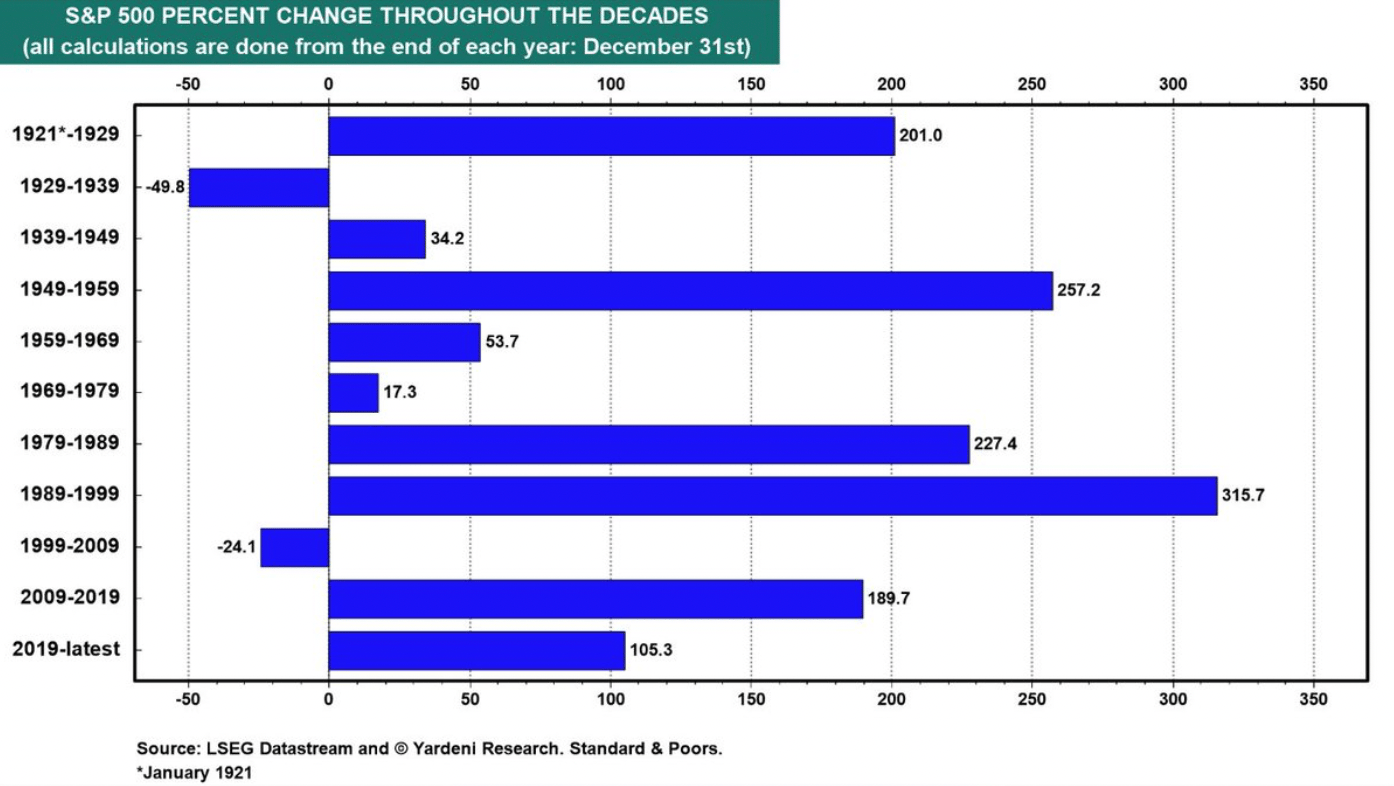

Another roaring decade?

Ed Yardeni notes there have been four “Roaring decades” (i.e., with the S&P 500 rising over 200%) since the 1920s. “We may be in a fifth now,” he thinks, “to be followed by a sixth during the 2030s."

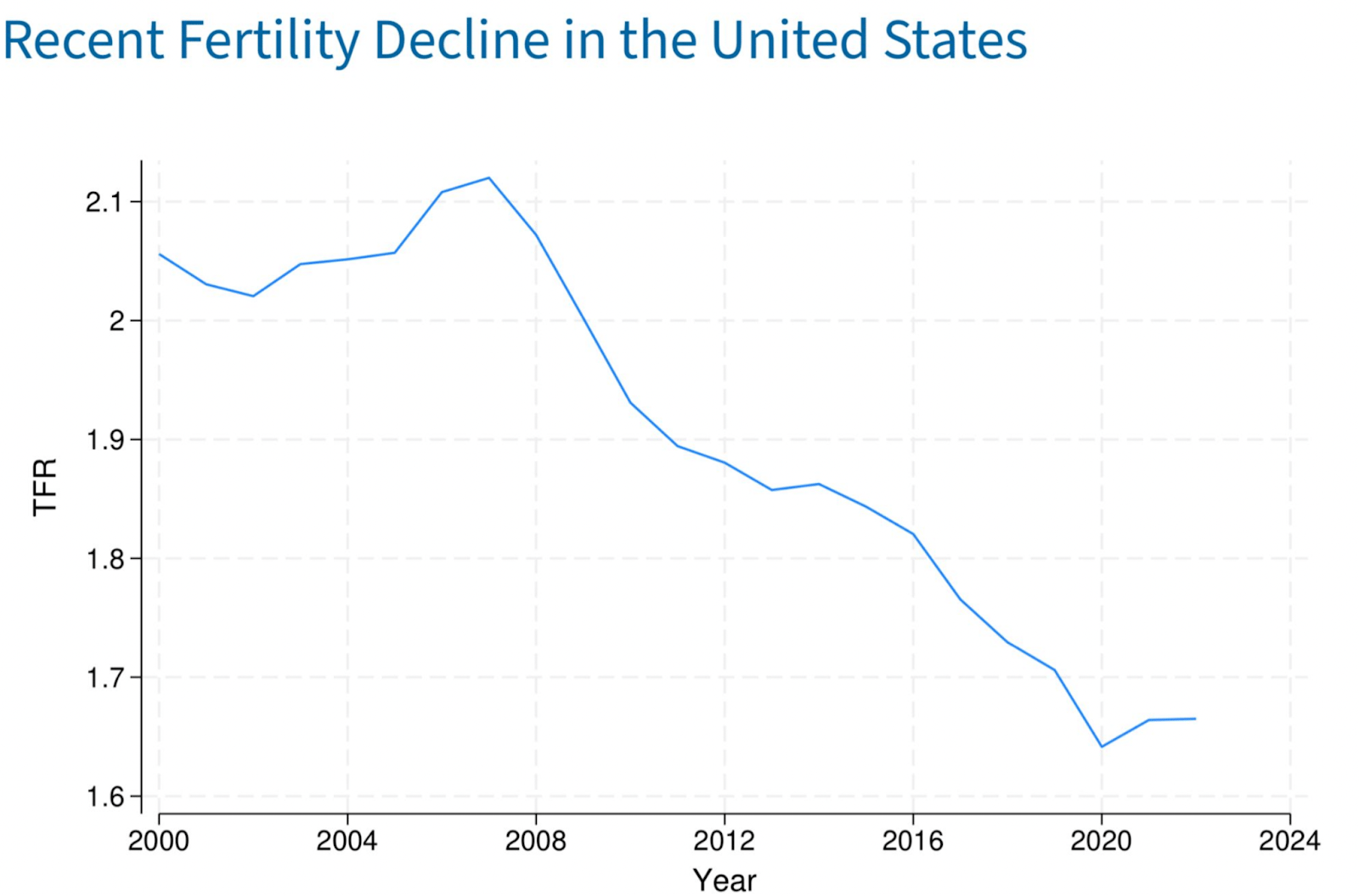

We’re gonna need a smaller boat:

Americans are having fewer kids than ever. But this is still a long way better than South Korea, the world’s worst at reproducing, with a total fertility rate of just 0.78 kids per woman.

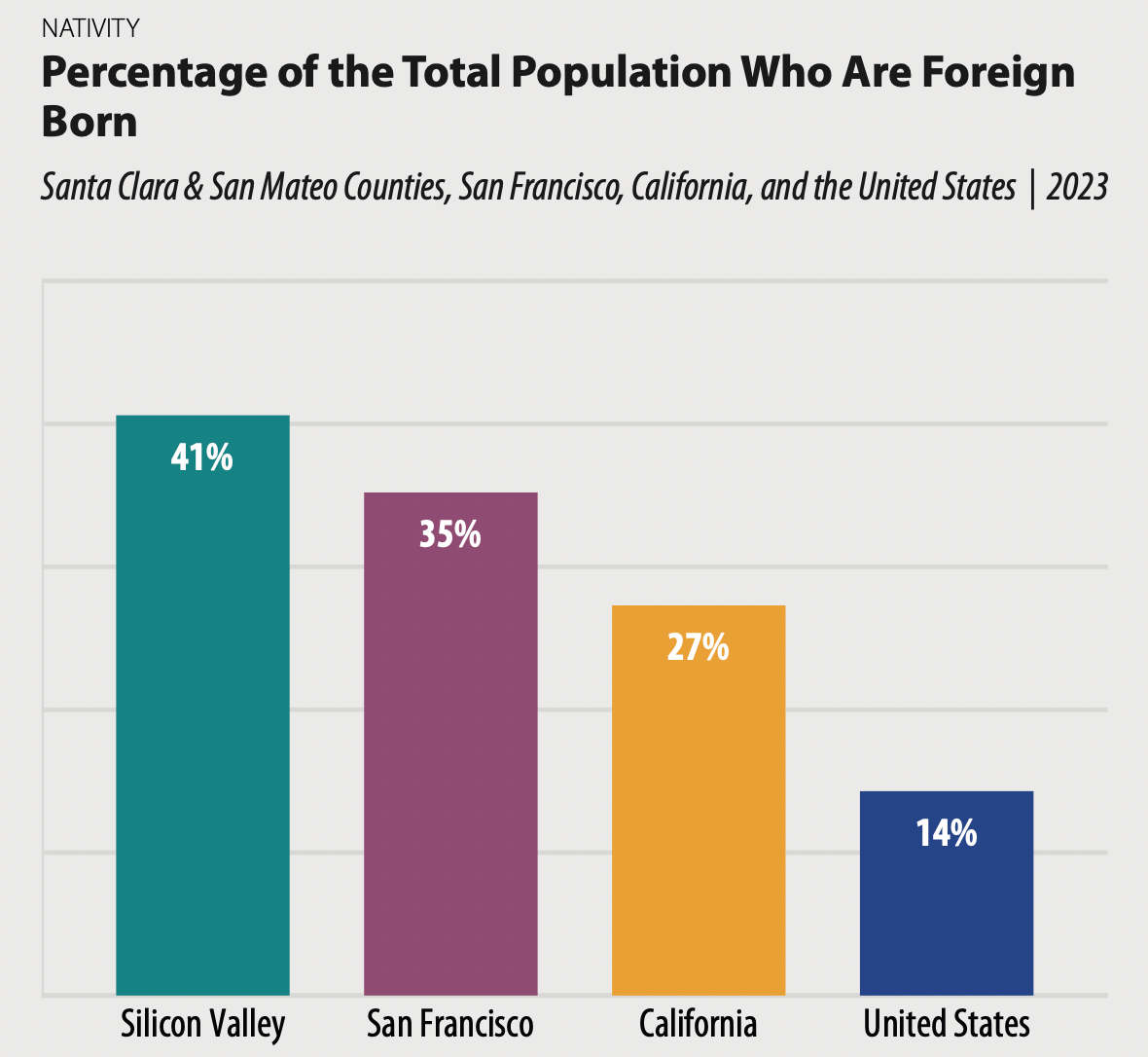

Cause or effect?

Silicon Valley has nearly 3x as many foreign-born residents than the US average (18% of these are undocumented).

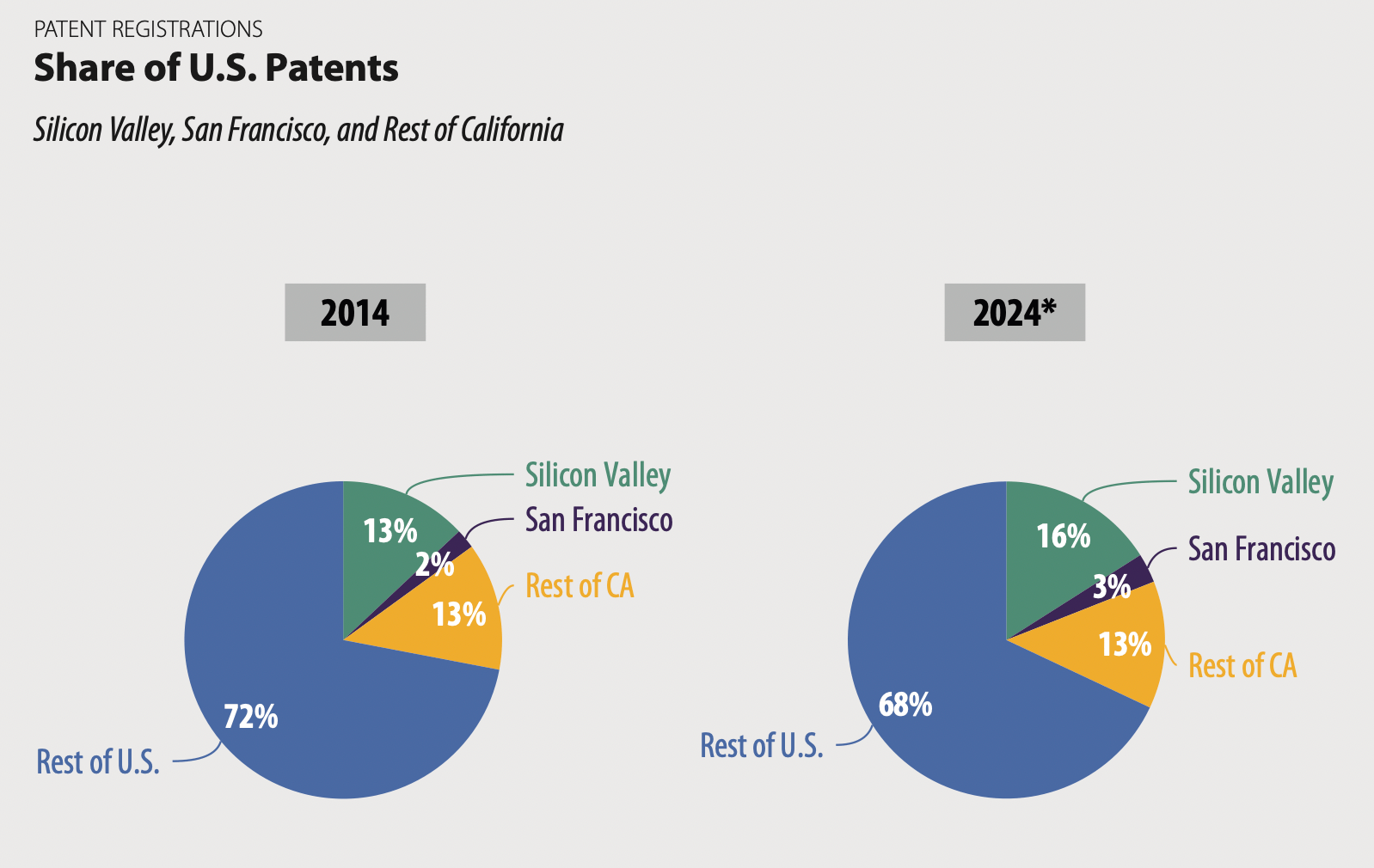

Silicon Valley, which hosts 0.9% of the US population, produces 16% of US patents.

It’s the American Dream built in Silicon Valley.

It may yet build AGI, too.

Have a great weekend, dreamy readers.

Brought to you by:

KAST: your bank without a bank — USD accounts, cards, and crypto in one.

Party with KAST at the Solid Gold Party on Oct 2nd. Five venues in one. Bottle service. All free flow from 9 pm to 2 am. The #1 party this Token! KAST cardholders get complimentary VIP pickup at Singapore Airport!

And behold the world’s only Solid Gold Card: 37g of rare status you can’t buy. One KAST believer will be gifted one at Token. Sign up for a chance to be chosen.

By David Canellis |

By Blockworks |

By Macauley Peterson |

Sponsored Content |

Brought to you by:

With Bridge’s stablecoin-backed infrastructure, Cenoa scaled to 40+ markets, grew 30x in 5 months, and surpassed $10M in monthly volume — delivering 80% lower cross-border fees and instant onboarding for entrepreneurs worldwide.

Institutional staking has rapidly matured into a sophisticated global market.

While early adopters were primarily retail users and crypto-native funds, the past three years have seen an influx of institutional players, drawn by the potential for predictable yield, low operational friction, and growing onchain governance influence.

Today, institutional staking spans a wide range of providers, each with distinct risk and operational profiles, as well as differentiated regulatory and technical considerations.

Get access to the full, unlocked report from Blockworks Research.

Check out the latest episode of Forward Guidance on YouTube, Spotify or Apple Podcasts.