- The Breakdown

- Posts

- 🟪 Cloudy skies

🟪 Cloudy skies

1 year into Sky, adoption lags behind vision

1 year later: MakerDAO’s transition to Sky

On Aug. 27, 2024, MakerDAO formally transitioned into Sky, a new identity meant to signal a fresh era of modular governance, ecosystem scaling, and real-world integrations.

One year later, the core pillars of that transformation are in place, but the adoption story remains mixed.

The renamed protocol now oversees over $7.8 billion in stablecoin liabilities across DAI and its successor USDS. But despite heavy investments in marketing incentives and ecosystem spinoffs, Sky’s headline stablecoin metrics have flatlined, or in some cases, reversed. Meanwhile, capital restructuring efforts and a sweeping token migration have begun reshaping protocol governance entirely.

The organizations’ financials are also a bit of a puzzle, Sky co-founder Rune Christensen said during a community call Wednesday.

“We have three different ways of measuring this stuff, and none of the three tend to agree,” said Christensen. He described the gap between on-chain PnL estimates, like the Steakhouse report ($8 million Q2 profit), and dashboard forecasts ($300 million run-rate), as a function of “capital transaction” accounting.

“By not counting capital transactions, we're actually lowering profits,” Christensen explained.

Critics like PaperImperium have questioned the effectiveness of management. “The cumulative cost to design, plan, and launch USDS is pretty high,” he wrote on X. “Around $44M went into it over the last few years… expenses currently run around $100m/year annually.”

He noted that, despite these incentives, USDS has not meaningfully surpassed DAI or other stablecoin competitors in market share, even in a favorable environment.

Blockworks contacted the Sky team with questions but was referred to the community call.

Rajiv, a lead contributor to Sky’s analytics effort, offered some nuance on the community call: “It just feels like the sweet spot for sUSDS is really these large, more institutional-type holders who really value the immediate liquidity.” Crypto funds like Galaxy Digital were cited as recent stakers, even as smaller long-tail users pulled back from Sky token reward participation.

Etherscan shows sUSDS, which receives the Sky savings rate (currently 4.75%), is held by a total of 4,656 wallets. That excludes some sUSDS pledged as collateral in certain DeFi smart contracts, but the figure should be fairly representative of the number of individuals or entities making use of the protocol.

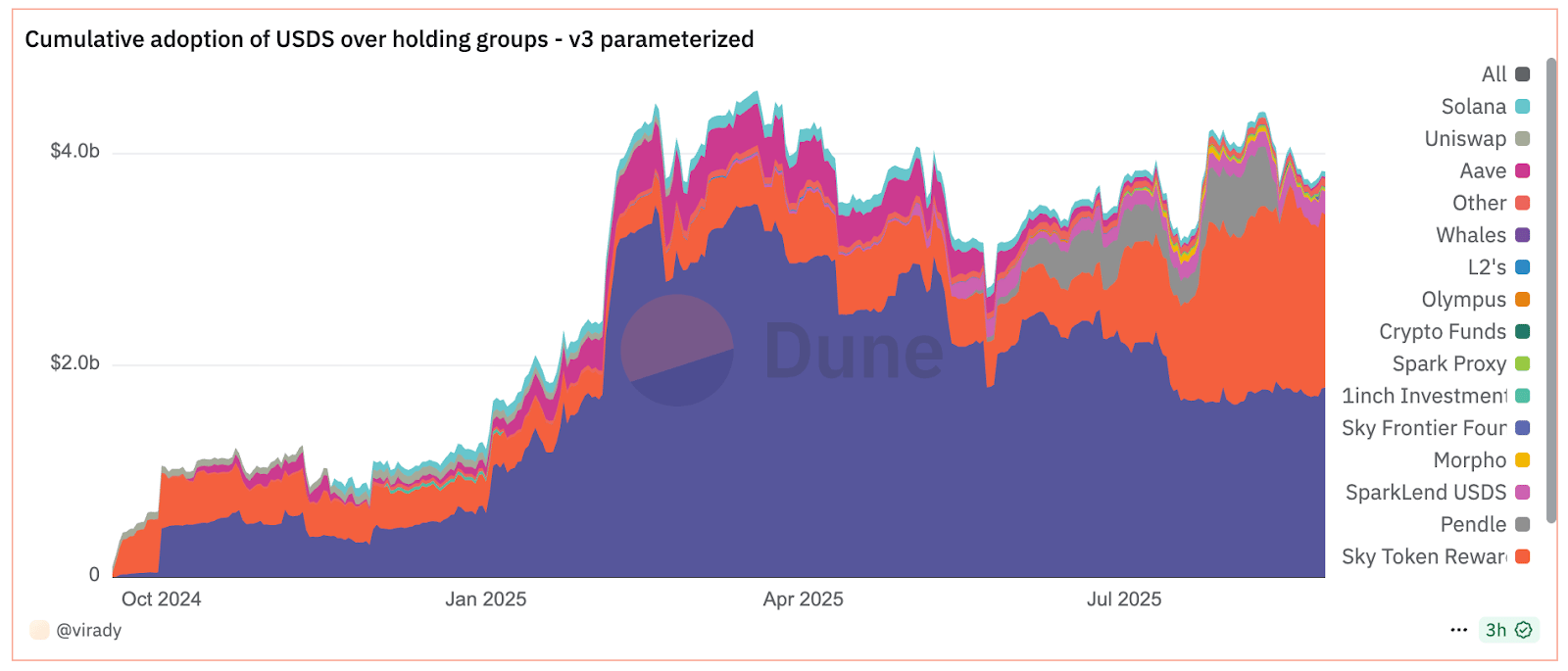

Source: Dune / Viridian Advisors

Still, the combined USDS and DAI supply ended Q2 2025 essentially flat, with a surprising twist: DAI itself is growing again. “Over the last few weeks, there's been a very interesting trend of an uptick in DAI demand,” Rajiv noted.

That observation underscores a broader shift: while Sky is no longer betting on transactional stablecoin PMF, it is leaning heavily into the idea of capital formation through bespoke ecosystem units like Spark and Grove. These “Stars” are expected to embed USDS as a super-senior capital layer while onboarding risk capital into higher-return strategies, Christiansen noted.

“Sky is evolving from just offering a stablecoin to offering the more general value of supporting capital formation,” Christiansen said.

He cited Spark as an example: “Sky put in $25 million, and got out $390 million.”

From brand to token

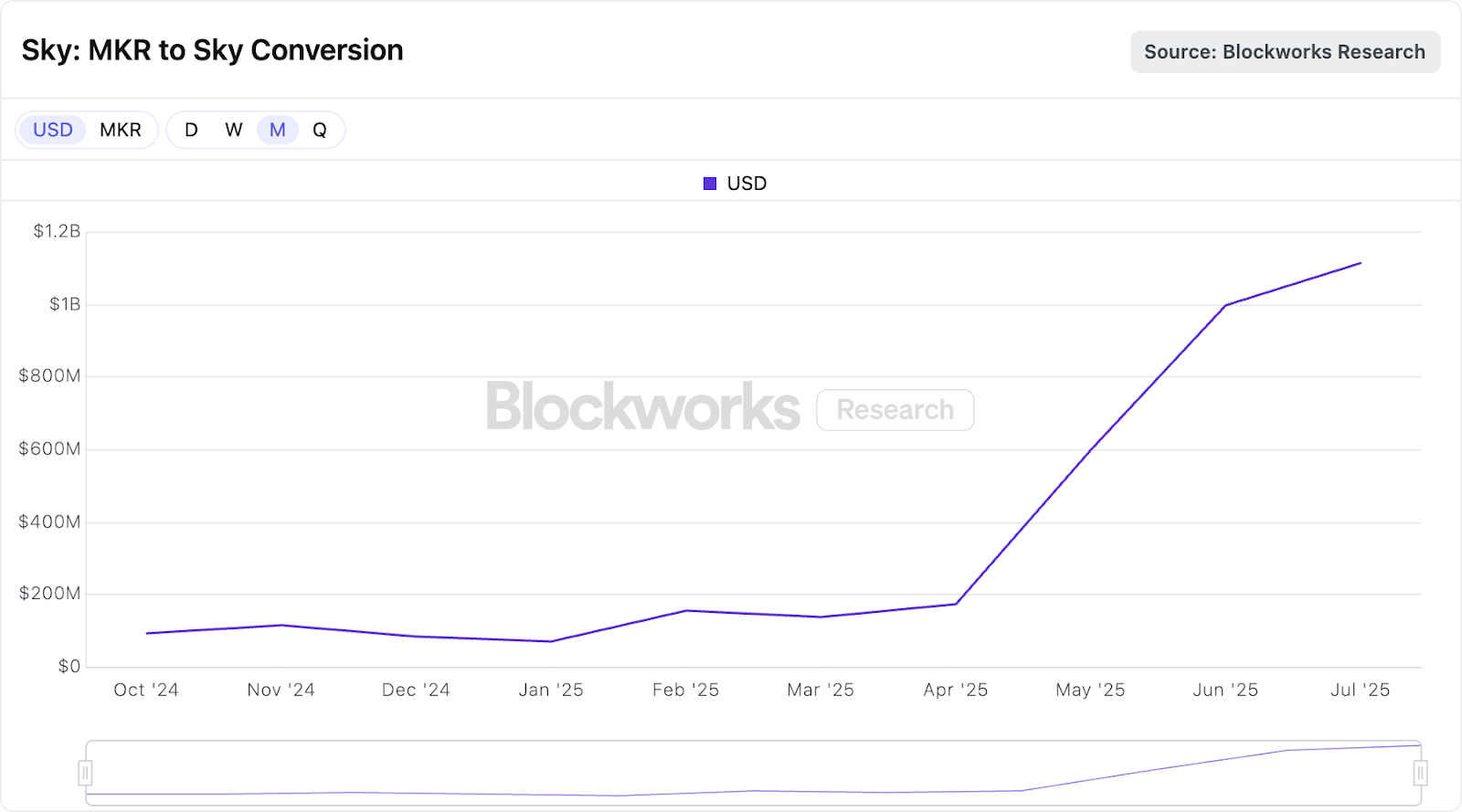

Another core milestone: the transition from MKR to SKY, now nearing completion.

As of May 2025, SKY has exclusive governance authority, with MKR holders able to convert 1:24,000. The pace of conversion spiked sharply in Q2, as shown in Blockworks Research data, following the announcement of a “Delayed Upgrade Penalty” — the planned 1% decay in the conversion ratio every three months starting on September 18.

Source: Blockworks Research

“It’s an important step towards eliminating fixed costs and ensuring income flows to SKY holders,” Christiansen said of the transition at the time. Sky staking is also a bright spot, enabling rewards in USDS, or compounding back into SKY via Yearn Finance liquid-staking vault.

Looking ahead, Sky’s governance architecture is expected to further evolve via the “Core Council,” and staking reforms could introduce lockups and anti-LST protections. Rune framed that as a “two-year” roadmap item, part of a longer arc toward institutional-grade governance and capital structure management.

So far, the market hasn’t rewarded the protocol with breakout usage, although the architecture is in good shape.

“Sky will grow as an entire economy,” Christiansen said. “More vertically integrated growth… [rather than] USDS being used everywhere for some particular specific niche.”

Brought to you by:

Arkham is a crypto exchange and a blockchain analytics platform that lets you look inside the wallets of the best crypto traders — and then act on that information.

Arkham’s Intel Platform has a suite of features including real-time alerts, customizable dashboards, a transaction visualization tool, and advanced transaction filtering — all of which is accessible on all major blockchain networks, and completely free.

Arkham’s main product is the exchange, where users can express their trade ideas against the market.

The Roundup

Empire: Like all good things, killer apps come in threes. David unpacks the voyages of modern-day crypto enterprise.

Forward Guidance: Summer, spring, winter and…altcoin autumn? Ben looks at the opportunities beyond BTC that investors are eyeing.

Lightspeed: The institutions are coming! The institutions are coming! Donovan outlines three new SOL DATs making headlines recently.

0xResearch: Markets are moving faster and investors are betting big. The BWR crew unpacks the corners of crypto currently stealing the spotlight.

The Drop: IP-IP-hooray. Kate’s got the exclusive on Camp’s L1 mainnet and its bid to prove that an IP-focused chain can work long-term.

Brought to you by:

Token.com brings Creator Capital Markets to Solana with a groundbreaking X-integration feature.

Trade the latest tokens and wrapped stocks directly from X posts in our innovative all-in-one app.

Creators monetise content through trading fees while traders access the best crypto Twitter alpha. Learn more at Token.com!

By Kate Irwin |

By Blockworks |