- The Breakdown

- Posts

- 🟪 Code is law, door is landlord

🟪 Code is law, door is landlord

The sci-fi future of onchain assets

Code is law, door is landlord: The sci-fi future of onchain assets

The opening scene of Philip K. Dick’s 1969 sci-fi classic Ubik features an apartment door demanding payment from its owner.

When Joe Chip, behind on his rent, attempts to open the door for a guest, it replies, “Five cents, please.”

Short of change, he offers to pay tomorrow, but his credit score is shot so the door ignores him.

He tries to reason with it: “What I pay you,” he informed it, “is in the nature of a gratuity; I don’t have to pay you.”

“I think otherwise,” the door responds, before instructing Chip to check his contract.

“You discover I’m right,” the door said. It sounded smug.

When Chip starts to unscrew the bolt mechanism with a knife, the door threatens legal action, but Chip is undeterred — “I’ve never been sued by a door. But I guess I can live through it.”

Before any damage is done, Chip’s guest pays from the other side and the door finally opens.

Later, the refrigerator, coffee maker and shower all demand payment before rendering their services — and the guest has to pay the door again to leave.

Such was Philip Dick’s dystopian vision of the future: Apartments turned into pay-as-you-go vending machines.

But this might also be the utopian future of decentralized finance.

The dream of decentralized finance is to transform every asset into a programmable financial instrument that automatically enforces the terms of its own contract.

The problem with decentralized finance is that it’s limited to crypto assets because a smart contract can’t reach into the physical world to repossess a car or evict a tenant.

But what if a smart contract could lock the door to your house, car or refrigerator?

In that world, a lender could accept those kinds of real-world assets — anything that can be locked — as collateral against onchain loans.

It’s not a new idea.

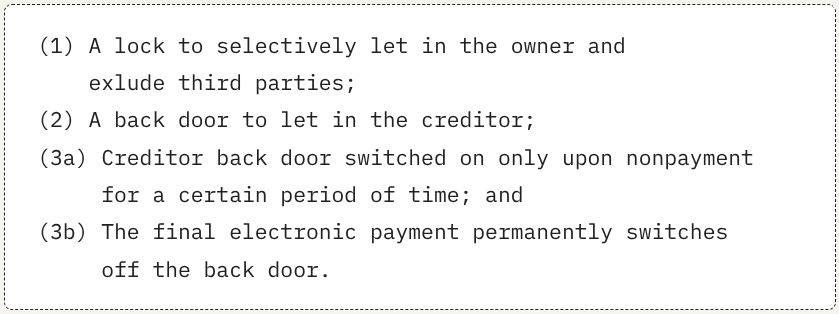

Way back in 1997, Nick Szabo described the utility of turning smart contracts into smart locks: “Many kinds of contractual clauses (such as collateral, bonding, delineation of property rights, etc.) can be embedded in the hardware and software we deal with, in such a way as to make breach of contract expensive (if desired, sometimes prohibitively so) for the breacher.”

“These protocols would give control of the cryptographic keys for operating the property to the person who rightfully owns that property,” he added, “based on the terms of the contract.”

So far, that property has only been tokens, because that’s the only property whose ownership can be embedded in smart contracts.

But smart locks, controlled by smart contracts with verifiable, immutable rules, could turn the whole world into a vending machine.

Szabo called vending machines the "primitive ancestor of smart contracts”: a mechanical contract that holds an asset (a can of soda, say) and releases it to anyone who satisfies the conditions of that contract (inserting a coin). No human or corporate shopkeeper needed.

The rules-based machine becomes the shopkeeper — much like Joe Chip’s door becomes his landlord.

Szabo thought something like the latter was where we were headed: “Smart contracts go beyond the vending machine in proposing to embed contracts in all sorts of property that is valuable and controlled by digital means.”

Sixteen years before the advent of Ethereum, Szabo envisioned smart locks granting digital control of real-world property, citing cars as the “most straightforward” use of smart locks.

“We can create a smart lien protocol: If the owner fails to make payments, the smart contract invokes the lien protocol, which returns control of the car keys to the bank.”

Nothing exactly like that has happened as of yet, but Szabo was at least directionally correct — on two counts: Smart contracts exist, on Ethereum and elsewhere, and auto-loan lenders are securing their collateral with remote locks.

Starter interrupt devices (SIDs) that allow lenders to remotely disable a car when a borrower has fallen behind on their payments have become popular with sub-prime auto lenders in recent decades.

This raises some obvious questions: What if you need the car to get to work to make money to catch up on your loan? What if you’re doing 80 on the freeway when your lender decides to disable your auto?

Unlike Joe Chip’s door, you can’t drop coins into the dashboard of a SID-disabled car to unlock it. And good luck getting someone on the phone at the lender to plead your case or even make a payment.

You could, however, quickly top up your payment via smart contract, on a smart phone with a digital wallet.

This is not a new idea, either.

In 2015, Slock.it promised exactly the kind of digital locks (Slocks) that Joe Chip negotiated with: “With Slock, the person who rents your house pays directly to the lock itself. The lock enters into a smart contract with the renter.”

For reasons that remain unclear, Slocks didn’t catch on — or get into production, even.

(The Slock.it team may have taken their eyes off the ball when their side project, The DAO, nearly sank Ethereum.)

But it might also be that they were just early.

If so, now may finally be the time for blockchain-based smart locks.

The infrastructure is built: Chains are fast, transactions are cheap, frontends are user-friendly.

TradFi wants to tokenize everything: Crypto assets have flopped this year, but the enthusiasm for bringing real-world assets onchain has only grown.

Investors want alternative assets: The demand for productive yield outside the shrinking universe of public equities is seemingly insatiable.

Smart contract smart locks might be the way to provide it.

Consider Turkey, for example, where borrowers pay 5% per month on their auto loans, which works out to over 100% per year — 70 percentage points above inflation.

If those loans were tokenized and governed by a smart contract that automatically disables a car when a borrower defaults, wouldn’t that attract investors from everywhere?

BlackRock’s Larry Fink said this week that “tokenization can greatly expand the world of investable assets beyond the listed stocks and bonds that dominate markets today.”

Philip K. Dick predicted the technology. Nick Szabo wrote the manual.

Now, finance just needs to build the door to this investors’ utopia.

Brought to you by:

Institutions and DeFi are converging on Canton, creating real-world finance with crypto-style speed.

The latest The Tie report shows growing demand for privacy, composability, and sustainable tokenomics.

With 575+ validators and 600K+ daily transactions driving on-chain activity, Canton’s network momentum is accelerating on-chain global finance.

Brought to you by:

Add onchain trading to your product without the hassle.

The Uniswap Trading API offers plug-and-play access to deep liquidity — powered by the same protocol that’s processed $3.3T+ in volume with zero hacks.

Get enterprise-grade execution across onchain and off-chain sources for optimal pricing. No complex integrations or crypto expertise — just seamless, scalable access to trusted DeFi infrastructure.

More liquidity. Less complexity.