- The Breakdown

- Posts

- 🟪 Crypto catch-up, in pictures

🟪 Crypto catch-up, in pictures

Big ideas, small use cases

Crypto catch-up, in pictures

Nobody does big ideas better than crypto: internet-native money, self-sovereignty, democratized finance…

Execution, however, has never been its strong suit.

Internet-native money is crypto’s foundational idea, but 15 years on, few use it to pay for anything on the internet.

The democratization of finance has largely become people getting fleeced in the memecoin casino.

Self-sovereignty remains a core principle, but most people have stored their crypto on centralized exchanges, and now, increasingly, with the evil empire itself (i.e., the stock market).

Still, these remain worthy aspirations.

But crypto’s high-minded ideals have been obscured by a morass of manipulated memecoins, presidential grifting, North Korean hacking and institutional co-opting.

This sometimes makes it hard to remember what crypto was supposed to be about.

Could even some OG Bitcoiners be losing faith? I can’t help but wonder if the recent sales of Satoshi-era coins are a quiet reaction to bitcoin’s growing corporate ownership.

To win over a new generation of converts, then, it might take more than lofty principles delivered in rousing sound bites.

It might require something simpler: a reason to actually use it.

Crypto’s mission statements would be more convincing if its proof of concept were something other than just the price of bitcoin — if people were using it onchain and not just buying it on the stock market.

So how’s that going? Let’s check the charts.

People are using the chains!

Ethereum processed an all-time high of 46.7 million transactions in July, thanks largely to the smart contract chain’s new, higher gas limit. A higher gas limit increases the computational capacity of each block, which lowers the competition for blockspace. As a result, the median fee on Ethereum has hovered around $0.20 recently, down from as high as $13 a little over a year ago.

(Note: Nearly all of today’s charts are freely available on the Blockworks website.)

Doing more for less:

Ethereum transactions are at record highs, but Ethereum REV — a measure of how much people pay to use the chain — is near record lows. In July, Solana, Hyperliquid and Tron all earned more in fees than Ethereum did. This is great news for Ethereum’s users, who can do more with less. But it may not be such great news for Ethereum’s investors.

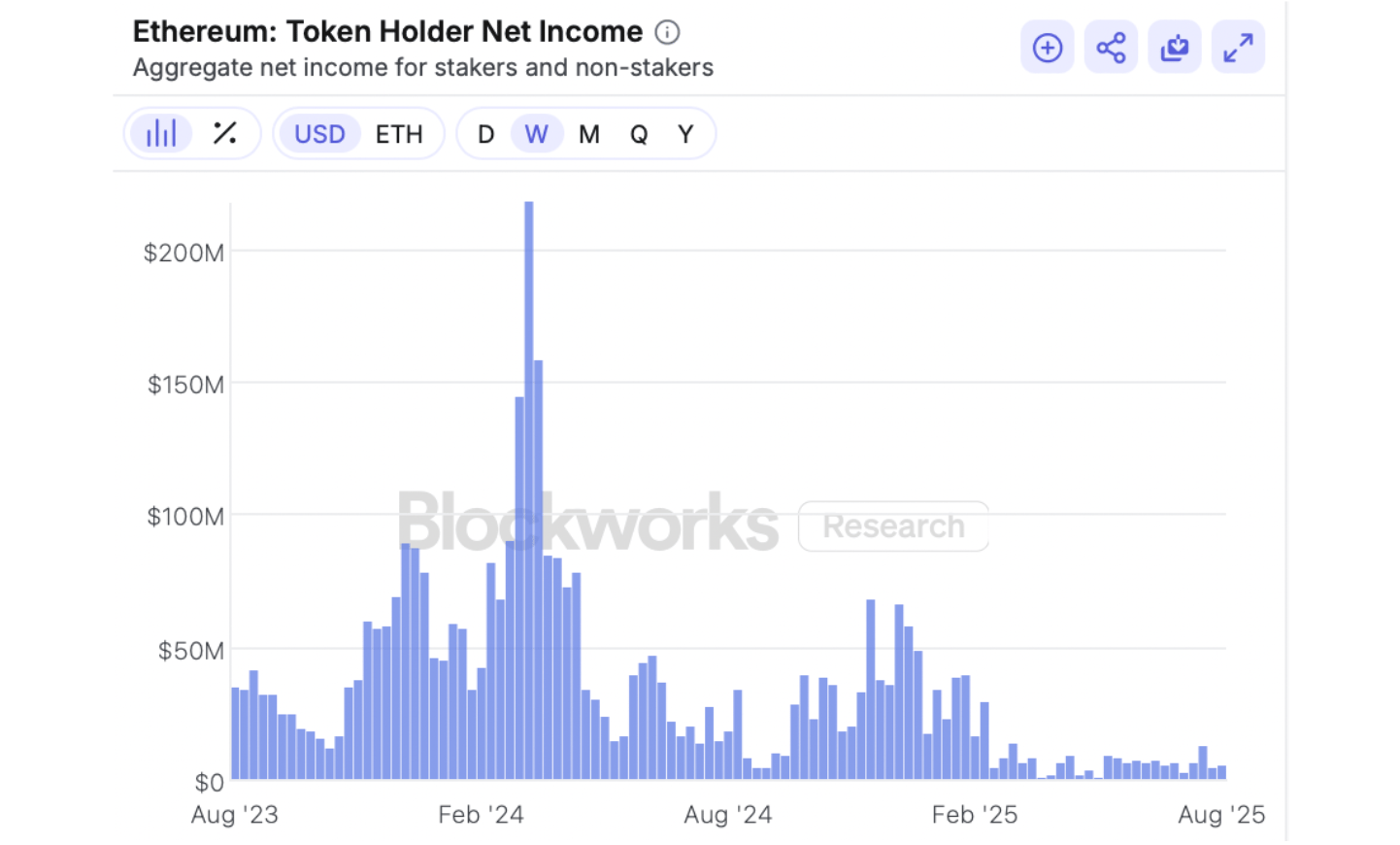

If blockchains had earnings:

Subtract payments to operators from REV and you get what can be thought of as the “net income” of a blockchain. On that basis, if we annualize the $31 million of net income that Ethereum recorded in July, we can say that ETH trades on a price-to-earnings ratio of 1,200x. Yikes.

Still, there have been more buyers than sellers lately:

ETH is up 45% over the past month, presumably because digital asset treasury companies have provided a new source of demand. DATs now hold $6.9 billion of ETH, up from near zero just a month ago. ETH ETFs bought an additional $5.4 billion worth in July as well.

Trending down:

Because most treasury companies have to sell shares to buy crypto, trading volume is considered a leading indicator of their purchases. Falling volumes suggest that DATs will be buying less crypto.

The stock market premium:

Collectively, digital asset treasury companies are now worth $88.5 billion more than the crypto they hold. The good news is that the stock market loves crypto. The bad news is that 100% of that premium can be attributed to financial engineering, which tends to go “poof” at some point.

The hype is real:

Hyperliquid just posted its best-ever month, recording $88 million of revenue in July. That is $1 million more than Solana did, which must mean…something. Hyperliquid now has a 75% share of the market for perpetual futures. I can’t think what its moat is, but it seems to have found one.

My favorite crypto chart:

This is the collective P&L for traders on Hyperliquid, which has been trending relentlessly lower. The big spike up in March was market manipulation, not a trader being right. The rest of the chart demonstrates that traders are rarely right. Like casinos, perps platforms grind their users to dust. But also like casinos, the users keep coming back. (Note: I’m not sure how super accurate this data is but I assume it’s directionally correct.)

Not as hype as it was:

Solana’s “token holder net income” has been more or less flatlining around $6 million a week. Annualized, that puts the SOL token on 390x P/E. Better than Ethereum, for sure, but still pretty yikes.

Memes vs. projects:

DeFi apps are great and constantly getting better. But “most of the assets are shady,” as Alex Thorn puts it. On Solana DEXs, for example, memecoins still trade 7x more volume than “project tokens.”

Colonel Mustard in the billiard room with a candle stick…

Like a game of Clue, this Sankey diagram demonstrates that DEX volumes have recently been dominated by memecoins on BNB Chain using PancakeSwap. I’m reliably told by the 0xResearch chat room that most of this is wash trading, however.

Less degen-ing:

The leading trading bot, Axiom, has seen falling trade volumes, which suggests the most active, most degen of retail crypto traders are finding fewer reasons to trade.

Tokenized equities haven’t inspired them, either:

Putting equities onchain has been a popular topic lately, but crypto traders seem disinterested so far. “Equities” trading volume has averaged less than $4 million a day on Solana.

Bitcoin’s mempool:

Bitcoin’s mempool, the queue of transactions waiting to be added to a block, has been a little busier of late, but activity remains near long-term lows. (I still think “MEMEpool” every time I read “mempool” and I’m not sure I’m wrong.) You can watch the mempool in a neat visualization here. It’s kind of mesmerizing, like watching fish in a fishbowl. And in the case of Bitcoin, it’s not much faster. The Ethereum mempool is busier and helpfully visualized here as a bus stop.

The original idea still stands:

However active crypto is at the moment (or inactive, Rob Hadick describes it), the foundational rationale is stronger than ever: Exploding government debt makes an alternative financial system worth exploring.

But it probably won’t help much if it happens on the stock market.

Brought to you by:

Arkham is a crypto exchange and a blockchain analytics platform that lets you look inside the wallets of the best crypto traders — and then act on that information.

Arkham’s Intel Platform has a suite of features including real-time alerts, customizable dashboards, a transaction visualization tool, and advanced transaction filtering — all of which is accessible on all major blockchain networks, and completely free.

Arkham’s main product is the exchange, where users can express their trade ideas against the market.

By Jack Kubinec |

By Casey Wagner |

By Casey Wagner |

Brought to you by:

Katana is a DeFi chain built for real sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn boosted yield and KAT tokens: Deposit directly into vaults on the katana app and start earning on your ETH, BTC, USDC, and more.