- The Breakdown

- Posts

- 🟪 DeFi’s having a resurgence

🟪 DeFi’s having a resurgence

But it’s not the same DeFi

DeFi’s having a resurgence, but it’s not the same DeFi

DeFi is having a moment, but it’s a different kind of comeback.

Total value locked (TVL) is climbing, new DeFi tokens are outperforming the market and a new generation of protocols is dominating mindshare. While Ethereum still reigns supreme in terms of capital parked onchain, the real action is happening elsewhere — in fast-paced trading arenas on Solana and BSC, and across hyper-efficient Ethereum layer-2s like Base and Arbitrum.

Let’s break it down.

DeFi resurgence: TVL and tokens are up

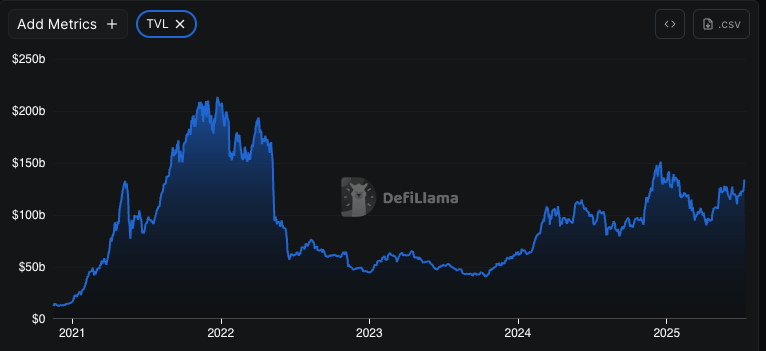

TVL across all DeFi chains currently sits around $135 billion, up from $51 billion in July 2023, according to DefiLlama. That’s more than double in under two years — not quite a full comeback, but certainly a resurrection from the sleepy bear market days.

But what’s grabbing headlines isn’t just the rising capital locked, it’s the projects.

Maple Finance’s SYRUP token, Ethena’s ENA, Hyperliquid’s HYPER, Euler’s EUL and the OG AAVE have all posted massive gains this cycle. Hyperliquid, in particular, has emerged as the new trading venue, with its perp DEX clocking over $500 million in daily volume, all without even a token incentive. The Defiant reported it’s also the first L1 to crack into the top 10 TVL dominance charts with no token distribution.

Stablecoin market cap is also surging, reaching a record $258 billion, with Stripe and PayPal involved. Meanwhile, tokenized RWAs are breaking ground from a non-existent category two years ago to a $25 billion category, with BlackRock and Franklin Templeton among the major players.

But TVL is still far from all-time highs

For all the hype, we’re still a long way from the glory days. In December 2021, DeFi TVL hit an all-time high of $215 billion. Today’s $135 billion figure puts us almost 40% below that peak, according to DefiLlama.

But it’s not that DeFi is failing, it’s that the metric is increasingly outdated. We’re no longer in a world of leveraged yield farms, where the only way to participate in open finance was to put up a big chunk of collateral. And that’s a good thing.

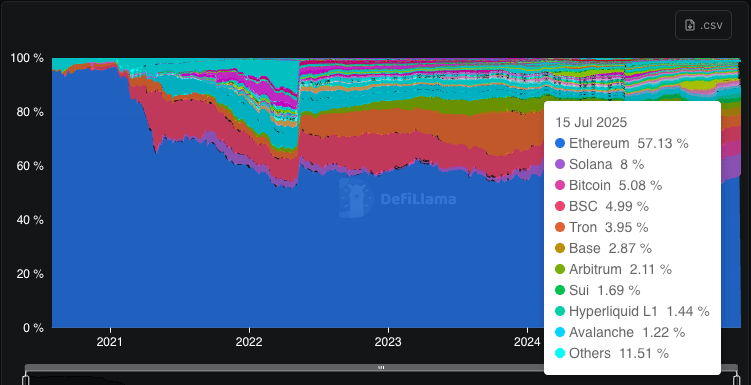

Even with increased competition, Ethereum has maintained dominance in TVL since the 2021 all-time high. As of July 15, it accounts for about 57% of the total DeFi TVL, compared to 59% in December 2021 and ~51% in early 2023. That’s despite dozens of new chains emerging: Solana, Sui, Hyperliquid and even Bitcoin’s growing L2 ecosystem.

If you consider that Ethereum’s layer-2s like Base, Arbitrum and Optimism don’t compete against Ethereum but extend it, you can argue Ethereum has even gained dominance. These chains settle to Ethereum, and activity moving to them is more of a horizontal migration within the ecosystem than a loss for Ethereum.

In that light, Base’s 2.87% TVL share and Arbitrum’s 2.1% are all wins for Ethereum’s modular strategy.

Trading volume tells a different story

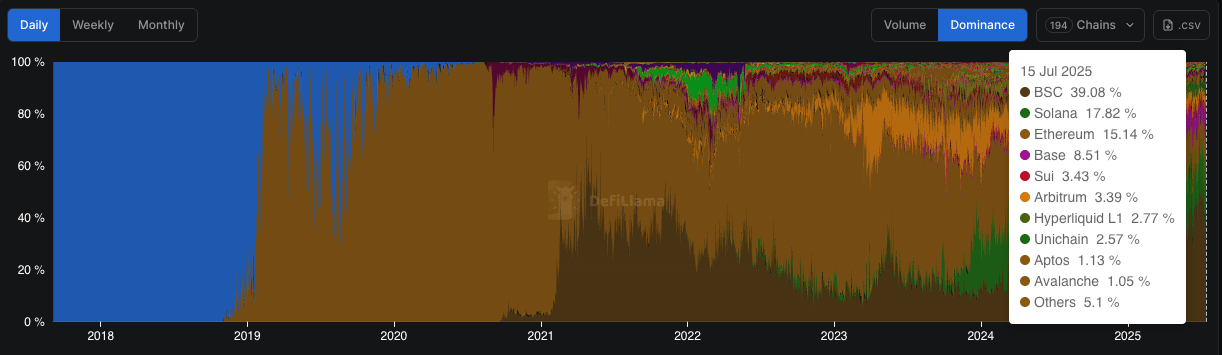

If you zoom in on DEX volumes, Ethereum layer-1 is losing ground.

Ethereum DEXs process around $3 billion per day, while BSC leads with $5.7 billion a day, and Solana isn’t far behind at $3.3 billion a day, according to DefiLlama. Ethereum still lags behind BSC and barely beats Solana when adding Base and Arbitrum DEX volumes. Meanwhile, Hyperliquid and SUI are closing in with over $500 million each, all signs that onchain trading has migrated to faster, cheaper rails.

DEX trading volumes by chain today contrast sharply with the breakdown in December 2021, when Ethereum handled the majority of onchain trading volume.

TVL ≠ usage anymore

This divergence tells us something important: TVL is no longer the best metric to measure DeFi activity.

Today’s DeFi is high-frequency, capital-light and increasingly composable. Protocols like Ethena and Hyperliquid generate massive volumes without requiring billions locked in a vault. The focus has shifted from capital parked to capital flowing.

And this trend is just beginning. As lending protocols advance toward unsecured or undercollateralized lending, expect even less capital to sit idle. That means even lower TVL may support even higher usage. It’s a paradigm shift from DeFi 2021, when capital efficiency was a meme, to 2025, where it’s table stakes.

The new DeFi is leaner, faster, more distributed and more experimental. And that’s exactly what makes it fun again.

Note: This essay by The Defiant founder Camila Russo was originally published on The Defiant Daily newsletter on July 15.

Brought to you by:

Trade stocks or crypto fully onchain all from your pocket with Helix Mobile.

Helix is the fastest growing decentralized order book exchange with over $13.5B in year-to-date volume!

Helix Mobile enables you to trade stocks like $HOOD, $TSLA, and $CRCL or crypto like $BTC and $ETH onchain with up to 50x leverage from your smartphone. Download now!

By Ben Strack |

By Casey Wagner |

By Casey Wagner |

By Donovan Choy |

Brought to you by:

Katana is a DeFi chain built for higher sustainable yield and deep liquidity. It concentrates liquidity into core applications and channels the chain’s revenue back to the users.

Creating a better DeFi experience that benefits the active users on the chain.

Earn KAT tokens: Pre-deposit with turtle club