- The Breakdown

- Posts

- 🟪 Smile and wave

🟪 Smile and wave

The next retail leverage wave could form in equity perps

Welcome back to The Breakdown! We’ve tagged in the 0xResearch crew today for a Monday markets edition. Kunal breaks down the growing case for equity perps as a retail-driven product nearing an inflection point. Enjoy, and you’ll have Byron back in your inboxes tomorrow!

The bull case for equity perps

Equity perpetuals are often framed as a crypto-native attempt to bring traditional markets onchain. In reality, their real competition is not options but leveraged ETFs, a product class that already has massive retail adoption. The appeal is simple. Retail investors increasingly want leverage in a clean and intuitive wrapper.

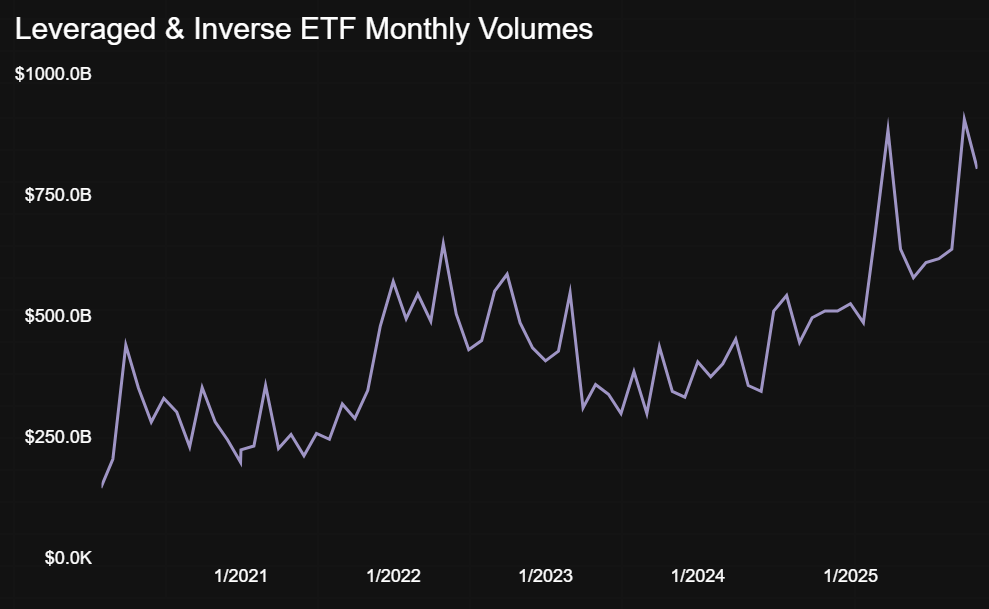

JPMorgan estimates retail equity flows in 2025 are over 50% higher than 2024 and above the meme stock peak of 2021. Leveraged ETFs have absorbed much of this appetite, with AUM growing from $41.6B in 2020 to $250B by late 2025, and monthly trading volumes exceeding $800B.

Source: Bloomberg

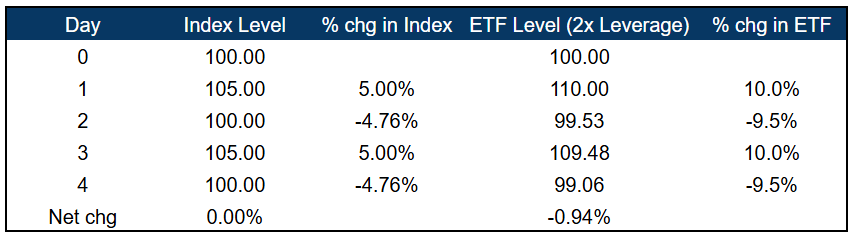

But leveraged ETFs are flawed: They rely on derivatives to reset exposure daily, which introduces volatility drag. Even when the underlying index goes nowhere, leveraged ETFs can lose value over time. These products are designed for short-term trading but are widely misunderstood and held longer than intended.

Equity perps fix this. They provide constant notional exposure without daily resets, meaning leverage does not decay mechanically. Volatility does not compound against the trader in the same way. For anyone seeking leveraged directional exposure, equity perps are simply a cleaner instrument.

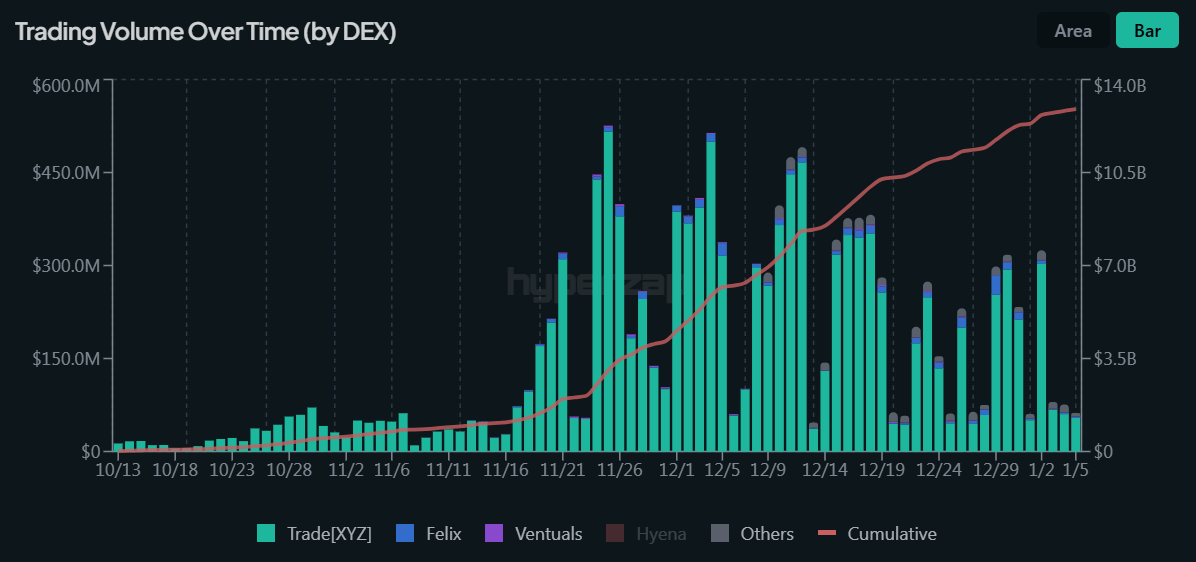

Early traction supports this view. Since mid-October, equity perp volume on Hyperliquid has reached roughly $12.9B, with daily volumes commonly found between $200M and $300M. Hyperliquid currently dominates market share, followed by Lighter.

Accessibility matters here. It’s no coincidence that equity perp volume has emerged on the same onchain venues that dominate crypto perps.

Source: Hyperzap

But there are frictions. When equity markets are closed, market makers cannot hedge, liquidity thins, and funding rates can spike. Platforms manage this differently through restricted trading hours or internal oracle adjustments. These issues explain why adoption has grown steadily rather than explosively.

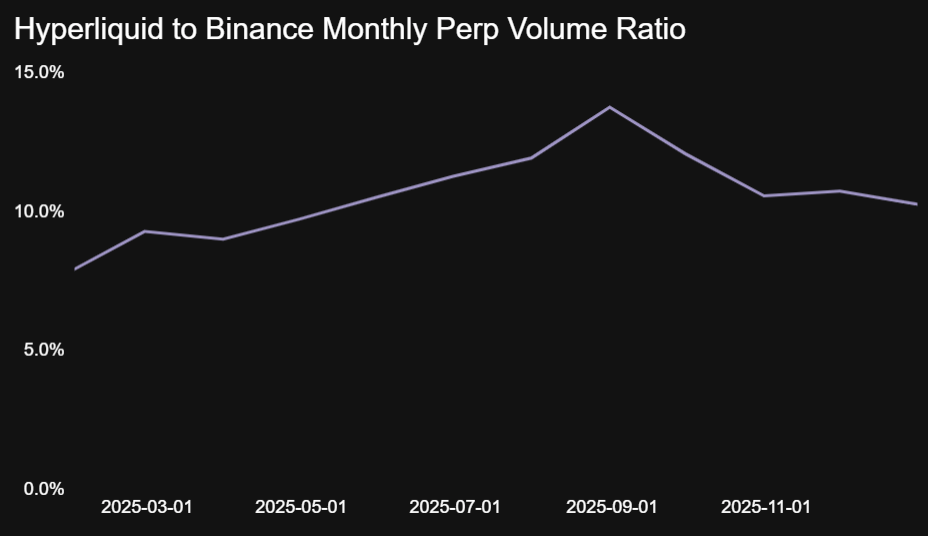

The long-term winners will not be determined by venue design but by distribution. Just as centralized exchanges dominate crypto perps, equity perps will likely scale through platforms with massive retail reach. Robinhood and Coinbase are best positioned.

Source: The Block

Both have already taken steps toward tokenized equities, and a compliant version of equity perps could emerge as early as 2026. The opportunity is large; leveraged ETFs currently trade between $800B and $900B per month. Capturing even 5% of those flows would increase trading volumes by an estimated 17% for Robinhood and nearly 70% for Coinbase. Ultimately, equity perps are not a crypto experiment. They are a retail product waiting for the right distribution channel.

How are DeFi and traditional rails actually converging?

Watch the Roundtable recording to hear voices from Blockdaemon, Aave, and Circle hash it out!

Brought to you by:

You’re only as decentralized as your weakest link. When data serving relies on centralized infrastructure, apps stall, streams break, and users feel it immediately.

Shelby is decentralized hot storage for read-heavy, real-time workloads like streaming, AI inference, and dynamic content. It’s coordinated on Aptos for speed, while remaining chain-agnostic by design.

The Shelby devnet is live with APIs, a CLI, and SDKs, including new React and Solana kits.