- The Breakdown

- Posts

- 🟪 Friday charts

🟪 Friday charts

Bubbles then, and now

Friday charts: Bubbles then, and now

Did the AI bubble just have its Burning Up moment?

In March 2000, Barron’s published a cover story — Burning Up — detailing how quickly internet stocks were going through cash, predicting that investors would be reluctant to give them more.

“When will the Internet Bubble burst?” the article began. “For scores of 'Net upstarts, that unpleasant popping sound is likely to be heard before the end of this year.”

Incredibly, the article was published within 10 days of the Nasdaq’s peak after a five-year, 570% rally — and the start of a 78% crash.

In hindsight, the Barron’s story looks less like coincidence and more like a catalyst: By spotlighting the cash burn, it helped cut off the flow of investor money keeping the bubble inflated.

Now, investors are having similar doubts about keeping the AI bubble inflated after a report from MIT concluded that “95% of organizations are getting zero return” on their generative AI spend.

Shares of Palantir fell as much as 20% this week in response, with Nvidia and AMD down 8% and 11%, respectively.

If that turns out to be the beginning of the end of investors’ love affair with those types of AI stocks, the MIT report will surely get the blame.

“These [AI] tools primarily enhance individual productivity, not P&L performance,” the report found, casting doubt on why companies would continue to invest in them.

The problem could be structural, too. Unlike human intelligence, the report finds that “most GenAI systems do not retain feedback, adapt to context or improve over time.”

If that makes companies decide to stop buying AI services from software providers, software providers will stop buying cloud services from the hyperscalers, and the hyperscalers will stop buying GPUs from the chipmakers.

That would be traumatic for investors, of course — and for the whole of the US economy, which has arguably been kept afloat by the hyperscalers’ giant investments in data centers and energy.

But we should remember that this is an investment bubble and not necessarily a bubble in AI itself.

Consider that Alan Turing conceived of artificial intelligence in the 1930s, a decade before the first working computer even existed.

The current investment bubble, if that’s what it is, has dramatically accelerated the realization of Turing’s vision, but his vision is hardly dependent on it.

As the internet before it, AI might do even better after its investment bubble has popped.

If big corporations give up on AI, other more innovative companies will make the most of the infrastructure they leave behind.

When Procter & Gamble said in 2018 it was cutting spending on Facebook ads because it wasn’t getting a return on them, many took it as an indictment of Facebook.

In truth, it was an indictment of Procter & Gamble, whose failure to figure out how to use online ads made room for new competitors who did.

The MIT study that so worried investors this week may similarly have surveyed corporations that just don’t know what to do with a new technology.

But it’s not just corporations — the latest iteration of ChatGPT has widely been considered a disappointment because it’s not as much of a step-change improvement as previous versions were.

But the new version is also creating “original research-level mathematics” that human mathematicians could not come up with themselves.

And AI is also designing physics experiments that a human physicist never would: “The outputs that the thing was giving us were really not comprehensible by people,” one researcher told Wired. “They were too complicated, and they looked like alien things or AI things. Just nothing that a human being would make.”

If physicists don’t quite know what to make of AI, it’s no wonder that corporations are struggling to.

Even Alan Turing did.

“Machines take me by surprise with great frequency,” Turing wrote in 1950, in response to skeptics who said machines will only ever do what we tell them to.

The surprise may not be that the bubble bursts — it presumably will, eventually — but that AI, like the internet, will just be getting started when it does.

Let’s check the charts.

Palantir v. Cisco:

John Authers notes that the run-up in Palantir dwarfs even the historic Cisco move in 1999. Appropriately, Cisco is finally approaching its all-time highs from 2000, thanks to a booming AI business.

The data center boom:

The US will soon be spending more on data centers than it does on office buildings.

Back to school:

Ben Carlson notes that a steep drop in OpenAI usage coincided with the end of the school year. Investors will have to hope that AI finds a better use case than students outsourcing their homework.

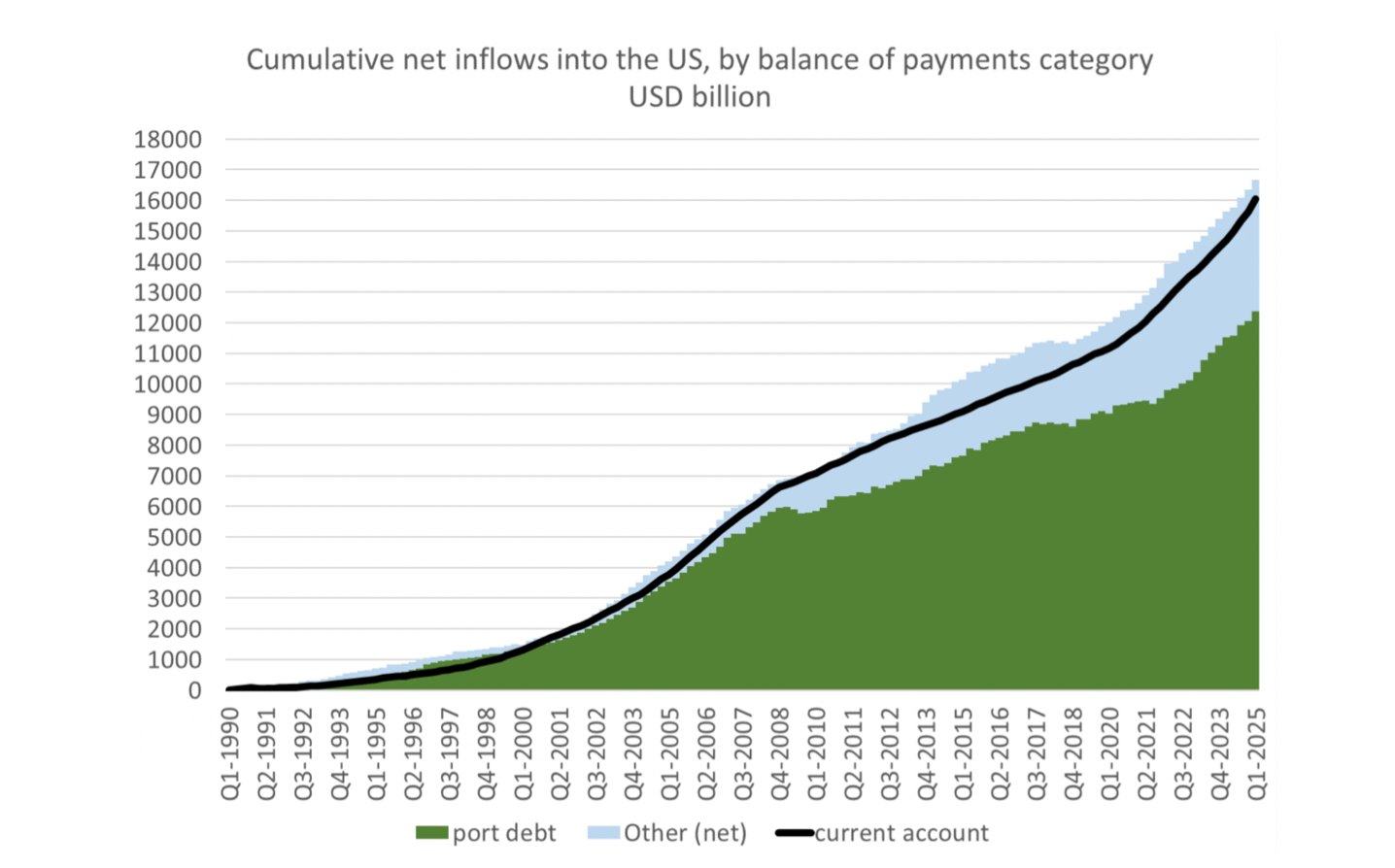

The US is exporting government debt and AI investments:

Brad Setser explains that the AI bubble is funding the US’s current account deficit. The blue area above is thought to be mostly investment flows into US equities. The green area is mostly government debt.

Generation degen:

This fun chart from BofA (via @MikeZaccardi) suggests millennials are driving the surge in trading volumes on US stock exchanges.

Someone is buying all the debt, too:

Despite all the hand-wringing over unsustainable government deficits, investors are pouring more money into bond funds than ever before.

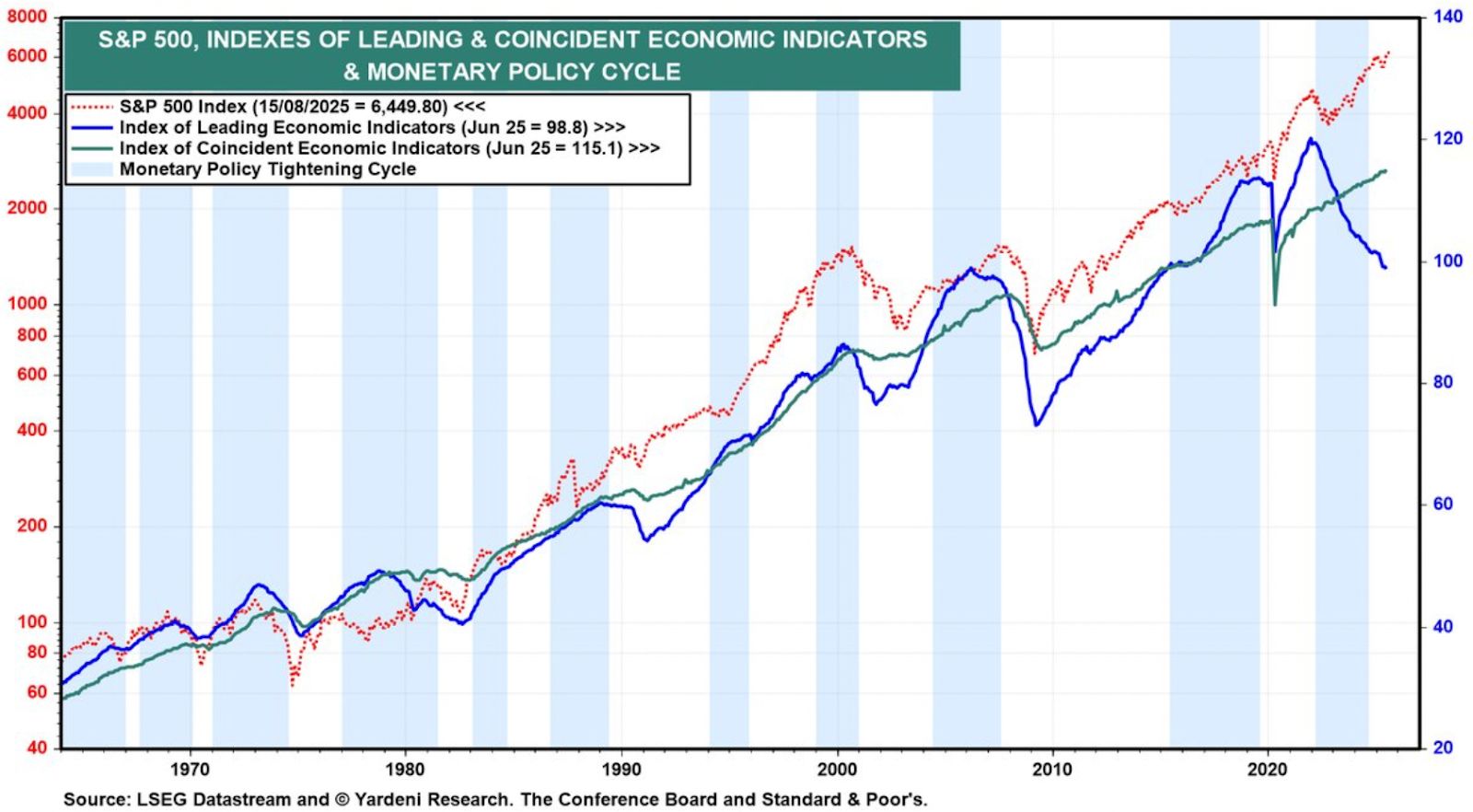

The market is ignoring the indicators:

The Conference Board’s Index of Leading Economic Indicators (in blue) has turned sharply lower. But stocks (in red) have continued to go higher.

The long view:

It’s always tempting to try to time the next investing bubble, but here’s a reminder of the opportunity cost: Adjusted for inflation, the S&P 500 is up 5,462% over the past five decades.

Past performance is no guarantee of future performance, of course, and the AI investment bubble may well be due to pop.

But Alan Turing might advise you to let yourself be surprised.

Have a great weekend, naturally intelligent readers.

Brought to you by:

Don’t let infrastructure complexity slow your digital asset strategy.

Blockdaemon provides a single point of access to the decentralized economy for the world’s leading financial institutions, including Citi, Goldman Sachs, and J.P. Morgan. Our globally distributed infrastructure offers high-performance nodes, unified APIs, secure MPC wallet infrastructure, and the industry's leading institutional staking platform — all with seamless API integration.

Power your business with the provider trusted to secure over $110B in digital assets for 400+ institutional clients.

By Ben Strack |

By Blockworks |

By Blockworks |

It’s the summer of DATS and the party is going strong.

But when October rolls around, everyone will be looking to DAS: London to hear from these meta-defining voices on where things stand and where they’re headed.

Buy your tickets with promo code: BREAKDOWNNL

📆 October 13-15 | London