- The Breakdown

- Posts

- 🟪 Friday charts

🟪 Friday charts

The pessimists’ bull market

Friday charts: The pessimists’ bull market

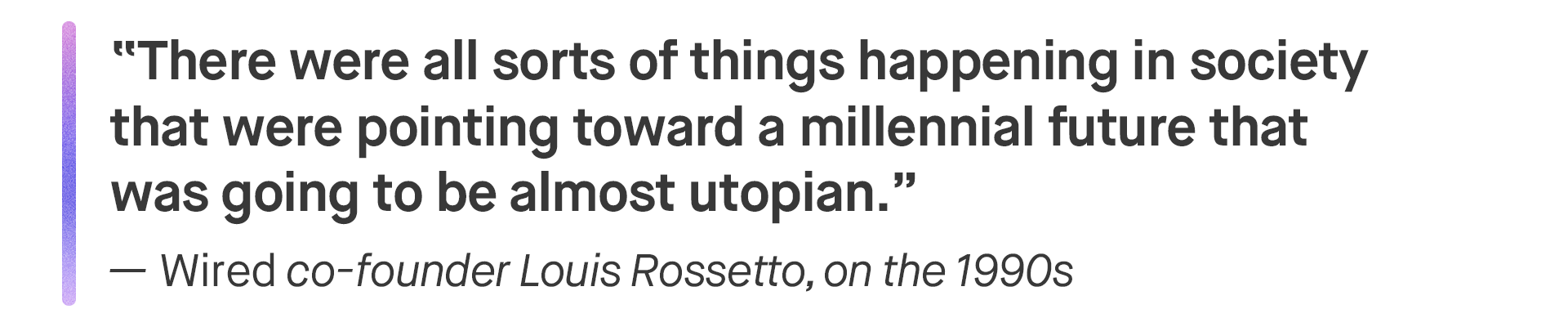

The 1990s bull market was driven by optimism.

The Cold War had been decided in favor of capitalism; optimistic views of globalization, free-market economics and liberal democracy were ascendant.

We trusted government officials to make good decisions: In 1999, Time Magazine unironically described Alan Greenspan, Bob Rubin and Larry Summers as “the committee to save the world.”

We trusted Silicon Valley, too, because the pre-social-media Internet looked like nothing but a good thing: “Digital technology,” Nicolas Negroponte wrote in 1995, would be “harmonizing and empowering" — “a natural force drawing people into greater world harmony.”

With equity markets booming and interest rates falling, the biggest worry was that the US government wasn’t borrowing enough money: A shortage of Treasury bonds threatened to gum up the financial system.

In all, the optimism was so pervasive that in 1997 Wired magazine proclaimed, “We're facing 25 years of prosperity, freedom, and a better environment for the whole world.”

Twenty-eight years later, that promise of prosperity seems to have held up — as measured by the stock market, at least: The S&P 500 is up nearly 1,500% since 1997.

But this current bull market runs on a fundamentally different fuel: fear.

Whereas 1990s investors rushed into dotcom stocks because they thought the internet would make the world a better place, 2020s investors are rushing into AI stocks because they fear they soon won’t have a place in it.

AI has induced a fear of obsolescence in humans, who may not have much to do after Artificial Superintelligence (ASI) is achieved.

Once AIs can do all the jobs, the only way to make money will be to own the AIs — a logic that transforms existential dread into investment strategy. If you think ASI is coming, it makes sense to buy as much of a stake in it as possible now, before it’s too late.

Other fears are causing investors to rush into precious metals.

In 2000, gold had fallen to $263 an ounce, down 60% from its high in 1980 — optimistic investors, besotted with tech stocks, had all but abandoned the “barbarous relic.”

In 2025, precious metals may be the only asset hotter than tech stocks.

It’s easy to see why — thanks to runaway deficit spending and fracturing geopolitics, Treasurys no longer seem like a risk-free asset. As a result, pension funds are divesting and central banks are diversifying.

And if Treasurys are no longer risk-free, where else do fretful investors and politically-minded central bankers have to turn?

Inert metals seem like a safer bet than the hyperactive US government at the moment.

Investing is about the future — future profits for companies, future consumption for investors. So it only makes sense that our hopes and fears about the future would be reflected in our investment portfolios.

1990s hope was soon undermined by the dotcom bust, 9/11, the Great Financial Crisis, and the rise of social media — all of which contributed to today’s pervasive feeling of fear.

But feelings aren’t facts, so this may not be the best way to invest.

With luck, today’s fears will come to seem at least as misplaced as 1990s hope.

Let’s check the charts.

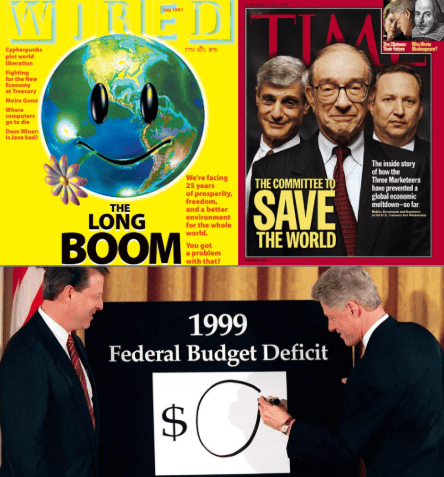

Fretful consumers:

US consumer confidence, which hit an all-time high in 2000, is nearing an all-time low in 2025.

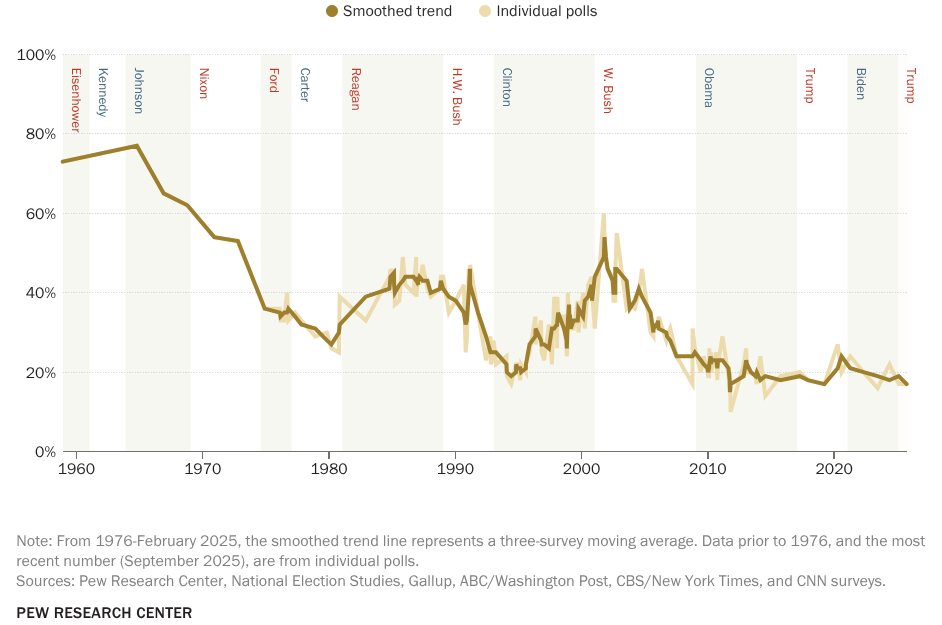

Distrusting Americans:

A long-running Pew survey finds that trust in government has fallen from 60% in 2001 to 16% in 2025. (Or should 60% be italicized? I’m not sure which number is more incredible.)

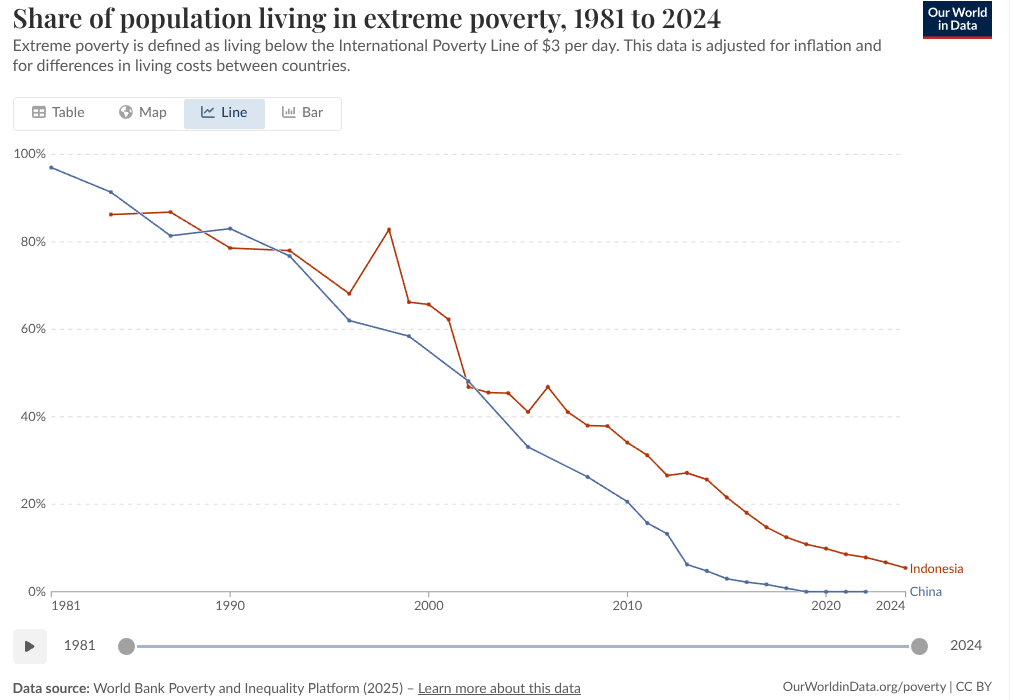

Wired was right:

Well, half right: “We are riding the early waves of a 25-year run of a greatly expanding economy that will do much to solve seemingly intractable problems like poverty and to ease tensions throughout the world.” Amazingly, poverty in big countries like China and Indonesia really is something close to being solved.

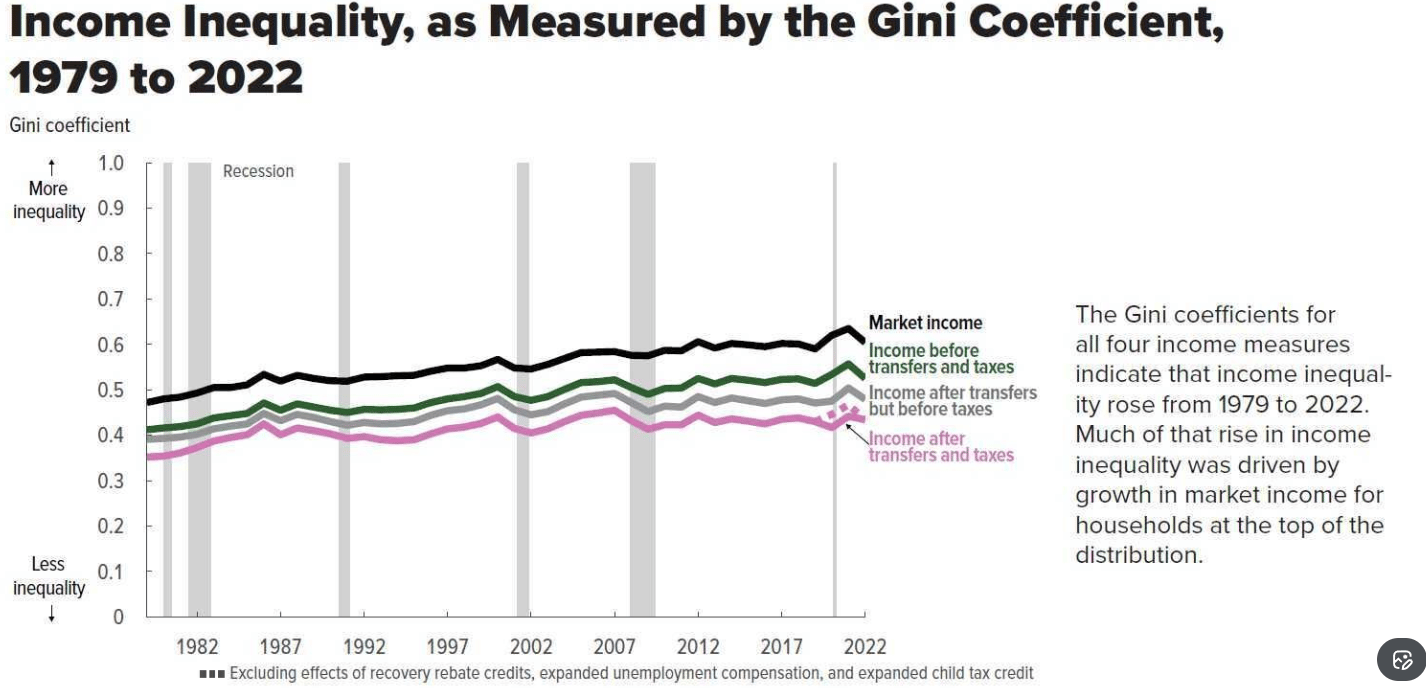

Narrative-violation warning:

Timothy Taylor notes that, after transfers and taxes (the pink line), inequality in the US has barely budged in recent decades.

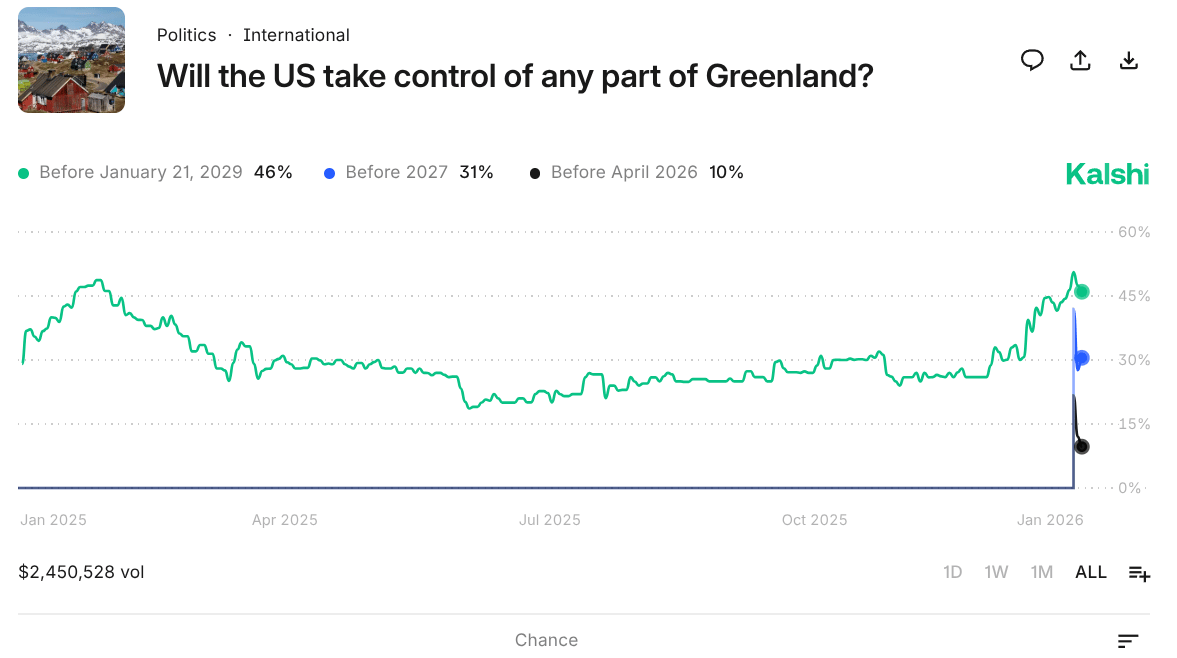

Greenland is still a coin flip:

Kalshi odds put a 46% probability on the US taking control of some part of Greenland — but also a 34.5% probability that the US will buy part of Greenland. I think that works out to a 75% probability that, should anything happen, it should be peaceful. (Note: Polymarket has the probability of the US acquiring part of Greenland at just 26%.)

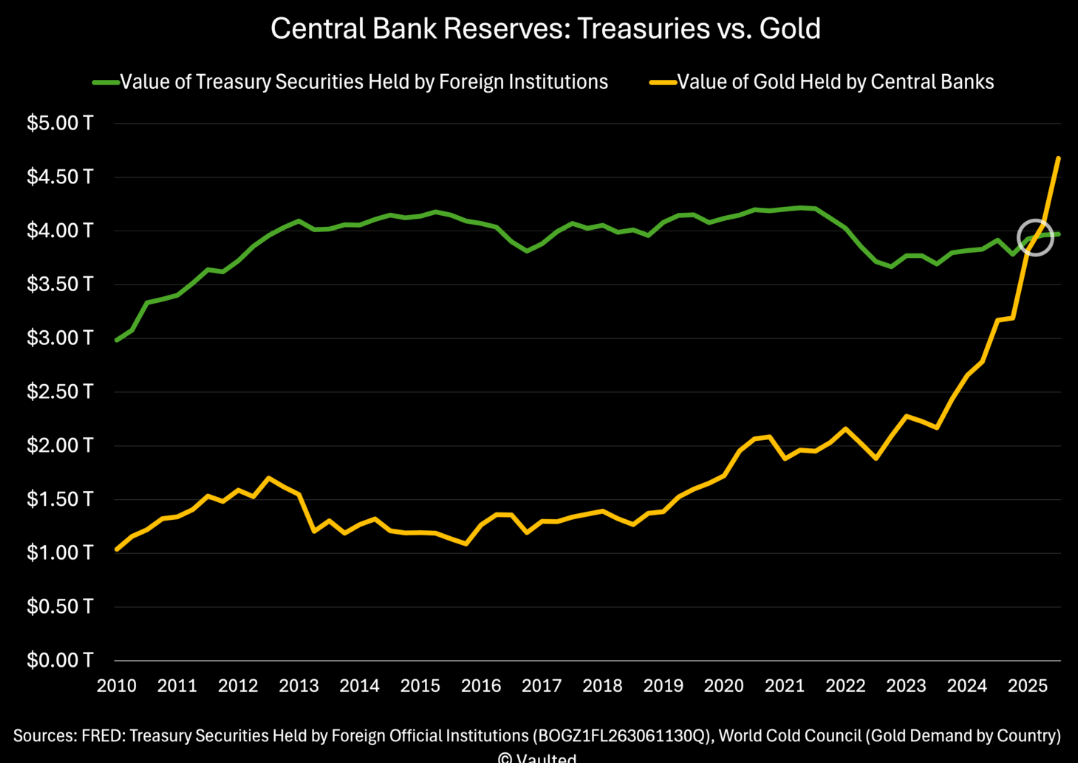

Gold zooms past Treasurys:

For the first time since 1996, the value of gold held by central banks ($4.6 trillion) exceeds the value of the US Treasurys they hold ($3.9 trillion).

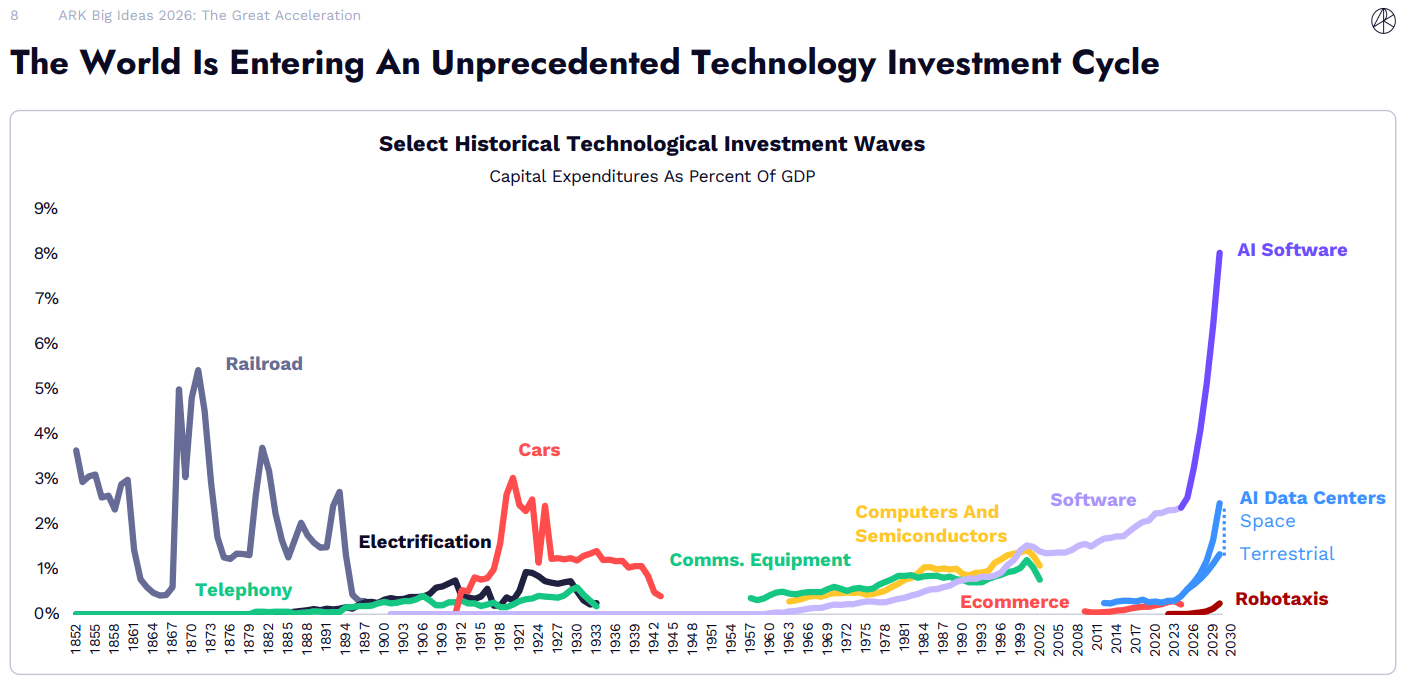

The AI bet:

Source: Ark

As a percentage of GDP, spending on AI is expected to make all other technology cycles look small.

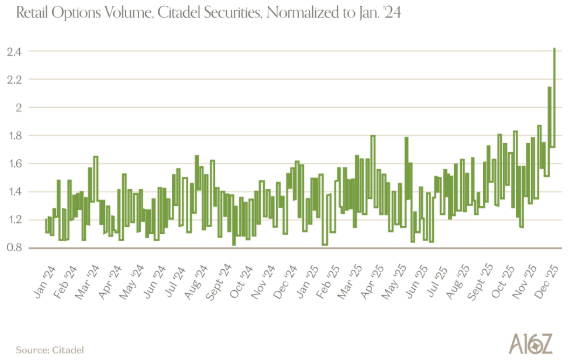

YOLO investing:

Retail investors are piling into options like never before — when you’re pessimistic about the future, lottery tickets look more appealing.

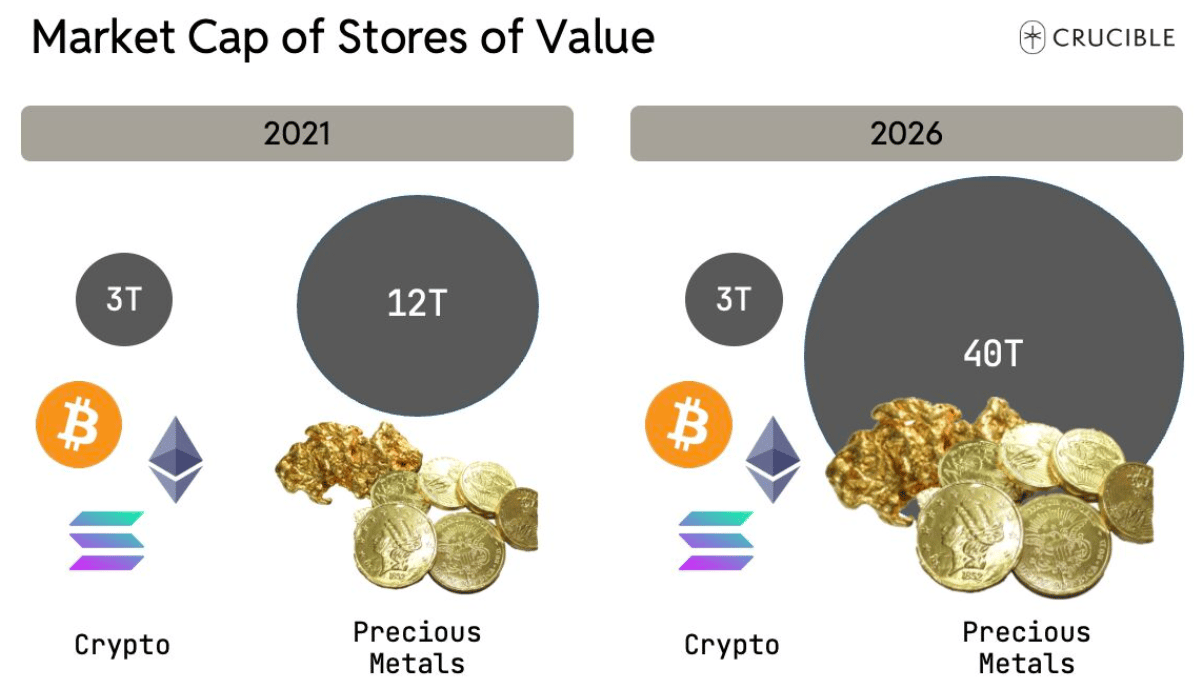

Missing out:

Via Meltem Demirors: Crypto investors had the right idea in looking for alternate stores of value — the issue is, they seemed to have picked the wrong ones. The total market capitalization of the crypto ecosystem is basically unchanged over the last five years, while precious metals have more than tripled.

Investing in the future might be even harder than predicting it — which may be good news.

Let’s hope the pessimistic predictions are all wrong.

Have a great weekend, precious readers.

Brought to you by:

Institutions and DeFi are converging on Canton, creating real-world finance with crypto-style speed.

The latest The Tie report shows growing demand for privacy, composability, and sustainable tokenomics.

With 575+ validators and 600K+ daily transactions driving on-chain activity, Canton’s network momentum is accelerating on-chain global finance.

Crypto's premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: BREAKDOWNNL for $100 off.