- The Breakdown

- Posts

- 🟪 Friday charts

🟪 Friday charts

Third-derivative thinking

Friday charts: Third-derivative thinking

Sir John Templeton’s adage about the four most dangerous words in investing first appeared in a 1987 New York Times article warning that the bull market in stocks was getting long in the tooth: “It is late and investors must be very cautious.”

Incredibly, the article ran just eight days before Black Monday — the worst day in stock market history.

(Even more incredibly, a neighboring sidebar profiled the cold-calling brokerage later made famous in the scene from Wolf of Wall Street when Jordan Belfort sells his first penny stock: “Thank you for your vote of confidence and welcome to the Investors Center.”)

In 1987, investors rationalized historically expensive stocks by telling themselves history didn’t apply: “‘This time is different,’ they will say, because investors have no other choice but to invest in stocks.”

Even after that painful lesson, similar thinking prevailed in 1999, 2007 and 2021 — always for different reasons, but always with the same result.

To Sir John’s point, what’s never different is that investors will always come up with reasons to overpay for stocks.

Is it happening again in 2025?

People increasingly seem to think so.

GQG Research compares 2025 to 1999 on an exhaustive list of metrics and concludes that today’s market “may be worse than the dotcom bubble.”

Dror Poleg warns that OpenAI is “probably worse” than WeWork: “The company would need a miracle to justify its current valuation.”

Paul Kedrosky sees similarities between today’s booming market for AI-related credit instruments and the famously overheated market for housing credit in 2008. He expects a similar result: “The bubble is getting tired.”

Even Sam Altman thinks AI is in a dotcom-style bubble.

In truth, it’s impossible to say because what even is a bubble?

Investment bubbles are a know-it-when-I-see-it kind of thing.

But it’s hard not to see it when an AI startup that “has not released a product and has refused to tell investors what [it’s] even trying to build” can raise $2 billion from investors, as Derek Thompson reports.

Raising money like that is only possible because there are now more private equity funds in the US (19,000) than McDonald’s restaurants (14,000).

As anecdotal evidence of bubbles go, that seems like a good one.

More concretely, the sheer size of the investments being made seems distinctly bubbly: McKinsey estimates that $6.7 trillion will be invested in AI data centers over the five years, from 2025 to 2030.

By comparison, telecom companies spent about $500 billion building internet infrastructure during the dotcom bubble (roughly $1 trillion adjusted for inflation).

But that’s hardly conclusive because the potential upside is so much bigger, too.

Where the internet promised to change how we shop and watch movies, AI promises to change, well, everything.

Marc Andreessen insists AI will be so much more revolutionary than the internet that there’s effectively no comparison: “It’s 10 or a hundred or a million times more valuable.”

In other words, it really is different this time: “All of your petty comparisons to bubbles in the 1990s just wash out because, my god, look at what the thing can do.”

If so, investors heeding Sir John’s old investing adage should perhaps heed Morgan Housel’s new one instead:

"The 12 most dangerous words in investing are "the four most dangerous words in investing are 'this time it's different.'""

There’s never been anything like AI so trying to compare it to anything risks being too simplistic.

Still, it's going to take something special to make the numbers work.

Derek Thompson colorfully illustrates this by noting that hyperscalers’ annual capex ($500 billion) is roughly the GDP of Singapore, while their AI-related annual revenue ($12 billion) is roughly the GDP of Somalia.

The wealth gap between Singapore and Somalia is a measure of how much business the hyperscalers will have to drum up to justify the mammoth investments they’re making.

Analysts at Deutsche Bank think their businesses will have to go “parabolic” to make that happen.

Are investors correctly pricing in the odds that demand for AI will go parabolic?

If so, Morgan Housel’s second-derivative thinking that it’s Sir John’s advice that’s dangerous will itself prove to be dangerous.

To avoid that trap, Patrick Collison proposes some third-derivative thinking:

“The 20 most dangerous words in investing are ‘the 12 most dangerous words in investing are ‘the four most dangerous words in investing are 'this time it's different’"

Whew! That’s a lot of derivatives — possibly three too many.

Investing is hard enough without resorting to an I-know-that-you-know-that-I-know loop of logic.

Fortunately, the truth is much less loopy: It’s different every time.

Let’s check the charts.

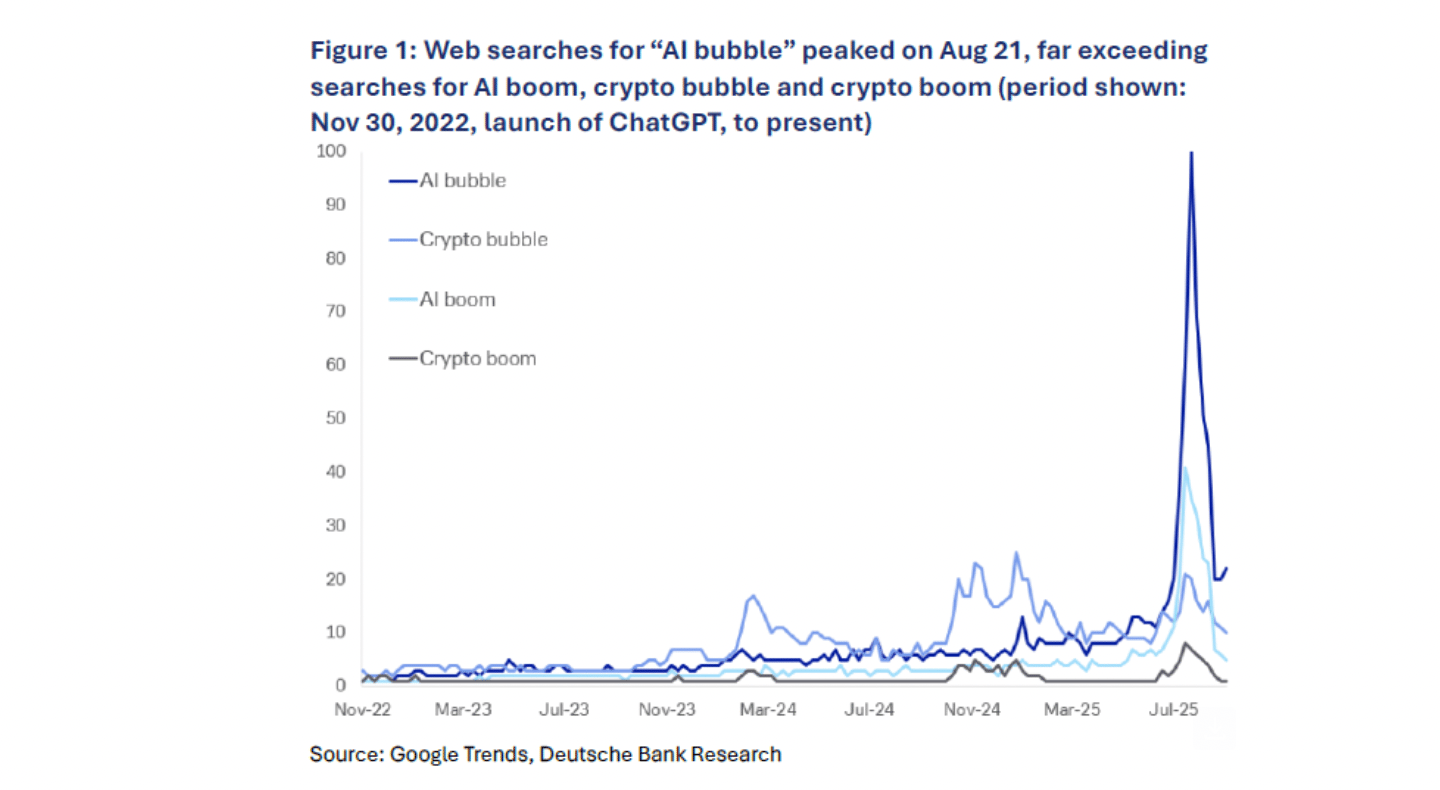

The AI-bubble bubble:

Deutsche Bank’s data on web searches suggests that media references to an AI bubble was itself a bubble that’s already burst. But that doesn’t mean we’re in the clear: “The moment everyone spots it may be the moment it is least likely to burst.”

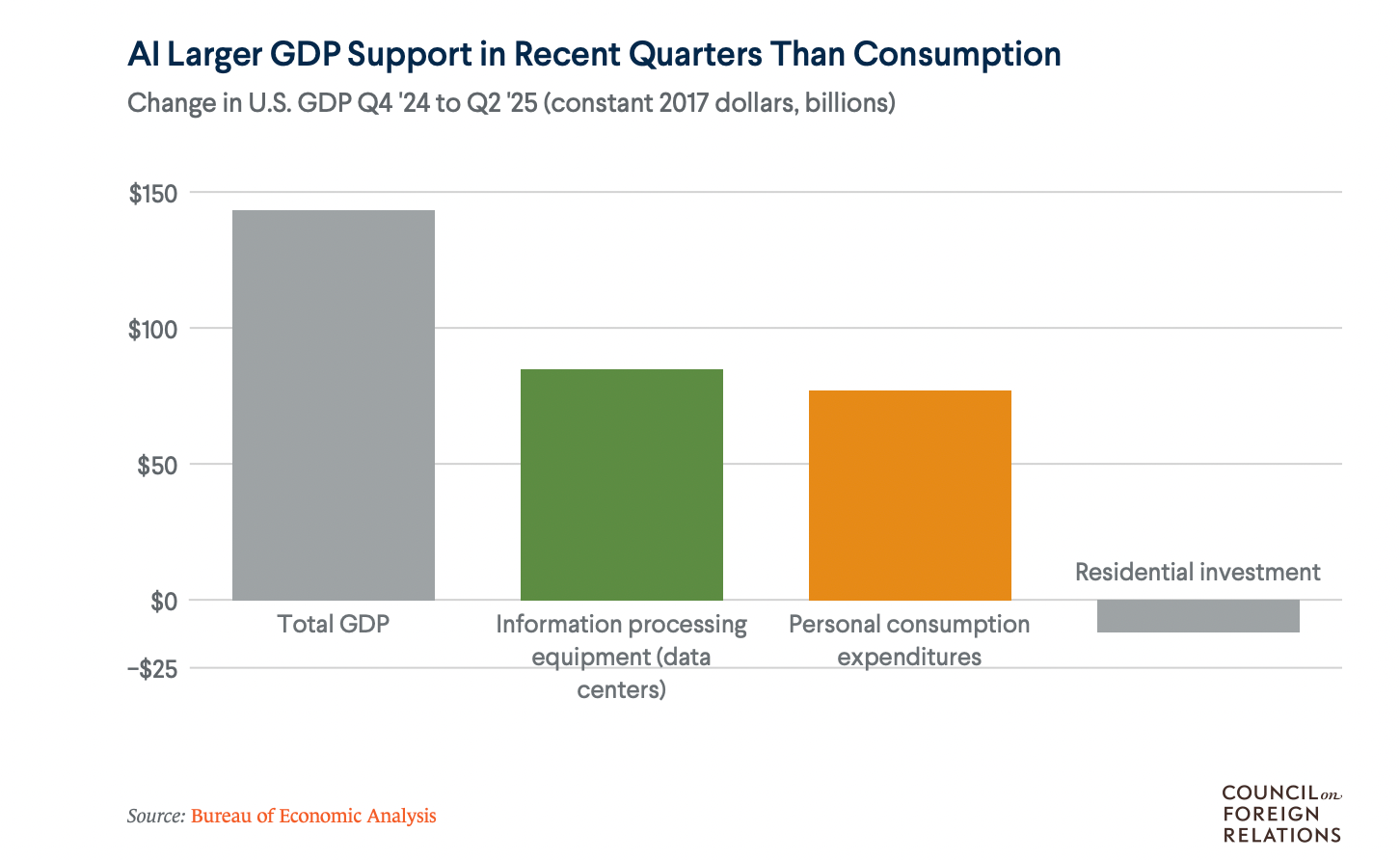

GDP bubble?

In the first half of the year, AI infrastructure investment was a bigger portion of US GDP growth than consumers were.

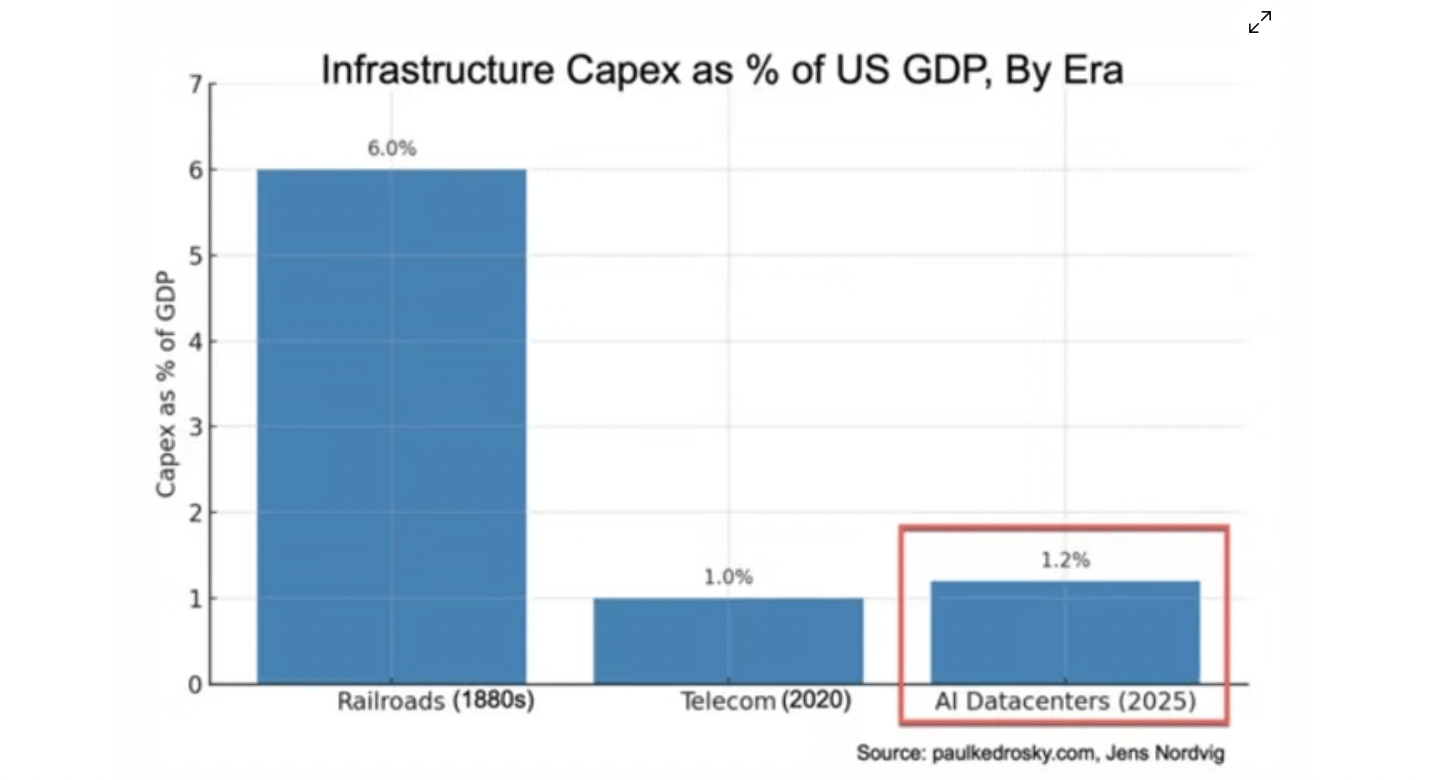

Comparing bubbles:

As a percentage of GDP, the investment in AI data centers is already bigger than the investments in internet infrastructure.

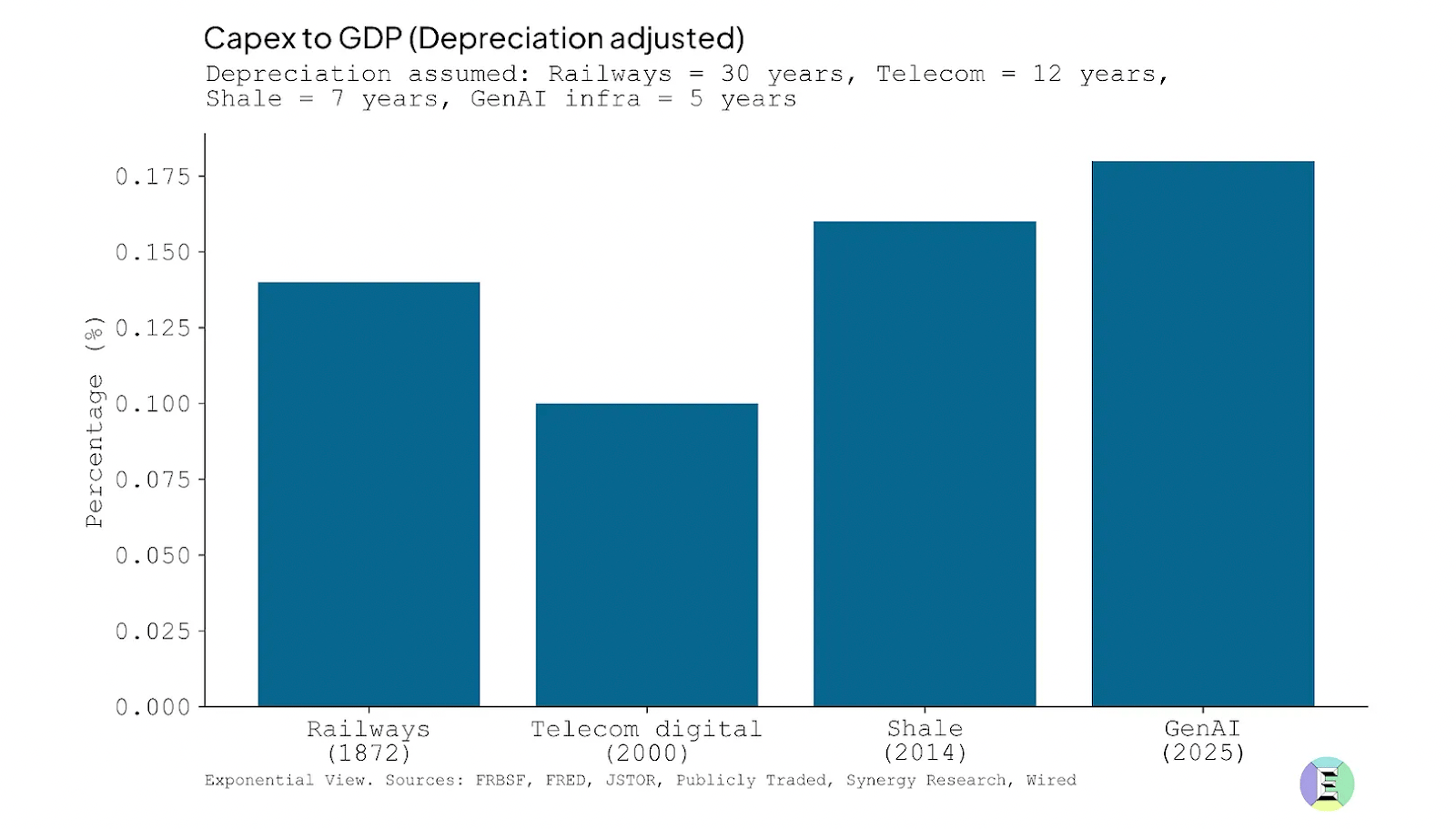

But how long will they last?

Adjusted for the useful life of the infrastructure built, investment in AI is already bigger than the 19th century investments in railroads. 150 years later, we’re still using some of those railroad tracks. But how long will it be before today’s GPUs are in a landfill? Five years? 10? Not 150, for sure.

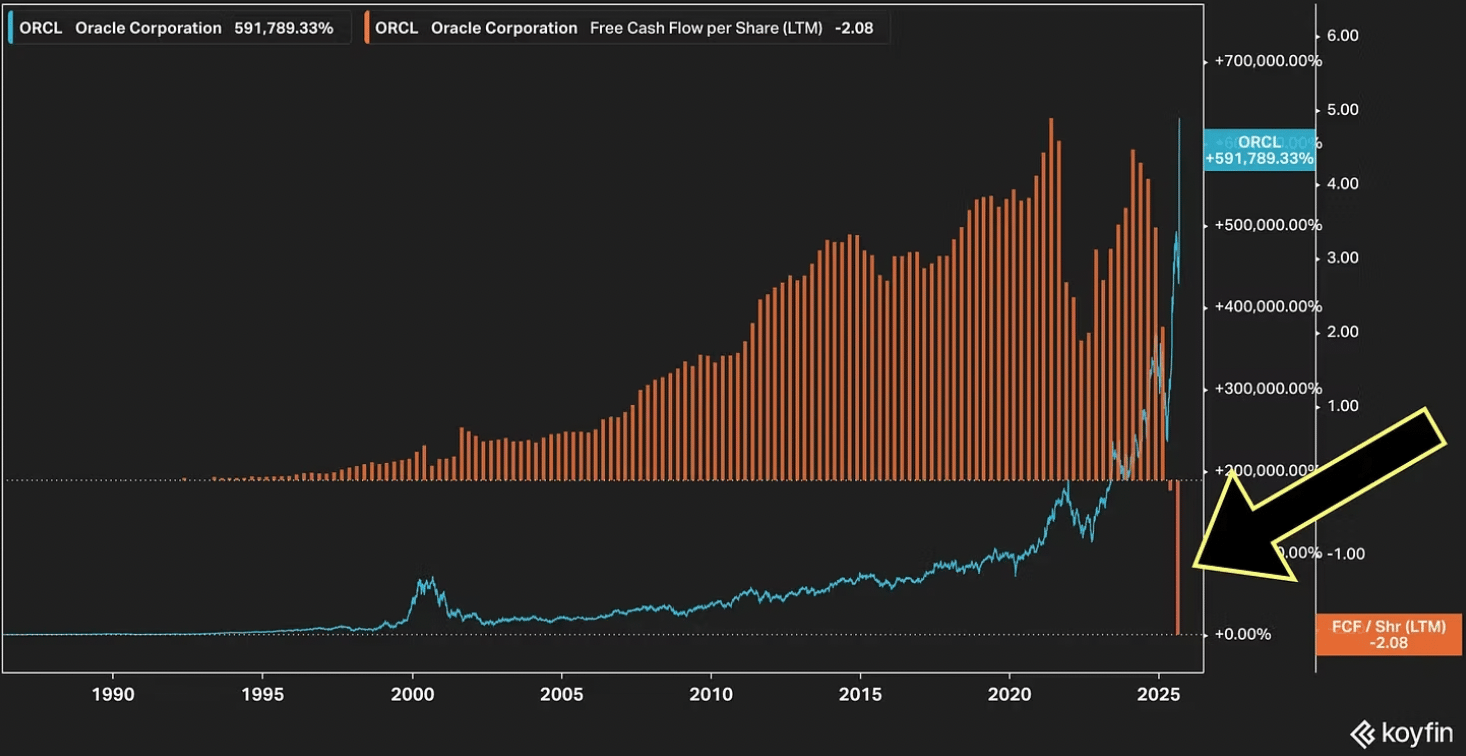

Burning cash:

Michael Allison notes that Oracle, which has almost always prioritized cash flows and share buybacks, is suddenly throwing caution to the wind and betting so big on AI it will have to either sell a lot of equity or borrow a lot of money.

There will be debt:

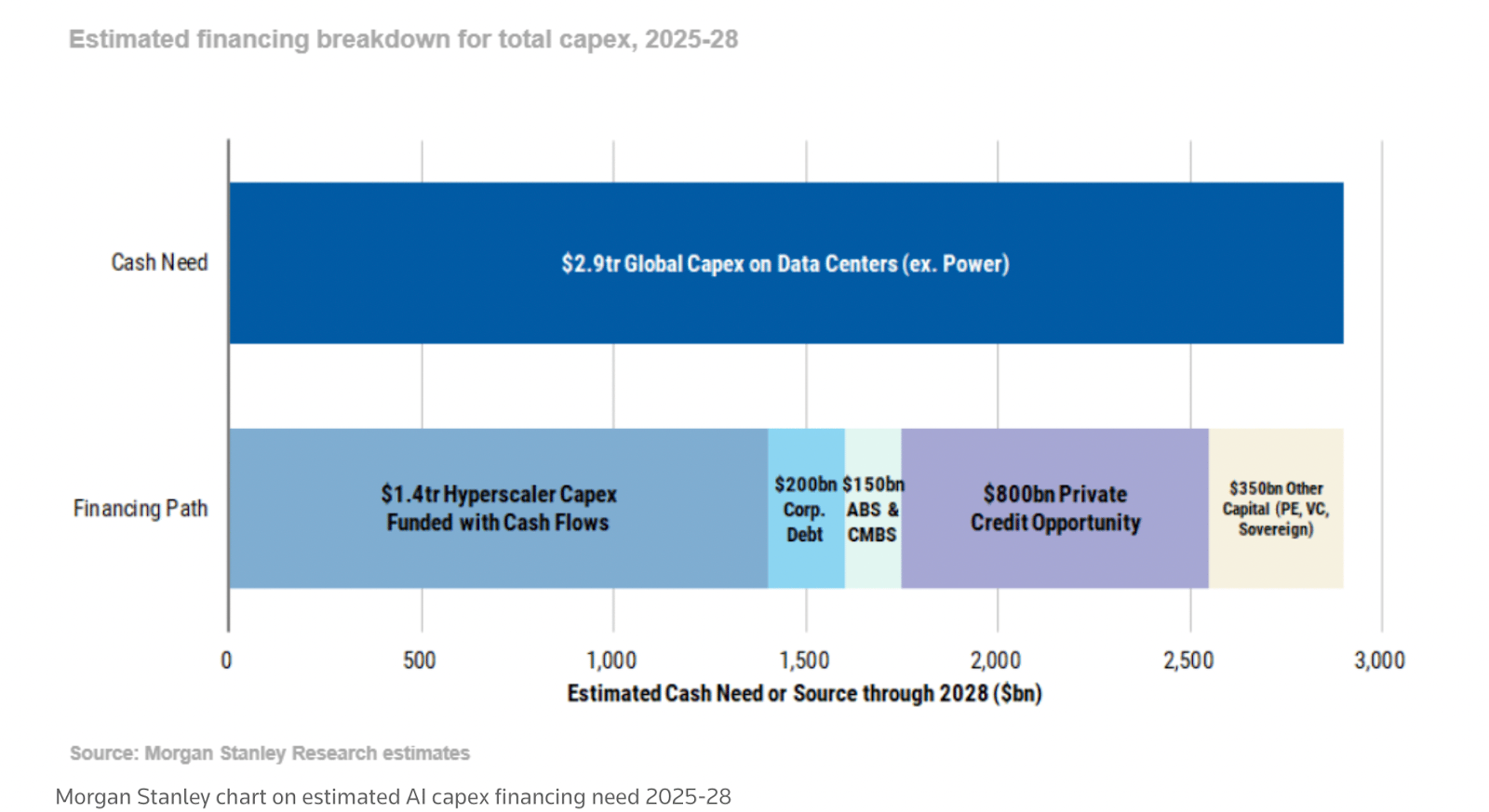

Morgan Stanley estimates that about half of data center spending through 2028 will be covered by hyperscalers’ cash flows, which is pretty good. But financing the other half might lead to trouble in credit markets and possibly the banking system.

We’re just getting started:

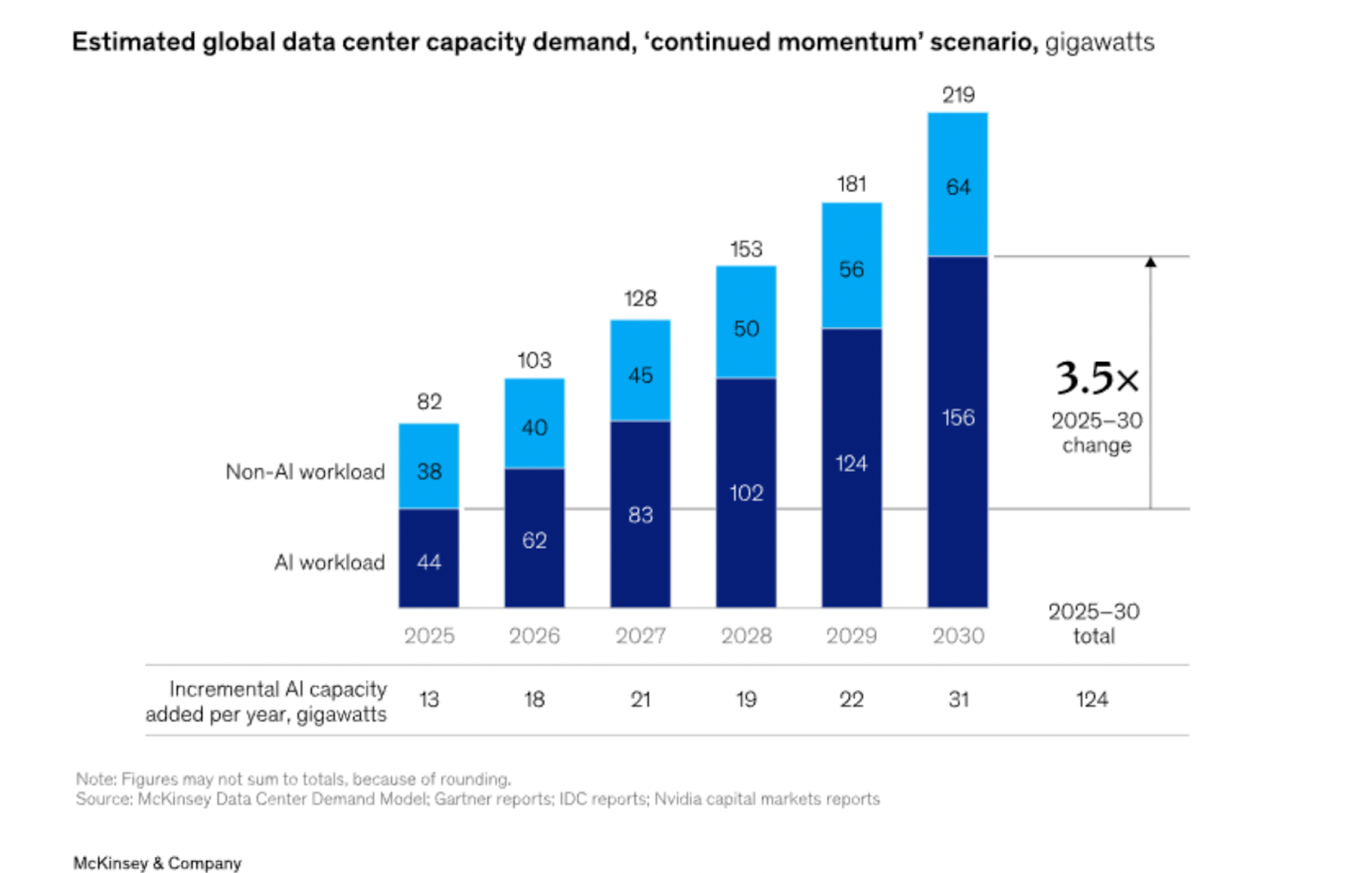

McKinsey estimates that AI workloads in data centers will increase 3.5x between now and 2030. If that’s right, and it all gets funded, and the power grid can support it…the stock market might not be in a bubble.

Bubble dashboard:

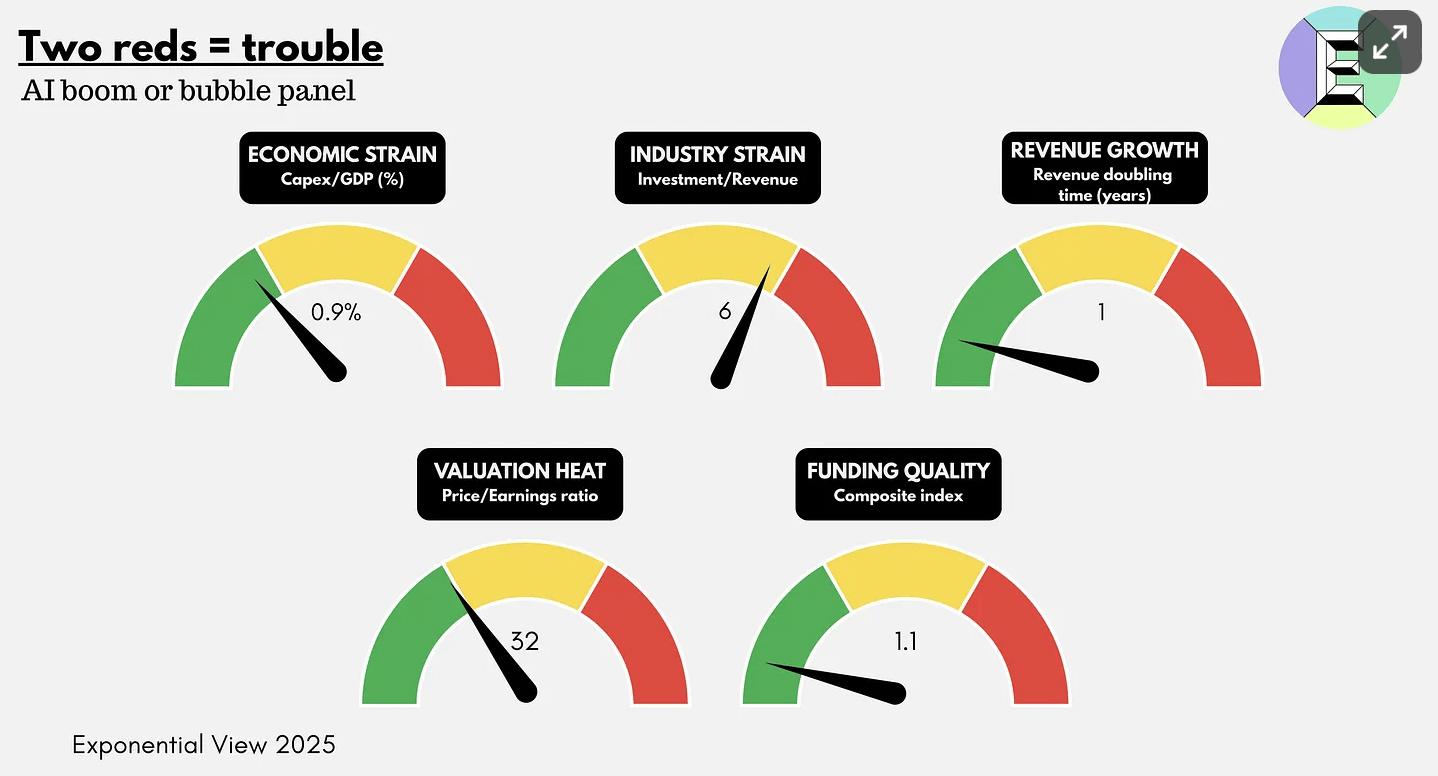

Azeem Azhar helpfully gives us some metrics to watch and concludes we’re not in bubble territory yet. Whether these indicators would flash red in time for investors to get out is another question (I doubt it).

Still pretty popular:

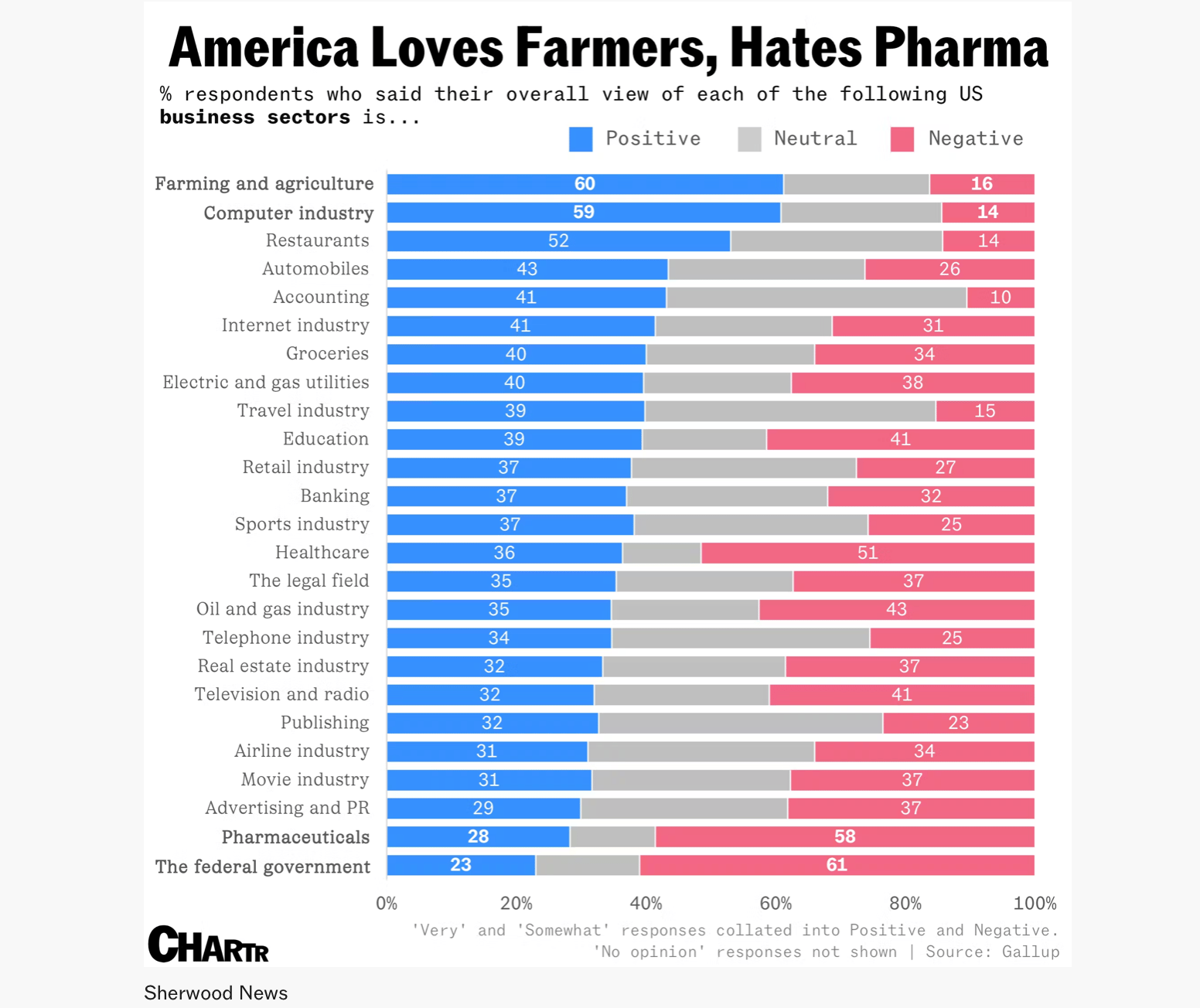

The “computer industry” is second to only farmers in a survey of how people feel about US business sectors. The internet industry finished a respectable sixth. (Not shown: newsletter writing at 100% positive.)

Let’s hope it’s different enough this time that it stays that way.

Have a great weekend, fourth-derivative thinkers.

Brought to you by:

Grayscale is excited to announce the launch of Grayscale CoinDesk Crypto 5 ETF (ticker: GDLC) — the first crypto exchange-traded product in the U.S offering investors access to the market cap-weighted performance of the five largest and most liquid crypto assets1 , covering 90% of the crypto market’s capitalization2 .

Grayscale CoinDesk Crypto 5 ETF (“GDLC” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. Investing involves risk, including possible loss of principal. An investment in GDLC is subject to a high degree of risk and volatility. GDLC is not suitable for an investor that cannot afford the loss of the entire investment. An investment in the Fund is not a direct investment in any cryptocurrency.

Grayscale CoinDesk Crypto 5 ETF has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents GDLC has filed with the SEC for more complete information about GDLC and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, GDLC or any authorized participant will arrange to send you the prospectus after filing if you request it by calling (833)903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent and Grayscale Investments Sponsors, LLC is the sponsor of GDLC.

By Ben Strack |

By Blockworks |

By Blockworks |

By Casey Wagner |

Sponsored Content |

Crypto is changing TradFi derivatives and rate markets as we know them.

DAS: London will feature all the builders driving this change.

Get your ticket today with promo code: BREAKDOWNNL

📅 October 13-15 | London

Tell your friends, rack up rewards! 🎉

Some market insights are just too good to not share. Use the Breakdown referral program and snag rewards while you’re at it:

1 Grayscale and CoinDesk, as of 8/29/2025. Largest and most liquid assets reflect eligibility for U.S. exchange and custody accessibility and U.S. dollar or U.S. dollar-related trading pairs. Exclusions include stablecoins, memecoins, gas tokens, privacy tokens, wrapped tokens, staked assets, or pegged assets. Largest is defined by circulating supply market capitalization, and most liquid is defined by 90-day median daily valued traded.

2 CoinDesk as of 08/31/2025, based on the crypto market ’s total investable universe.