- The Breakdown

- Posts

- 🟪 And the 2025 winners are...

🟪 And the 2025 winners are...

Crypto dethroned amid holiday lull

Happy Friday! We’ve brought the 0xResearch analysts back today to recap some market moves and the top takeaways from their recent podcast episode. Enjoy!

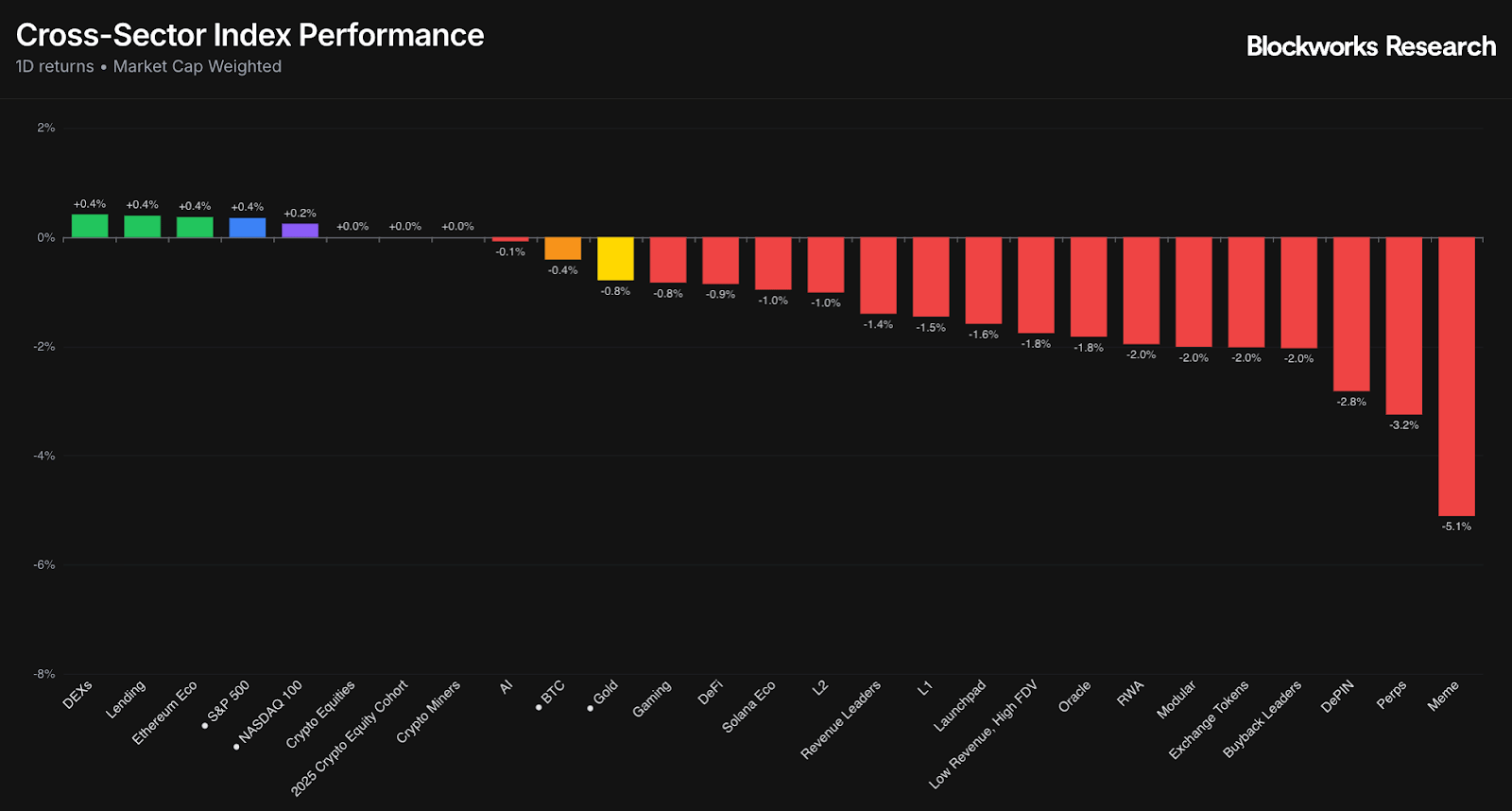

It’s been a slow week with Christmas, and traditional markets were closed yesterday. BTC slipped slightly (-0.4%) on muted volumes across the board, reflecting the broader holiday lull. With price action quiet, it’s a good moment to step back, reflect on 2025 and think about 2026 positioning.

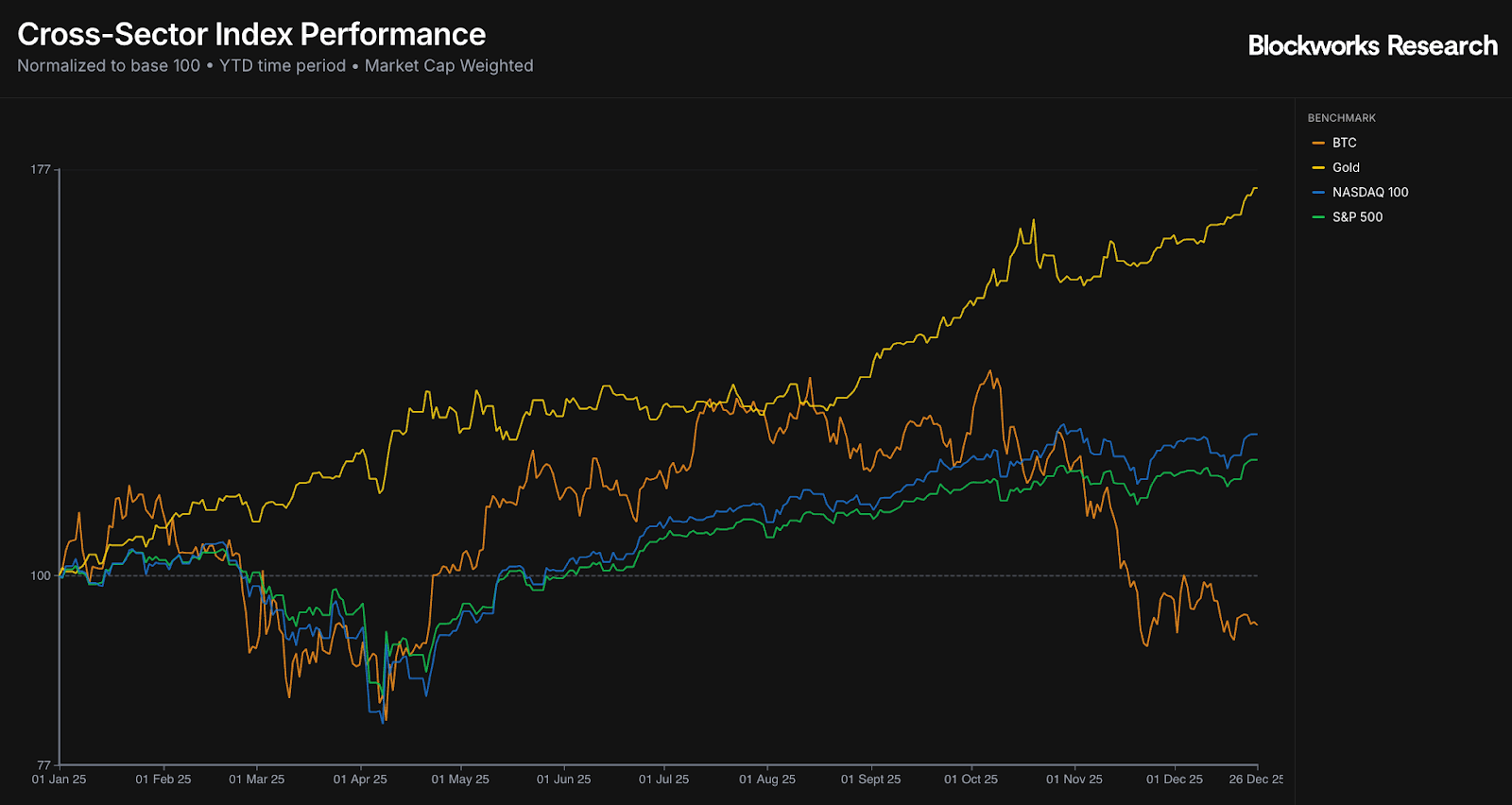

Bitcoin has underperformed stock benchmarks this year, but its performance vs. gold and silver is even more striking. In hindsight, those two will likely be remembered as the standout assets of 2025, a surprising outcome if you’d predicted it at the start of the year. Gold is having its best year since 1979, up around 72% year to date and recently breaking out to new all-time highs above $4,500 an ounce. Silver has done even better, rallying nearly 160% year to date and about 45% in the past month alone, reaching a record ~$75 an ounce yesterday.

Looking ahead, 2026 could present compelling opportunities in liquid tokens. Many quality DeFi names are trading near multi-year lows, even as fundamentals and forward-looking growth remain strong. Crucially, value capture has flipped from infrastructure to applications: On Solana, for example, apps now generate roughly 3x the revenue of the network. The key question for investors is whether, and when, valuations will start to reflect this new reality.

“Crypto is dead” = crypto natives are saturated: Dougie DeLuca’s core point is that most builders still design only for crypto natives, but those users are already onboarded. The next leg of growth comes from apps that hide crypto rails and serve mainstream users directly.

BD vs. real sales, and who L1s should actually serve: The group argues most “BD” in crypto is just protocol-to-protocol deals, not real sales to end customers. Chains’ true customers are app developers and asset issuers (AWS analogy), and winning the asset listings (spot + perps) is what attracts innovation, as seen in Solana vs. Hyperliquid around new tokens.

Monetizing L1s and exchanges is still unsolved: There’s tension between being the “Nasdaq” (backend venue with thin economics) vs. the “Robinhood” (owning the end user and higher margins). Hyperliquid currently monetizes better via perps, while Solana captures little from huge spot flows, and everyone is experimenting with models that don’t alienate builders (e.g., enshrining specific apps).

Stablecoins as a monetization vector (and a fragmentation risk): The crew expects every chain and many companies to issue their own stablecoin to internalize yield, but that creates a messy, fragmented landscape. It likely pushes value toward stablecoin-as-a-service models and routing/FX layers that abstract thousands of branded dollars away from the end user.

“Crypto fund” as a category will fade: DeLuca argues that saying you’re a “crypto fund” in the next five to 10 years will sound as odd as saying you’re an “internet fund” today. Investors will specialize by vertical (fintech, consumer, infra, etc.), noting non-crypto natives like YC-backed fintechs are already producing successful onchain apps.

The dual equity-token structure is unworkable: The Aave Labs vs. Aave DAO situation is held up as a case study in misaligned equity vs. token incentives. IP and frontends sitting in separate companies create value leakage and governance headaches. They also discuss Uniswap’s recent efforts to tightly align Labs and UNI token economics.

Look for the full podcast on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

How are DeFi and traditional rails actually converging?

Watch the Roundtable recording to hear voices from Blockdaemon, Aave, and Circle hash it out!

Brought to you by:

You’re only as decentralized as your weakest link. When data serving relies on centralized infrastructure, apps stall, streams break, and users feel it immediately.

Shelby is decentralized hot storage for read-heavy, real-time workloads like streaming, AI inference, and dynamic content. It’s coordinated on Aptos for speed, while remaining chain-agnostic by design.

The Shelby devnet is live with APIs, a CLI, and SDKs, including new React and Solana kits.