- The Breakdown

- Posts

- 🟪 The greatest glass of lemonade

🟪 The greatest glass of lemonade

OpenSea faces a tricky path, but this is crypto — anything can happen

Brought to you by:

Wells, wells, wells

The SEC’s latest salvo in its crypto crackdown was aimed at OpenSea, the once-mighty NFT marketplace.

As expected, the response from the crypto community was twofold: praise OpenSea, blast Gary Gensler. It’s a sympathetic view: For all the SEC’s “come on in and register” talk, the reality actually translates to “sit down and comply."

For much of the past two years, OpenSea’s reputation has taken a hit, largely on the back of the emergence of competitors and the perception that the NFT marketplace has been slow to evolve in a more difficult environment. New reporting published this week by The Verge painted a portrait of a startup buffeted by headwinds both inside and out.

Now OpenSea is on the front lines of the battle over regulation in the US. It’s not an enviable position, to be sure — much-needed resources could now be devoted to lawyers if the SEC actually takes them to court — but this week was the first time in quite a while that OpenSea garnered so much universal support. Goodwill like this can go a long way.

Again, maybe I’m reading the tea leaves wrong here, but imagine if OpenSea were to translate this good will into positive momentum for its platform, services, etc. The marketplace faces a tricky path — turn the ultimate lemon into the greatest glass of lemonade of all time — but this is crypto, after all.

Now, on to the roundup:

— Michael McSweeney

Tired of panels? We got you covered at Permissionless. Hear from the leading voices across different ecosystems on the design debates that will shape the future of the crypto space.

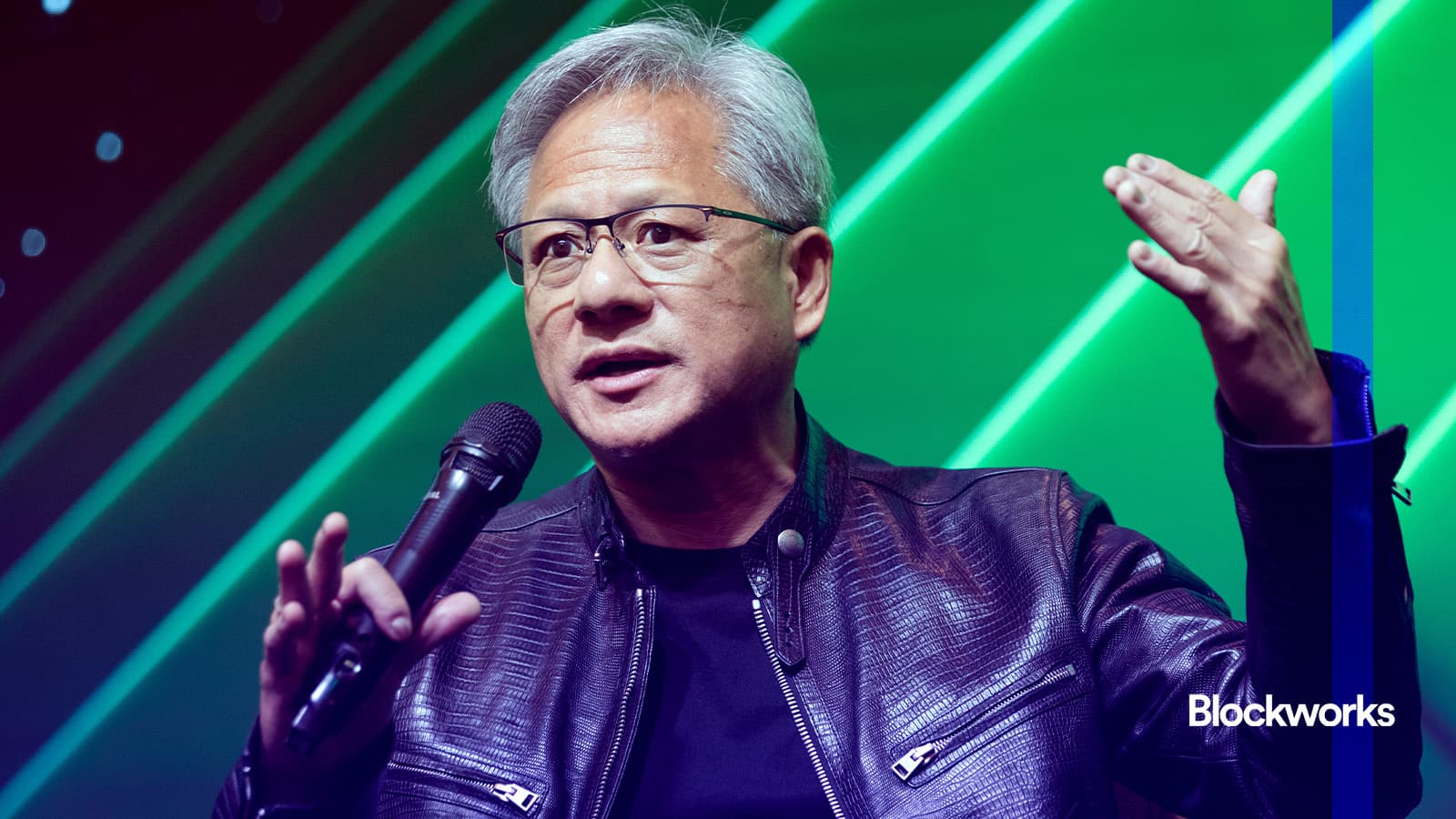

On Thursday, the On the Margin crew decoded this week’s NVIDIA earnings. Naturally, I care a great deal about this given the not-inexpensive graphics card in my gaming rig, but I digress: As Felix Jauvin wrote, “the company had huge expectations to live up to. It was priced to perfection.”

Look, if you’re expecting me to translate Jack Kubinec’s head-turning headline this week, I’m gonna take a pass on that one.

Beneath the zoomer mambo-jumbo was a real story: A major liquid restaking platform is getting into the governance token game. As Jack wrote: “Many of the Solana ecosystem tokens airdropped this year were meant as governance tokens, and it will be interesting to see how these newer protocols actually govern.”

Drift Protocol is looking to borrow a leaf from Polymarket’s book with a new prediction market — and maybe steal some mindshare to boot. Bettors are lining up to predict the outcome of the upcoming presidential election — as the 0xResearch team suggests, there’s plenty of political speculation to go around this season.

The Empire team was all over the Telegram/TON situation this week, and for good reason: One of the Web’s acclaimed bastions of free speech is under fire from regulators in France. The situation raises thorny questions, David Canellis wrote, given Telegram’s outsized role as a crypto-comms platform. Stay tuned, as they say.

Speaking about NFTs and those pesky securities rules, Byron’s (reasoned) take was this: “At the risk of being crypto-cancelled, yes, I think some NFTs could reasonably be categorized as securities.” He’s got a point — yes, some crypto-folks will loathe this idea, and yes, some NFTs are going to fix snugly within the Howey test’s confines. Womp womp.

Blockworks Research is conducting a survey to gain insight into the institutional staking landscape. This data will help industry leaders adopt their strategies as the industry matures.

If you're an institutional staker, we want to hear from you (and if you’re new to Blockworks Research, get 20% off of our service while you’re at it!)