- The Breakdown

- Posts

- 🟪 Reverse-takeover DATs

🟪 Reverse-takeover DATs

A grab bag of risks for investors

Reverse-takeover DATs are a grab bag of risks for investors

The half-life of a market opportunity is a function of the frictions involved in exploiting it.

A business opportunity like selling GPUs might last forever because GPUs and the proprietary software needed to run them are hard to make.

A financial opportunity like arbitraging a stock across exchanges might last just a fraction of a second because trading on stock exchanges is easy.

Digital asset treasury companies (DATs) are somewhere in between.

There’s currently a mad rush of new DATs seeking to arbitrage the premium that investors are willing to pay for crypto tokens held by an exchange-listed company.

But it takes months for a company to get listed on exchanges, so despite all the new entrants, the window of opportunity has not yet been closed.

Everyone expects it will be soon though, so only those fastest to market are likely to profit.

Getting there via an IPO is out of the question — wrangling all the lawyers and bankers, getting approved by the SEC, and marketing a deal to investors can take a year or more.

A SPAC listing is faster — it might compress the listing process down to six months or so, as several DATs are currently attempting.

They still might not make it in time.

The premium for exchange-listed crypto (as measured by mNAV) is already shrinking — before any of the proposed SPAC deals have even been finalized.

So to get a new company listed on the stock exchange before the DAT opportunity is arbitraged away, the only option may be to acquire a company that’s already on the stock exchange.

This is creating some strange exposures for investors.

Just recently, we’ve had a biotech company become an ETH DAT, a toy maker a TRON DAT, a maker of cleaning products a DOGE DAT, and a wellness company a BONK DAT.

In most cases, the only redeeming feature of this odd assortment of businesses is that they’re already listed on a US stock exchange.

A new Solana DAT, for example, has been created by a de facto takeover of a company that’s developed a new kind of syringe, Sharps Technology.

It’s not a good business.

For the first quarter of this year, Sharps Technology recorded $0 of revenue and an operating loss of $2 million. At the end of last year, the company told the SEC it had “substantial doubt” about its ability to continue as a going concern. In 2023, Sharps’ accounting firm resigned because the company “did not meet [its] internal risk tolerance metrics.”

And yet, the newly crypto-focused company says it will remain in the business of selling syringes.

This commitment to a failing enterprise — wholly unrelated to the company’s new mission to accumulate crypto — seems to defy business logic.

But it does have financial logic.

“If you don’t create an ACTUAL operating business aside from crypto asset accumulation,” Paul McCaffery wrote in an email this week, “you’re going to get excluded from Russell indices.”

That may not sound like the worst fate in the world to you, but it could be for a business that’s dependent on its share price trading above NAV.

“Russell inclusion is essential to monetizing the capital markets flywheel,” McCaffery explains. “It forces institutional buying in the order of approximately 17% of the free float of a company…and increases proportionally as companies issue new shares.”

This could prove to be mission-critical: A DAT that’s excluded from indices, McCaffery warns, is almost certain to trade below mNAV.

Trading below mNAV is the DAT equivalent of failing to sell any syringes, so index exclusion is not something they will want to risk.

Those aren’t the only risks in being a pure-play asset company, either.

Without an operating business, a new DAT could fall short of exchange listing requirements and face higher regulatory scrutiny if the SEC deems it an investment company.

As a result, the seed investors that create these new DATs have been taking on some strange business risks.

(And legal risks, too — Andrew Keys warns that reverse-takeover DATs are a “honeypot” for litigation.)

They could, of course, look for higher-quality companies to merge with, but that would be 1) more expensive and 2) slower.

“For now,” McCaffery explains, “these investors have insisted on mNAV (or very close) valuations with the primary focus on speed and the goal of tapping the capital markets flywheel ASAP.”

In other words, they just want the exchange listing and something they can call an operating business — and they don’t want to pay anything for it.

Unfortunately, you do get what you pay for.

And in their rush to catch the DAT opportunity before it’s arbitraged away, what investors are getting is some strange risks.

Brought to you by:

Arkham is a crypto exchange and a blockchain analytics platform that lets you look inside the wallets of the best crypto traders — and then act on that information.

Arkham’s Intel Platform has a suite of features including real-time alerts, customizable dashboards, a transaction visualization tool, and advanced transaction filtering — all of which is accessible on all major blockchain networks, and completely free.

Arkham’s main product is the exchange, where users can express their trade ideas against the market.

By Ben Strack |

By Donovan Choy |

By Blockworks |

By Blockworks |

Brought to you by:

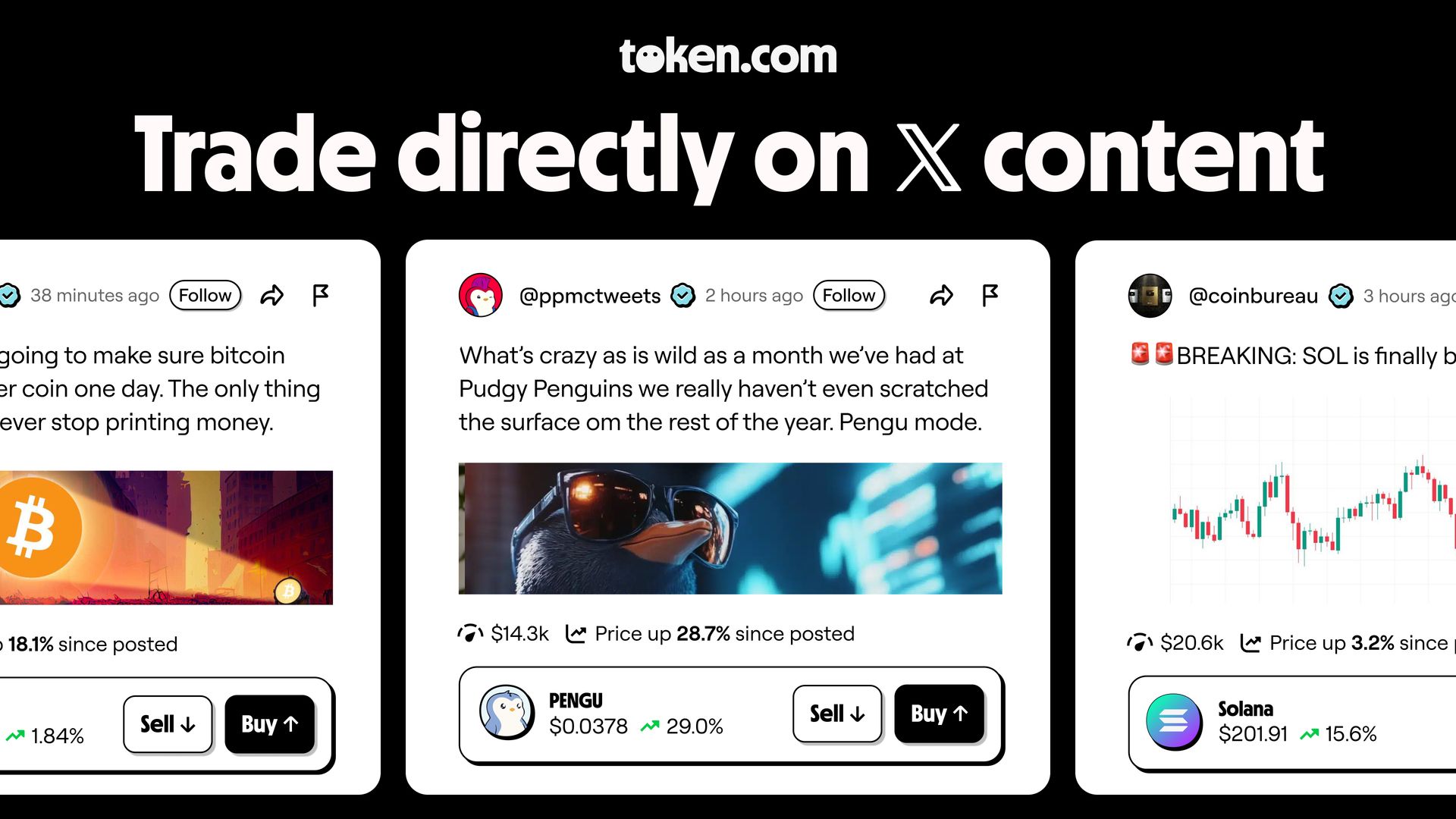

Token.com brings Creator Capital Markets to Solana with a groundbreaking X-integration feature.

Trade the latest tokens and wrapped stocks directly from X posts in our innovative all-in-one app.

Creators monetise content through trading fees while traders access the best crypto Twitter alpha. Learn more at Token.com!