- The Breakdown

- Posts

- 🟪 Sanctions are sieges

🟪 Sanctions are sieges

Stablecoins are escape routes

Sanctions are sieges; stablecoins are escape routes

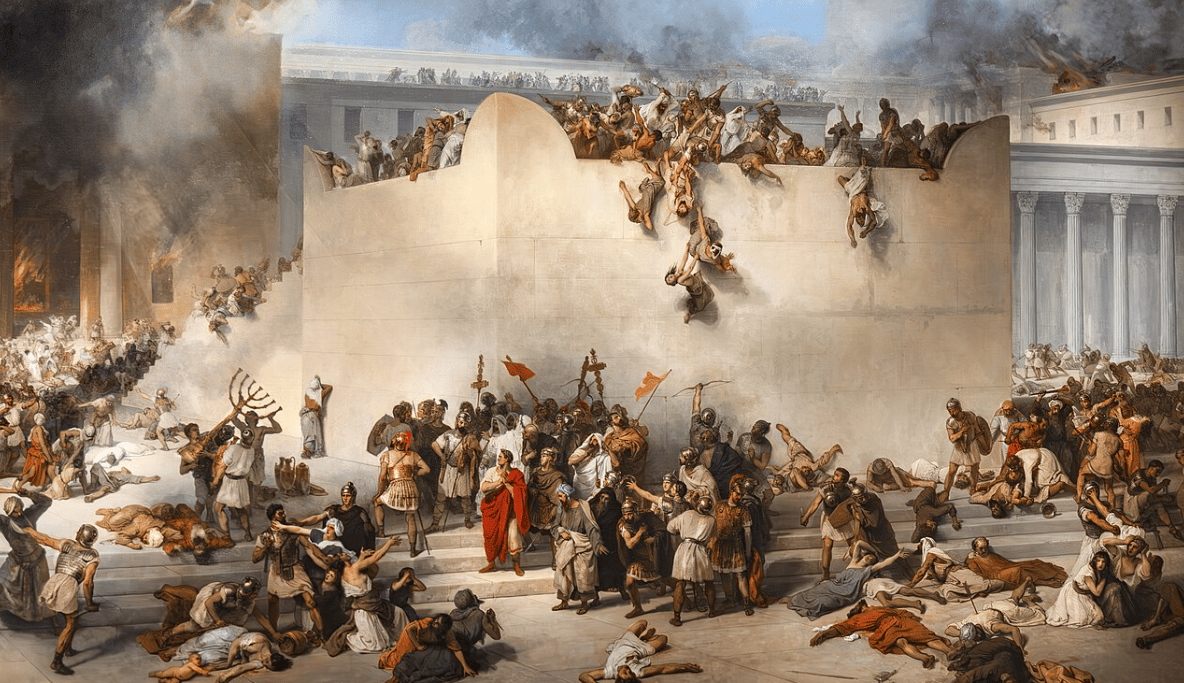

For millennia, the siege of a walled town has been recognized as an act of war — and a particularly brutal one, at that.

Unlike battles that target enemy combatants, sieges, wielding starvation as a weapon, target civilians.

The goal of a siege "is surrender, not by defeat of the enemy army,” Michael Walzer writes in Just and Unjust Wars, “but by the fearful spectacle of the civilian dead."

Sieges, he adds, are “the oldest form of total war.”

Ancient moral traditions acknowledged the cruelty of sieges. Talmudic law, interpreting the biblical command in Deuteronomy, held that all sieges should leave an escape route for non-combatants.

"We are commanded when we besiege a city to leave one side unguarded so that if they wish to flee, they will have a way to escape,” the Talmudic scholar Nachmanides wrote in the 13th century. “For in this way we shall learn to behave with compassion even with our enemies in time of war."

Yet history's most famous sieges — from ancient Troy to Soviet Leningrad — have disregarded this principle of compassion, encircling cities completely and compelling surrender through civilian deprivation.

This is how economic sanctions work, too.

Sanctions have become so commonplace they seem like administrative routine now — as unremarkable as the latest tariff news or a new banking regulation.

To the extent that we bother to think about them, sanctions seem better than dropping bombs, because anything seems better than that.

At times, however, they can be even worse.

“Sanctions are the modern version of siege warfare," the legal scholar and ethicist Joy Gordon writes. “Each involves the systematic deprivation of a whole city or nation of economic resources.”

They used to be recognized as such. Through World War I, economic sanctions were considered an act of war, subject to the rules of armed conflict. In Europe, for example, naval blockades required a declaration of war to be considered legal.

Beginning with the Covenant that established the League of Nations, however, sanctions were reframed as an alternative to war — a “peaceful” instrument of international diplomacy that could replace the use of force.

“Apply this economic, peaceful, silent, deadly remedy and there will be no need for force," Woodrow Wilson said in lobbying for the League of Nations in 1919. “The boycott is what is substituted for war.”

But how can sanctions be both peaceful and deadly?

It doesn’t seem like they can — but they are undoubtedly deadly.

A recent study found that “unilateral sanctions” caused an estimated 560,000 deaths globally in the 10 years preceding 2025.

Tragically, these deaths are indiscriminate — or worse.

“The principle of discrimination in just war doctrine requires the attacker to distinguish between combatants and non-combatants,” Joy Gordon explains.

But sanctions not only fail to make that distinction, they target the wrong ones: “Civilian suffering is not ‘collateral’ damage,’” Gordon adds, “but rather is the primary objective of the siege strategy.”

Bombs are sometimes aimed at civilians, too, of course. But they don’t have to be. When sanctions are levied against a country, by contrast, they’re deliberately aimed at the country’s entire population.

Gordon argues further that because sanctions “deprive the most vulnerable and least political sectors of society of the food, potable water, medical care, and fuel necessary for survival and basic human needs, [they] should be subject to the same moral objections as siege warfare.”

It’s hard to argue with that — so much so that it might even be a rare case of bipartisan agreement.

Right-wing commentator Richard Hanania, for example, agrees with Gordon: Sanctions, he writes, are “immoral” and “ineffective,” employed as commonly as they are only because they’re “politically convenient.”

Similarly, the official stance of the Catholic Church is that sanctions “cannot be justified when the resulting effects are indiscriminate.”

They usually are. However targeted the sanctions against, say, Venezuela and Iran may be in principle, the practical effect is that the general population of those countries are deprived of basic necessities like food and medicine, regardless of the individuals’ connection to the government.

As such, I think we should celebrate anything that undermines the effectiveness of such sanctions.

Like stablecoins.

The government of Venezuela is thought to receive payment for 80% of its oil sales in Tether’s USDT, for example, some of which gets circulated as currency in the country’s increasingly dollarized economy. This helps the non-combatants of Venezuela to purchase the basic necessities so often denied by sanctions.

In Iran, the central bank acquired more than $500 million of USDT last year, reportedly using the stablecoin to prop up the rial by buying it on local crypto exchanges — a failed, but worthy, attempt at making life in sanctioned Iran more tenable.

That’s not how sanctions evasion is generally portrayed, though.

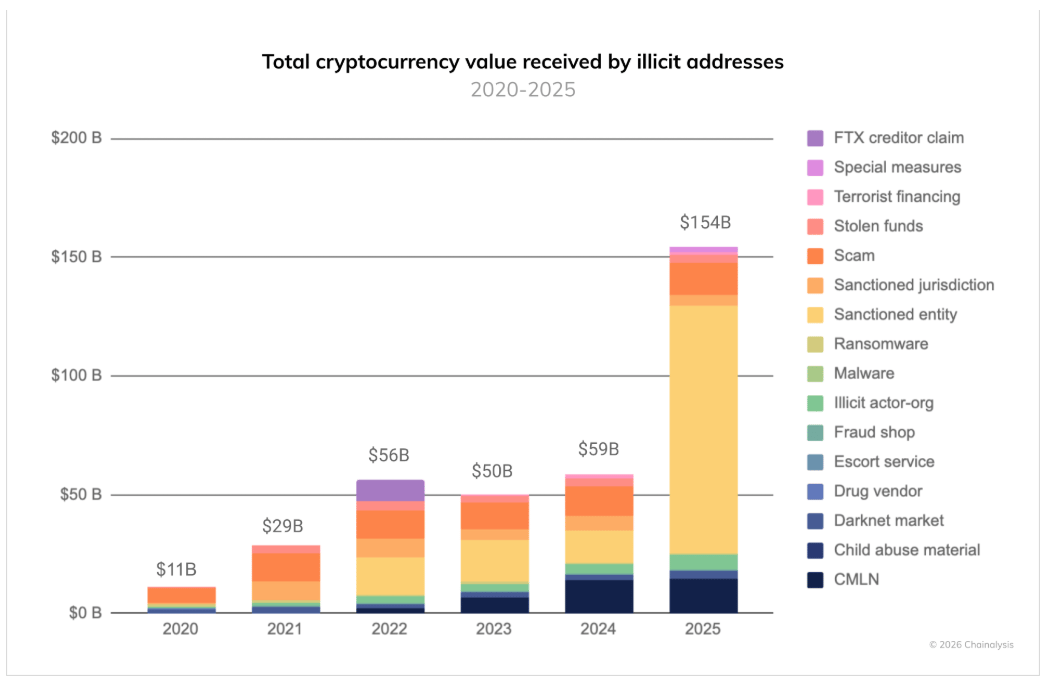

Chainalysis, for example, categorizes sanctions evasion (in yellow, below) as “illicit,” which puts it in the unsavory company of terrorist financing, ransomware, escort services and child-abuse material.

I don’t think it belongs there.

If the Catholic Church is correct that “it is not licit that entire populations, and above all their most vulnerable members, be made to suffer because of such sanctions,” then logic dictates that the evasion of such sanctions cannot be illicit.

So I’d categorize sanctions evasion as, say, a “crypto use case” instead — and a principled, cypherpunk one, at that.

Stablecoins and crypto offer what the rules of war have always required: the unguarded side of a siege.

Brought to you by:

Institutions and DeFi are converging on Canton, creating real-world finance with crypto-style speed.

The latest The Tie report shows growing demand for privacy, composability, and sustainable tokenomics.

With 575+ validators and 600K+ daily transactions driving on-chain activity, Canton’s network momentum is accelerating on-chain global finance.

Crypto's premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: BREAKDOWNNL for $100 off.