- The Breakdown

- Posts

- 🟪 Trends change

🟪 Trends change

Blockchains are built to last

Blockchains are forever

Crypto comes in waves. And like surfing, it’s entirely possible to paddle too early and miss out altogether.

Some of the biggest phenomena in crypto have caught their respective waves with precision.

Yuga Labs rolled out Bored Apes in April 2021, as bitcoin and ether were headed to their first major peak of that bull market cycle.

More recently, Pump.fun nailed it when it deployed in January 2024 — just as SOL was about to double in price in two months on the back of bitcoin ETFs.

Both companies are now case studies in capturing and monetizing the attention of mass-market crypto consumers, even if it’s difficult to say how many individuals were directly involved with either one.

Only around 5,500 addresses have ever owned a Bored Ape NFT, and less than 12,000 have held the cheaper Mutant Apes. ApeCoin, the token meant to tie the room together, is found in many more wallets — more than 182,000 at current count, and that’s not including an untold number of exchange accounts containing APE.

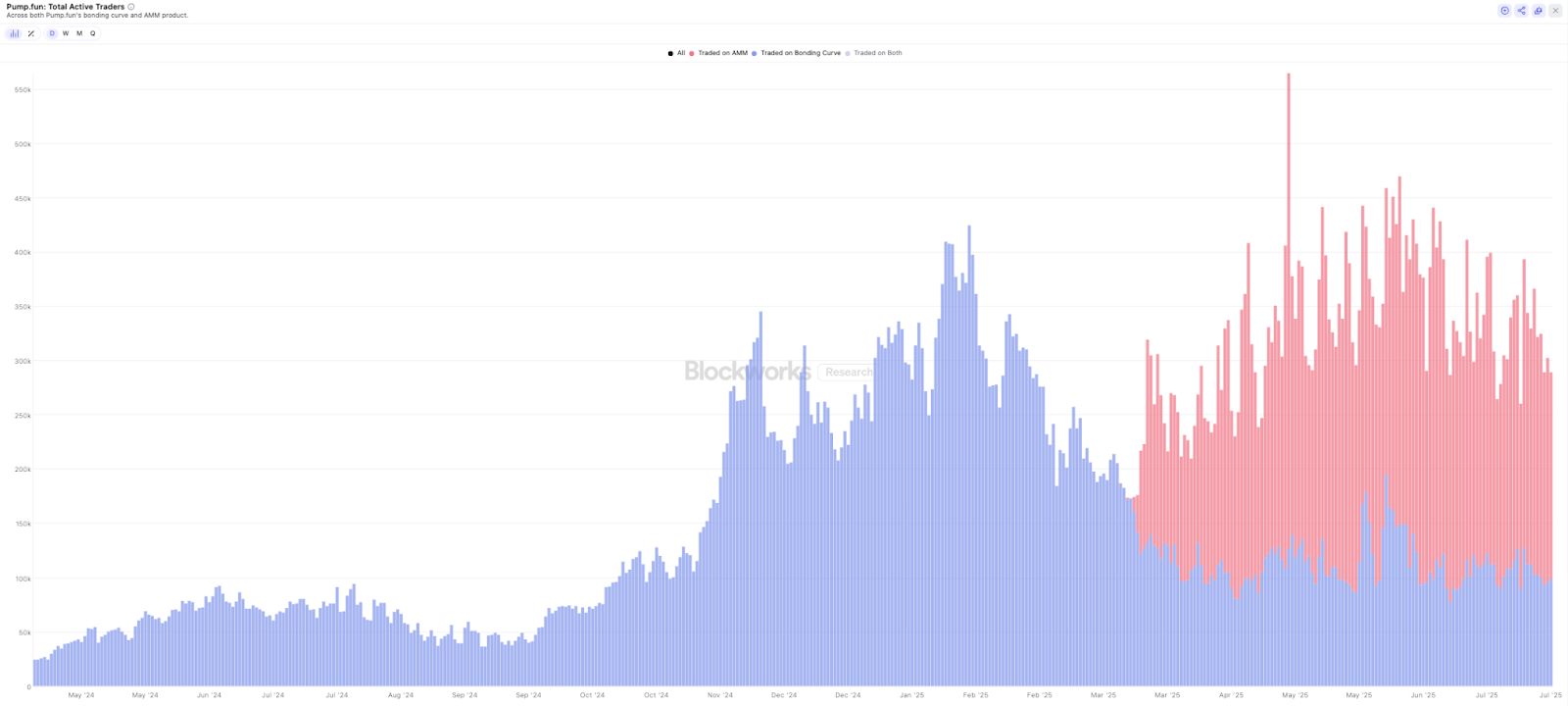

Pump.fun’s active daily address count is nearly double that, ranging between 260,000 and about 500,000 trading addresses right now, per Blockworks Research data. Although, again, it’s unlikely that individual users map one-to-one with active addresses, so the true number is likely smaller.

Pump.fun has, so far, made it through 15 months of bull market

In any case, this is about the maximum size of the playing field on which any consumer crypto app vies to compete, fielding around half a million active addresses per day at best. That’s excluding traditional crypto exchanges, whose active userbases stretch into the millions.

(Coinbase reports about 10 million active users per month, which averaged out over 30 days is actually quite similar to the lower end of pump.fun’s daily active address count, although the two aren’t directly comparable.)

Best case scenario: the playing field grows between the waves of the crypto market. It would be good news for the VCs and other investors who’ve bet that the world has enough blockchains and could now do with more useful apps running on top of them.

Until then, timing will be everything, and the ecosystem may be limited to serving niche communities of early crypto adopters. In such an environment, the consumer apps that make it will capture the attention of crypto’s hot ball of money and maintain it long enough to make stake holders comfortable (and, perhaps more preferably, profitable). Will they persist between cycles? Has Bored Apes?

Blockchains and cryptocurrency can do more. I’ve previously subjected you to some thoughts on tokenomics within the context of World, and the role that well-designed, hyper-utilized token experiments could play in humanity’s future.

Zoom out. By their very nature, properly decentralized blockchain networks are intended to be immortal, lasting much longer than bull and bear markets.

Nothing is eternal, maybe, but it can still be a goal

Blockchains will be online for as long as there are people interested in running the machines that serve as validating nodes on the network, and the modern-day blockchain space is built on incentivizing those people to continue doing so with valuable tokens.

It could be that the current narrative bent towards consumer apps over infrastructure is missing the forest for the trees, particularly when it comes to gaming.

Stop Killing Games is a consumer movement that hopes to sway studios and publishers from snuffing out games from their back catalogue, most of which tend to be online-only these days. Games are routinely made unavailable for good when the company responsible decides the overhead costs of the relevant server is, economically, not worth the squeeze.

Blockchain fixes this. While blockchains themselves are not exactly suitable to host online games in their entirety, there could be a future where gaming communities band together to operate servers on their own, paying for the upkeep through token rewards in the same way that Ethereum or Bitcoin validators are sustained by token emissions.

Of course, it’s debatable whether it’s possible in practice, especially when dealing with modest userbases. But in a world where crypto is still a universe of niche apps mostly populated with relatively small active communities, there are few other use-cases that make sense with longevity in mind.

Perhaps killer consumer crypto apps are already here — they just don’t know it yet.

Brought to you by:

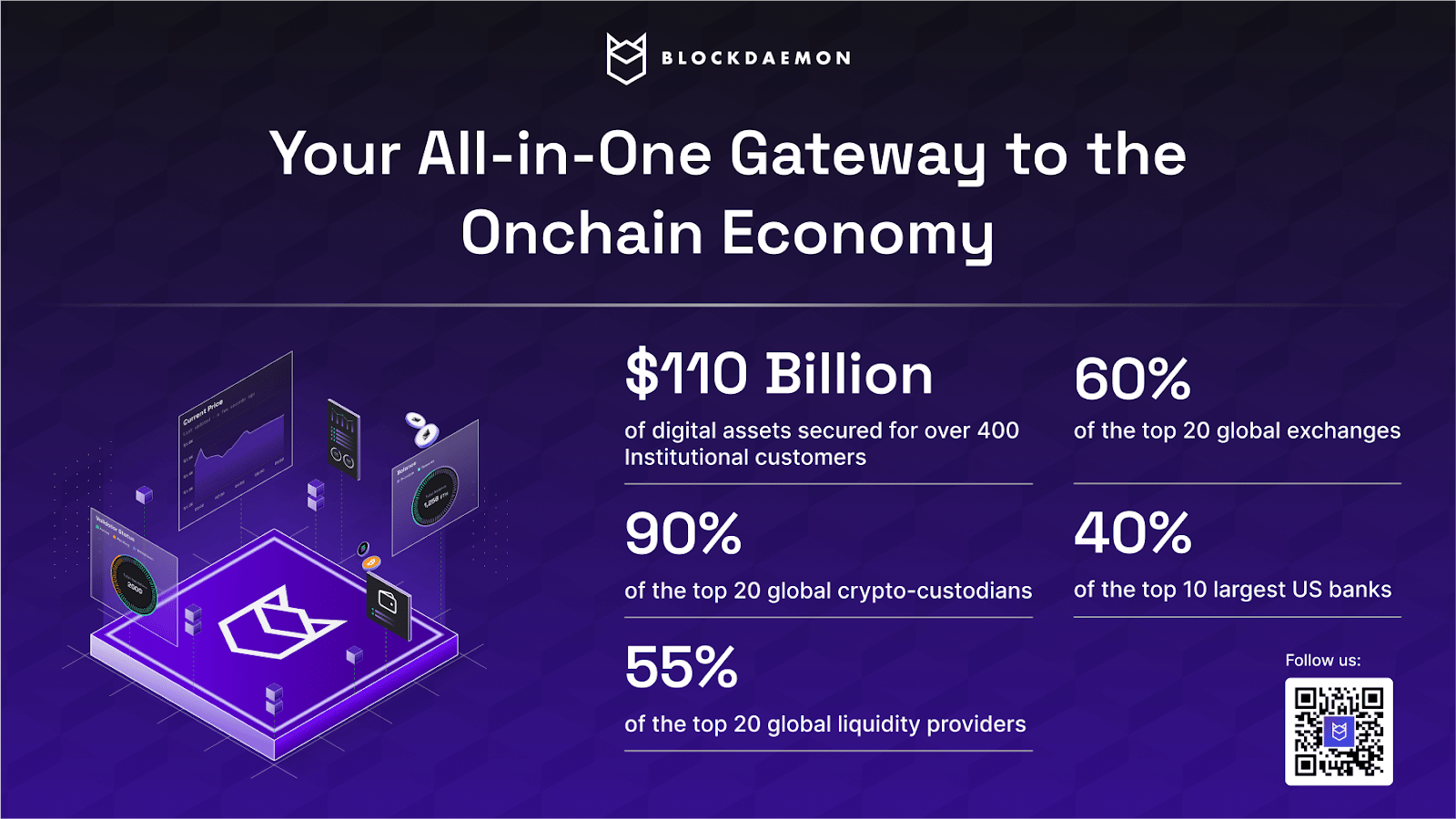

Don’t let infrastructure complexity slow your digital asset strategy.

Blockdaemon provides a single point of access to the decentralized economy for the world’s leading financial institutions, including Citi, Goldman Sachs, and JPMorgan. Our globally distributed infrastructure offers high-performance nodes, unified APIs, secure MPC wallet infrastructure, and the industry's leading institutional staking platform — all with seamless API integration.

Power your business with the provider trusted to secure over $110B in digital assets for 400+ institutional clients.

The Roundup

Empire: Temp check — Katherine’s got the bar graphs and pie charts showing how GPs and LPs are thinking about crypto.

Forward Guidance: Oh ETH ETFs, you’re growing up so fast. Ben recaps investor sentiment and the evolving demand for these products in honor of their first birthday.

Lightspeed: 2025 is for the grindset. Jack listed Solana’s five biggest moments of the year — and it’s only July.

0xResearch: The real AI moat? Macauley looks at Story Protocol’s bid to solve the data bottleneck in the race to real-world AI.

The Drop: Fear not, the Penguin alpha is here. Kate shared the hot takes from her exclusive interview with Pudgy Penguins CEO Luca Netz. Flippin’ fantastic.

Supply Shock: Consensus can be messy. David unpacks the moment that shifted the definition of Bitcoin for many operators. Spoiler: It may be a touchy subject.

Brought to you by:

Kinto is coming back.

Kinto — the modular exchange built on a purpose-made stage-1 rollup with KYC/AML and a battle-tested, non-custodial smart wallet — just turned its toughest moment into a rallying cry. Due to a sophisticated proxy exploit, a hacker took control of the $K token on Arbitrum, seizing liquidity.

Kinto wallets and L2 were not affected. Kinto community raised $750k in minutes to restore it. $K will be back trading next week. Follow Kinto's comeback story.

By Ben Strack |

By Felix Jauvin |