- The Breakdown

- Posts

- 🟪 Product delivery

🟪 Product delivery

Owning the rails doesn’t help if no one wants a ride

0xResearch returns to its analyst roots. Daily alpha and insights now coming directly from our research team. Investment research, market commentary, and unfiltered data-driven takes in your inbox.

What product do blockchains deliver?

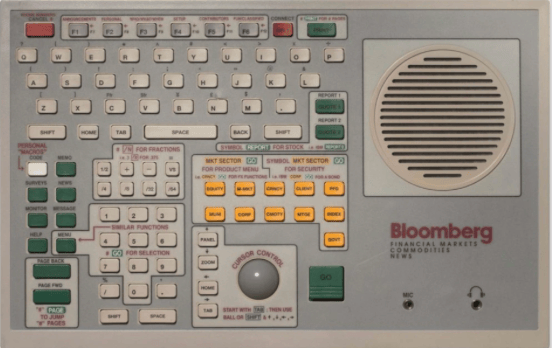

I’m old enough to remember when a Bloomberg Terminal was a stand-alone box wedged onto a cluttered trading desk between a dual-receiver phone and a clacking machine for time-stamping order tickets.

The chunky keyboard had colorful buttons for the most-used functions, a squawk-box speaker, and a fun roller ball that made navigating the Terminal feel like playing Missile Command (an arcade game found in 1980s bowling alleys and pizza parlors that I was extremely good at).

Soon, though, the Bloomberg “terminal” was just software, displayed on the same screen as your trading system, using the same keyboard you used for everything else.

That made it seem less special to me, which I thought would make it less valuable, too — if all the financial news and market prices could be displayed directly on my regular computer screens, surely anyone could provide it?

Michael Bloomberg knew otherwise.

Bloomberg never confused the product he was selling (information) with the device that delivered it (a chunky, colorful box) — so when a better delivery mechanism came along, he was quick to embrace it.

As a result, Bloomberg Terminals soon became as ubiquitous on trading desks as empty coffee cups and Patagonia vests.

There are many counterexamples.

Kodak thought its product was rolls of film, so it ignored the digital camera (despite inventing it, even). It’s actual product, it turned out, was preserving memories, and digital cameras (and now phones) are better devices to deliver it.

Newspaper publishers thought their product was a physical paper delivered to your door, but that was just the delivery mechanism. The real product was news and ads, which the internet was much better at delivering.

Record labels thought their product was CDs, but that was just a delivery mechanism. The real product was music, and MP3s (and then streaming) delivered it better.

In each case, once-dominant companies mistook the means of delivery for the thing being delivered — like Amtrak confusing a desire to get somewhere with a desire to ride over railroad tracks.

Could the crypto industry be making the same mistake?

The risk of confusion seems unusually high in crypto, because it’s unusually difficult to know what the product is.

Michael Saylor, Larry Fink, and every ETF investor will tell you the product that Bitcoin sells is a store of value — bitcoin — the sole purpose of which is to go up.

Others think Bitcoin’s product is decentralization and censorship resistance, and that the token merely enables those things.

ETH investors seem equally of two (or more) minds: is Ethereum selling blockspace? A store-of-value token? A secure network to host real-world assets?

Or maybe we don’t have to choose — maybe Ethereum can be all of those things.

But that risks a lack of focus: the drive to make ETH a store of value, for example, can be at odds with selling as much blockspace as possible.

“You must keep the main thing the main thing,” Bill Gates once advised.

Solana seems better at that: its community is unified around a mission to get the chain as fast as possible while staying decentralized enough to remain permissionless.

But is that a product or a delivery device?

Delivery devices are important, too: Blockbuster and Netflix both delivered movies, but Blockbuster delivered them from stores and Netflix delivers them straight into your home.

But people go to Netflix because that's where the movies are now, not because movies are more enjoyable if they’re delivered over the internet.

Similarly, people might continue to go to Solana because that's where the tokens are now.

Matt Hougan says “Solana is the new Wall Street,” citing its technical merits: speed, throughput, finality.

But what makes Wall Street, Wall Street isn’t how fast NYSE and Nasdaq are — it’s because that’s where the best stocks are.

The technology those exchanges run on isn’t particularly valuable, and the blockchain that Solana and other ecosystems run on might not be either.

“If you don’t have a native digital asset on the chain,” Figure co-founder Mike Cagney says, “it’s basically worthless technology.”

Most chains have tokens, of course, but why would they have value if the chain itself is “basically worthless”?

Presumably because they’re the best way to deliver some kind of product.

Michael Bloomberg would likely remind us that blockchains are just delivery devices.

The product is what they deliver: ownership, coordination, and permissionless access.

If so, those are the things the industry should keep as the main thing.

Brought to you by:

Katana was built by answering a core question: What if a chain contributed revenue back into the ecosystem to drive growth and yield?

We direct revenue back to DeFi participants for consistently higher yields.

Katana is pioneering concepts like Productive TVL (the portion of assets are actually doing work), Chain Owned Liquidity (permanent liquidity owned by Katana to maintain stability), and VaultBridge (putting bridged assets to work generating extra yield for active participants).

By Ben Strack |

By Macauley Peterson |

By Donovan Choy |

By Katherine Ross |

By Blockworks |

Stablecoins are having an institutional moment. How will that play out?

Leaders in the institutional world will hash it out live onstage at DAS London.

Get your tickets today with promo code: BREAKDOWNNL for £100 off.

📅 October 13-15 | London