- The Breakdown

- Posts

- 🟪 The dollar needs a new bonfire of the bills

🟪 The dollar needs a new bonfire of the bills

Lessons from Colonial America

The dollar needs a new bonfire of the bills

Fiat money was invented in colonial America, and to convince people it had value, the colonies that issued it periodically lit their tax revenue on fire.

Paper money dates to 11th-century China, but historian Dror Goldberg argues that fiat — money valued primarily because the state demands it for taxes — was invented by the colony of Massachusetts in 1690.

Colonial Americans didn’t call it money at the time; to them, “real money” was metallic coins like Spanish pieces of eight, and the most-common form of paper their local governments printed was referred to as “bills of credit.”

But (as discussed yesterday) very little “real” money was available in the colonies, so bills of credit circulated as money instead.

Counterintuitively, when the bills circulated back to the government as taxes, they were burned.

This goes against our modern expectation of governments collecting taxes to use for current or future spending.

But at that early stage of monetary history, money-issuing governments knew they had to give people reason to believe the paper they printed in arbitrary amounts had value.

To make the public “cherish” its money, the government had to prove it could make that money scarce.

“Whereas it is of the greatest importance to preserve the credit of the paper currency of this colony,” the Virginia legislature resolved in 1760, “nothing can contribute more to that end than a due care to satisfy the publick that the paper bills of credit, or treasury-notes, are properly sunk.”

To that end, the legislature appointed a committee to ensure that, “at least twice a year,” all the bills of credit that had been collected in taxes were “burnt and destroyed.”

This bonfire of the taxes was often conducted in public, to make a memorable show of the government’s fiscal responsibility.

“The burning was an event,” Andrew David Edwards writes, “advertised in public newspapers and marked in legislative records.”

By making a public display of making money more scarce, the government hoped to maintain its value.

300 years later, that’s still sort of how it works.

Over the past three and half years, the Federal Reserve has “burned” about 2.4 trillion of the bills of credit (aka, dollars) it printed after the pandemic (in the form of bank reserves).

Technically, the Fed makes money more scarce by reducing the amount of debt it holds: US dollars are created when the Fed buys bonds from banks (which adds to banks’ reserves), and destroyed when the Fed lets those bonds mature (reducing bank reserves).

As a demonstration of responsible monetary policy, that’s not quite as dramatic as lighting bills of credit on fire.

Nor is the money destroyed very publicly: The Fed’s role in creating and destroying money did not get a mention in today’s FOMC’s statement, which announced only its decision on interest rates (a quarter-point cut).

In his press conference, however, Chair Powell additionally announced that the FOMC had decided to “cease run-off” of the debt it holds.

This is a modern way of saying it will not burn any more money.

In fact, it might soon be printing it again.

Reserves “have to be ample,” Powell said in the Q&A, adding that “at a certain point, you want reserves to start gradually growing.”

The Fed grows reserves by buying bonds.

In other words, the Fed will soon be printing money again (by buying bonds), because $6.6 trillion of bank reserves is no longer “ample” in today’s monetary regime.

There are a lot of monetary plumbing reasons for that, most of which are beyond my newsletter-writer understanding.

But the announced change of direction highlights perhaps the biggest difference between burning bills of credit in 1760 and reducing bank reserves today: It was fiscal policy back then and monetary policy now.

“Colonial Americans burned their money because each bill represented a tax debt that had been repaid,” Andrew David Edwards explained.

That’s of course not what’s happening now.

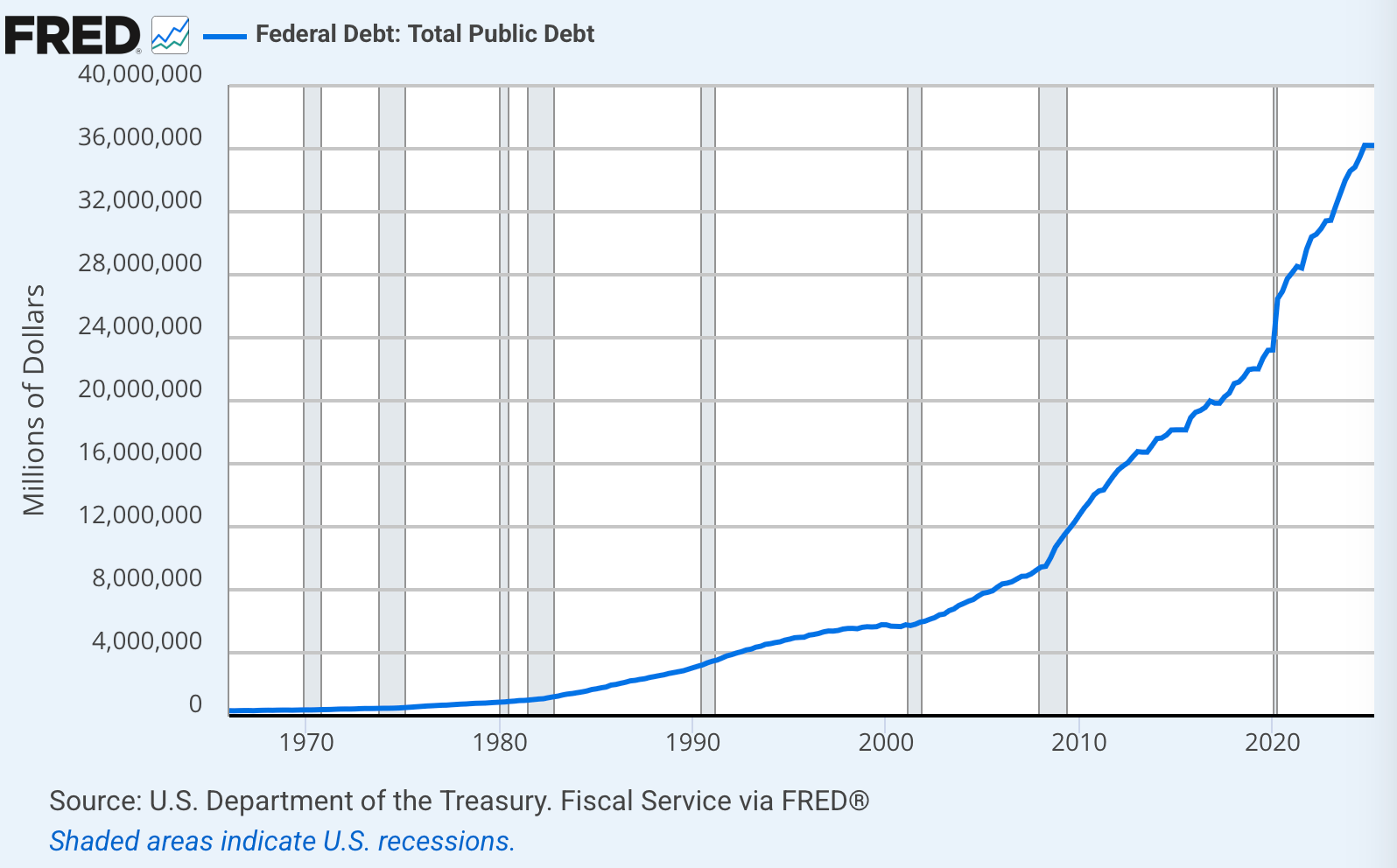

In the time the Federal Reserve responsibly burned $2.4 trillion of reserves, the federal government somewhat irresponsibly added $6 trillion of debt.

George Washington, who used his farewell address to advise that governments’ “vigorous exertions in time of peace to discharge the debts,” would not approve.

Despite a strong economy, the US has made no effort at all to reduce its debt, and that has gotten people worried about fiat money again.

There’s not much the Fed can do about that, because burning bank reserves will never be as convincing as burning tax receipts.

Brought to you by:

Grayscale is excited to announce the launch of Grayscale CoinDesk Crypto 5 ETF (ticker: GDLC) — the first crypto exchange-traded product in the U.S offering investors access to the market cap-weighted performance of the five largest and most liquid crypto assets1 , covering 90% of the crypto market’s capitalization2 .

Grayscale CoinDesk Crypto 5 ETF (“GDLC” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. Investing involves risk, including possible loss of principal. An investment in GDLC is subject to a high degree of risk and volatility. GDLC is not suitable for an investor that cannot afford the loss of the entire investment. An investment in the Fund is not a direct investment in any cryptocurrency.

Grayscale CoinDesk Crypto 5 ETF has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents GDLC has filed with the SEC for more complete information about GDLC and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, GDLC or any authorized participant will arrange to send you the prospectus after filing if you request it by calling (833)903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent and Grayscale Investments Sponsors, LLC is the sponsor of GDLC.

By Marc Arjoon and Boccaccio |

By Ben Strack |

Brought to you by:

peaq, the Machine Economy Computer, proudly sponsors The Breakdown newsletter. The robots are here — and they’re coming onchain. With peaq, you earn while the robots work.

Recent highlights include: world’s first Machine Economy Free Zone in the UAE, world’s first tokenized robo-farm in Hong Kong, world’s first Web3 Robotics SDK, world’s first onchain robot.

New peaq app: Get early access to tokenized robots. Be the world’s first to benefit from the rise of the robots: https://www.peaq.xyz/

Tell your friends, rack up rewards! 🎉

Some market insights are just too good to not share. Use the Breakdown referral program and snag rewards while you’re at it:

1 Grayscale and CoinDesk, as of 8/29/2025. Largest and most liquid assets reflect eligibility for U.S. exchange and custody accessibility and U.S. dollar or U.S. dollar-related trading pairs. Exclusions include stablecoins, memecoins, gas tokens, privacy tokens, wrapped tokens, staked assets, or pegged assets. Largest is defined by circulating supply market capitalization, and most liquid is defined by 90-day median daily valued traded.

2 CoinDesk as of 08/31/2025, based on the crypto market ’s total investable universe.